Question

Sand Key Development Company has a capital structure consisting of $20 million of 10% debt and $30 million of common equity. The firm has

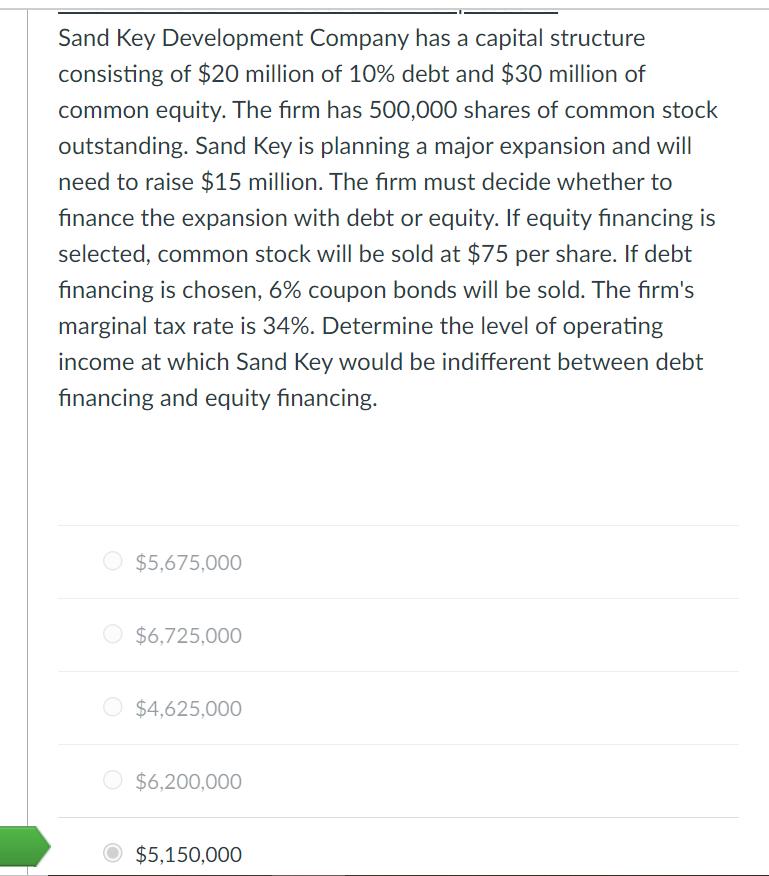

Sand Key Development Company has a capital structure consisting of $20 million of 10% debt and $30 million of common equity. The firm has 500,000 shares of common stock outstanding. Sand Key is planning a major expansion and will need to raise $15 million. The firm must decide whether to finance the expansion with debt or equity. If equity financing is selected, common stock will be sold at $75 per share. If debt financing is chosen, 6% coupon bonds will be sold. The firm's marginal tax rate is 34%. Determine the level of operating income at which Sand Key would be indifferent between debt financing and equity financing. $5,675,000 $6,725,000 $4,625,000 $6,200,000 $5,150,000

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

EPS if the firm chooses the equity option EPS if the firm choo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Federal Taxation 2016 Comprehensive

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

29th Edition

134104374, 978-0134104379

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App