Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Construct a transaction analysis, Construct a cash flow statement following the direct method. Niam Limited is a public limited company producing electronic products. For the

Construct a transaction analysis, Construct a cash flow statement following the direct method.

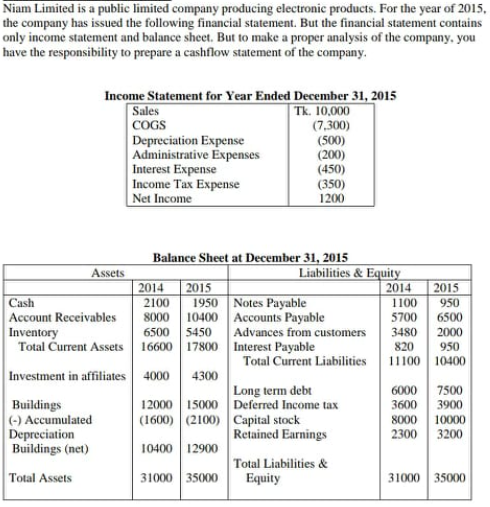

Niam Limited is a public limited company producing electronic products. For the year of 2015, the company has issued the following financial statement. But the financial statement contains only income statement and balance sheet. But to make a proper analysis of the company, you have the responsibility to prepare a cashflow statement of the company. Income Statement for Year Ended December 31, 2015 Sales Tk. 10,000 COGS (7.300) Depreciation Expense (500) Administrative Expenses (200) Interest Expense (450) Income Tax Expense (350) Net Income 1200 Balance Sheet at December 31, 2015 Assets Liabilities & Equity 2014 2015 2014 2015 Cash 2100 1950 Notes Payable 1100 950 Account Receivables 8000 10400 Accounts Payable 5700 6500 Inventory 6500 5450 Advances from customers 3480 2000 Total Current Assets 16600 17800 Interest Payable 820 950 Total Current Liabilities 11100 10400 Investment in affiliates 4000 4300 Long term debt 6000 7500 Buildings 12000 15000 Deferred Income tax 3600 3900 (-) Accumulated (1600) (2100) Capital stock 8000 10000 Depreciation Retained Earnings 2300 3200 Buildings (net) 10400 12900 Total Liabilities & Total Assets 31000 35000 Equity 31000 35000 Niam Limited is a public limited company producing electronic products. For the year of 2015, the company has issued the following financial statement. But the financial statement contains only income statement and balance sheet. But to make a proper analysis of the company, you have the responsibility to prepare a cashflow statement of the company. Income Statement for Year Ended December 31, 2015 Sales Tk. 10,000 COGS (7.300) Depreciation Expense (500) Administrative Expenses (200) Interest Expense (450) Income Tax Expense (350) Net Income 1200 Balance Sheet at December 31, 2015 Assets Liabilities & Equity 2014 2015 2014 2015 Cash 2100 1950 Notes Payable 1100 950 Account Receivables 8000 10400 Accounts Payable 5700 6500 Inventory 6500 5450 Advances from customers 3480 2000 Total Current Assets 16600 17800 Interest Payable 820 950 Total Current Liabilities 11100 10400 Investment in affiliates 4000 4300 Long term debt 6000 7500 Buildings 12000 15000 Deferred Income tax 3600 3900 (-) Accumulated (1600) (2100) Capital stock 8000 10000 Depreciation Retained Earnings 2300 3200 Buildings (net) 10400 12900 Total Liabilities & Total Assets 31000 35000 Equity 31000 35000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started