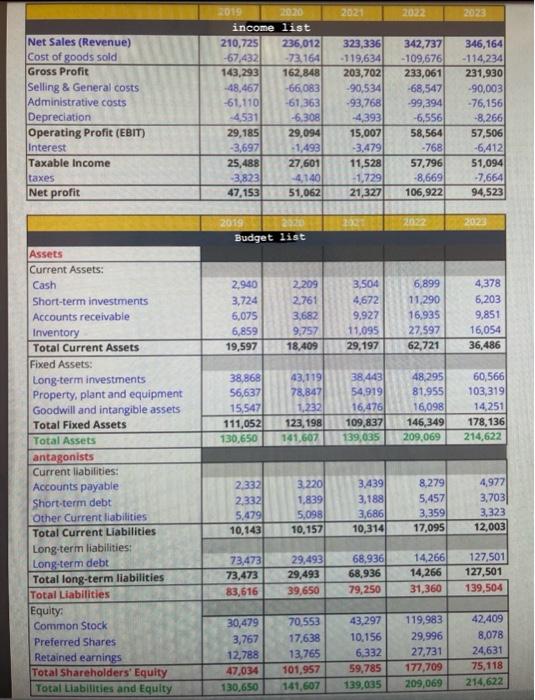

Construct a cash flow statement

\begin{tabular}{|c|c|c|c|c|c|} \hline & 2019 & 2020 & 2021 & 2022 & 2023 \\ \hline \multicolumn{6}{|c|}{ income list } \\ \hline Net Sales (Revenue) & 210,725 & 236,012 & 323,336 & 342,737 & 346,164 \\ \hline Cost of goods sold & 67,432 & 73,164 & 119,634 & 109,676 & 114,234 \\ \hline Gross Profit & 143,293 & 162,848 & 203,702 & 233,061 & 231,930 \\ \hline Selling \& General costs & 48,467 & 66,083 & 90,534 & 68,547 & 90,003 \\ \hline Administrative costs & 61,110 & 61,363 & 93,768 & 99,394 & 76,156 \\ \hline Depreciation & 4.531 & 6,308 & 4,393 & 6,556 & -8.266 \\ \hline Operating Profit (EBIT) & 29,185 & 29,094 & 15,007 & 58,564 & 57,506 \\ \hline Interest & 3,697 & 1,493 & 3,479 & -768 & 6,412 \\ \hline Taxable Income & 25,488 & 27,601 & 11,528 & 57,796 & 51,094 \\ \hline taxes & 3,823 & 4,140 & 1,729 & 8,669 & 7,664 \\ \hline Net profit & 47,153 & 51,062 & 21,327 & 106,922 & 94,523 \\ \hline & & & & & \\ \hline & 2019 & & 3x & 202 & 2023 \\ \hline \multicolumn{6}{|c|}{ Budget list } \\ \hline \multicolumn{6}{|l|}{ Assets } \\ \hline \multicolumn{6}{|l|}{ Current Assets: } \\ \hline Cash & 2,940 & 2209 & 3,504 & 6,899 & 4,378 \\ \hline Short-term investments & 3,724 & 2.761 & 4,672 & 11,290 & 6,203 \\ \hline Accounts receivable & 6,075 & 3,682 & 9.927 & 16,935 & 9,851 \\ \hline Inventory & 6,859 & 9,757 & 11,095 & 27,597 & 16,054 \\ \hline Total Current Assets & 19,597 & 18,409 & 29,197 & 62,721 & 36,486 \\ \hline \multicolumn{6}{|l|}{ Fixed Assets: } \\ \hline Long-term investments & 38,868 & 43,119 & 38,443 & 48,295 & 60,566 \\ \hline Property, plant and equipment & 56,637 & 78.847 & 54,919 & 81,955 & 103,319 \\ \hline \multirow{2}{*}{\begin{tabular}{l} Goodwill and intangible assets \\ Total Fixed Assets \end{tabular}} & 15,547 & 1,232 & 16,476 & 16,098 & 14,251 \\ \hline & 111,052 & 123,198 & 109,837 & 146,349 & 178,136 \\ \hline \begin{tabular}{|l|l|l|} \end{tabular} & 130,650 & 141,607 & 139,035 & 209,069 & 214,622 \\ \hline \multicolumn{6}{|l|}{\begin{tabular}{l} antagonists \\ \end{tabular}} \\ \hline \multicolumn{6}{|l|}{\begin{tabular}{l} antagonists \\ Current liabilities: \end{tabular}} \\ \hline Accounts payable & 2,332 & 3,220 & 3.439 & 8,279 & 4,977 \\ \hline Short-term debt & 2,332 & 1,839 & 3,188 & 5,457 & 3,703 \\ \hline Other Current liabilities & 5,479 & 5,098 & 3,686 & 3,359 & 3,323 \\ \hline \multirow{2}{*}{\multicolumn{6}{|c|}{\begin{tabular}{l} Total Current Liabilities \\ Long-term liabilities: \end{tabular}}} \\ \hline & & & & & \\ \hline Long-term debt & 73,473 & 29,493 & 68,936 & 14,266 & 127,501 \\ \hline Total long-term liabilities & 73,473 & 29,493 & 68,936 & 14,266 & 127,501 \\ \hline \begin{tabular}{|l|l|} Total Liabilities \\ \end{tabular} & 83,616 & 39,650 & 79,250 & 31,360 & 139,504 \\ \hline \multicolumn{6}{|l|}{\begin{tabular}{l} Total Liabilities \\ Equity: \end{tabular}} \\ \hline Common Stock & 30,479 & 70,553 & \begin{tabular}{l|l|} 43,297 \\ \end{tabular} & 119,983 & 42,409 \\ \hline Preferred Shares & 3,767 & 17.638 & 10,156 & 29,996 & 8,078 \\ \hline Retained earnings & 12,788 & 13,765 & 6.332 & 27,731 & 24,631 \\ \hline Total Shareholders' Equity & 47,034 & 101,957 & \begin{tabular}{l|l} 59,785 \\ \end{tabular} & 177,709 & 75,118 \\ \hline Total Liabilities and Equity & 130,650 & 141,607 & 139,035 & 209,069 & 214,622 \\ \hline \end{tabular}