Answered step by step

Verified Expert Solution

Question

1 Approved Answer

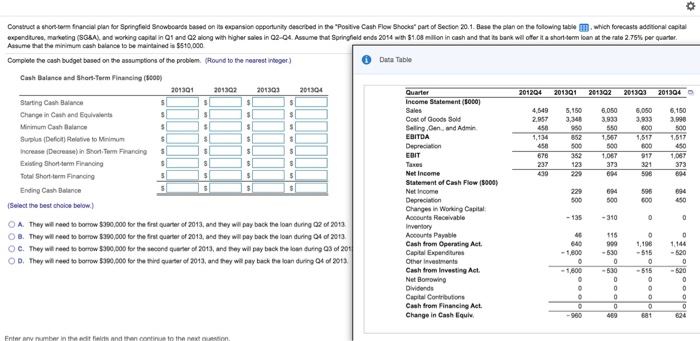

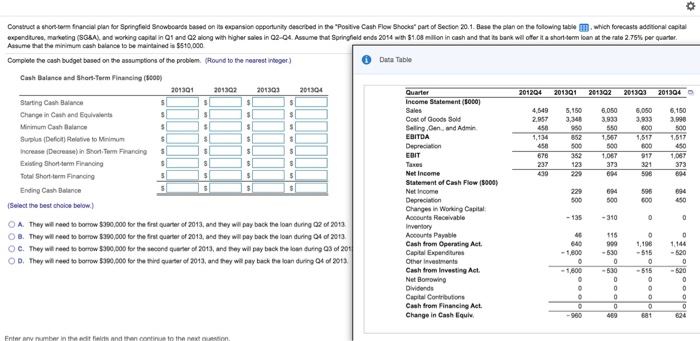

Construct a short-term financial plan for Springfield Snowboards based on is expansion opportunity described in the Positive Cash Flow Shocks part of Section 20.1. Base

Construct a short-term financial plan for Springfield Snowboards based on is expansion opportunity described in the Positive Cash Flow Shocks part of Section 20.1. Base he plan on the following table , which forecasts additional capital expenditures, marketing (SGSAL and working capital in 1 and 2 along with higher sales in 02-04. Assume that Springfield ends 2014 with $1,08 million in cash and that its bank will offer it a short-term loan at the rate 2.75% per quarter. Asume that the minimum cash balance to be maintained is $10,000 Complete the cash budget based on the assumptions of the problem. Round to the nearest Integer) Data Table Cash Balance and ShortTerm Financing (5000) 201301 201302201303 201204 2013Q1201302201309 201304 Income Statement (5000) 5,150 6,050 3.900 Cost of Goods Sold Seling.Gen. and Admin EBITDA 550 Starting Balance Change in Cash and Equivalent Minimum Cash Balance Surplus Deficit Relative to Minimum increase Decrease) in Short Term Financing Existing Short term Fencing Total Short term Financing Ending Cash Balance Statement of Cash Flow (5000) 094 Select the best choice below.) Changes in Working Capital Accounts Receivable Inventory Accounts Payable Cash from Operating Act. Capital Expenditures O A. They will need to borrow $390,000 for the first quarter of 2013, and they will pay back the loan during 2 of 2013 OB. They will need to borrow $390,000 for the first quarter of 2013, and they will pay back the loan during 04 of 2013 c. They will need to borrow $300,000 for the second quarter of 2013, and they will pay back the loan during 3 of 201 OD. They will need to borrow $500,000 for the third quarter of 2013, and they will pay back then during 04 of 2013 115 -530 1,196 -515 -520 -515 - 520 Cash from Investing Act. Net Borowing Dividends Capital Contributions Cash from Financing Act. Change in Cash Equi. 000 469 01624 Fre m her in the arts and then continue to the next Construct a short-term financial plan for Springfield Snowboards based on is expansion opportunity described in the Positive Cash Flow Shocks part of Section 20.1. Base he plan on the following table , which forecasts additional capital expenditures, marketing (SGSAL and working capital in 1 and 2 along with higher sales in 02-04. Assume that Springfield ends 2014 with $1,08 million in cash and that its bank will offer it a short-term loan at the rate 2.75% per quarter. Asume that the minimum cash balance to be maintained is $10,000 Complete the cash budget based on the assumptions of the problem. Round to the nearest Integer) Data Table Cash Balance and ShortTerm Financing (5000) 201301 201302201303 201204 2013Q1201302201309 201304 Income Statement (5000) 5,150 6,050 3.900 Cost of Goods Sold Seling.Gen. and Admin EBITDA 550 Starting Balance Change in Cash and Equivalent Minimum Cash Balance Surplus Deficit Relative to Minimum increase Decrease) in Short Term Financing Existing Short term Fencing Total Short term Financing Ending Cash Balance Statement of Cash Flow (5000) 094 Select the best choice below.) Changes in Working Capital Accounts Receivable Inventory Accounts Payable Cash from Operating Act. Capital Expenditures O A. They will need to borrow $390,000 for the first quarter of 2013, and they will pay back the loan during 2 of 2013 OB. They will need to borrow $390,000 for the first quarter of 2013, and they will pay back the loan during 04 of 2013 c. They will need to borrow $300,000 for the second quarter of 2013, and they will pay back the loan during 3 of 201 OD. They will need to borrow $500,000 for the third quarter of 2013, and they will pay back then during 04 of 2013 115 -530 1,196 -515 -520 -515 - 520 Cash from Investing Act. Net Borowing Dividends Capital Contributions Cash from Financing Act. Change in Cash Equi. 000 469 01624 Fre m her in the arts and then continue to the next

Construct a short-term financial plan for Springfield Snowboards based on is expansion opportunity described in the Positive Cash Flow Shocks part of Section 20.1. Base he plan on the following table , which forecasts additional capital expenditures, marketing (SGSAL and working capital in 1 and 2 along with higher sales in 02-04. Assume that Springfield ends 2014 with $1,08 million in cash and that its bank will offer it a short-term loan at the rate 2.75% per quarter. Asume that the minimum cash balance to be maintained is $10,000 Complete the cash budget based on the assumptions of the problem. Round to the nearest Integer) Data Table Cash Balance and ShortTerm Financing (5000) 201301 201302201303 201204 2013Q1201302201309 201304 Income Statement (5000) 5,150 6,050 3.900 Cost of Goods Sold Seling.Gen. and Admin EBITDA 550 Starting Balance Change in Cash and Equivalent Minimum Cash Balance Surplus Deficit Relative to Minimum increase Decrease) in Short Term Financing Existing Short term Fencing Total Short term Financing Ending Cash Balance Statement of Cash Flow (5000) 094 Select the best choice below.) Changes in Working Capital Accounts Receivable Inventory Accounts Payable Cash from Operating Act. Capital Expenditures O A. They will need to borrow $390,000 for the first quarter of 2013, and they will pay back the loan during 2 of 2013 OB. They will need to borrow $390,000 for the first quarter of 2013, and they will pay back the loan during 04 of 2013 c. They will need to borrow $300,000 for the second quarter of 2013, and they will pay back the loan during 3 of 201 OD. They will need to borrow $500,000 for the third quarter of 2013, and they will pay back then during 04 of 2013 115 -530 1,196 -515 -520 -515 - 520 Cash from Investing Act. Net Borowing Dividends Capital Contributions Cash from Financing Act. Change in Cash Equi. 000 469 01624 Fre m her in the arts and then continue to the next Construct a short-term financial plan for Springfield Snowboards based on is expansion opportunity described in the Positive Cash Flow Shocks part of Section 20.1. Base he plan on the following table , which forecasts additional capital expenditures, marketing (SGSAL and working capital in 1 and 2 along with higher sales in 02-04. Assume that Springfield ends 2014 with $1,08 million in cash and that its bank will offer it a short-term loan at the rate 2.75% per quarter. Asume that the minimum cash balance to be maintained is $10,000 Complete the cash budget based on the assumptions of the problem. Round to the nearest Integer) Data Table Cash Balance and ShortTerm Financing (5000) 201301 201302201303 201204 2013Q1201302201309 201304 Income Statement (5000) 5,150 6,050 3.900 Cost of Goods Sold Seling.Gen. and Admin EBITDA 550 Starting Balance Change in Cash and Equivalent Minimum Cash Balance Surplus Deficit Relative to Minimum increase Decrease) in Short Term Financing Existing Short term Fencing Total Short term Financing Ending Cash Balance Statement of Cash Flow (5000) 094 Select the best choice below.) Changes in Working Capital Accounts Receivable Inventory Accounts Payable Cash from Operating Act. Capital Expenditures O A. They will need to borrow $390,000 for the first quarter of 2013, and they will pay back the loan during 2 of 2013 OB. They will need to borrow $390,000 for the first quarter of 2013, and they will pay back the loan during 04 of 2013 c. They will need to borrow $300,000 for the second quarter of 2013, and they will pay back the loan during 3 of 201 OD. They will need to borrow $500,000 for the third quarter of 2013, and they will pay back then during 04 of 2013 115 -530 1,196 -515 -520 -515 - 520 Cash from Investing Act. Net Borowing Dividends Capital Contributions Cash from Financing Act. Change in Cash Equi. 000 469 01624 Fre m her in the arts and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started