Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Recall that the change in cash (i.e., the statement of cash flows) is algebraically related to the balance g. Construct the 2013 statement of

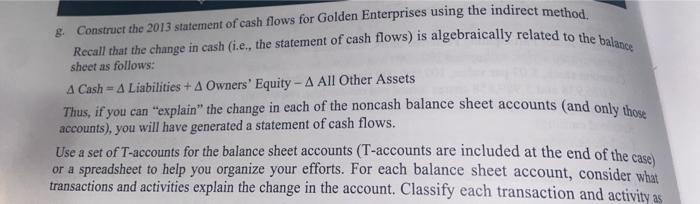

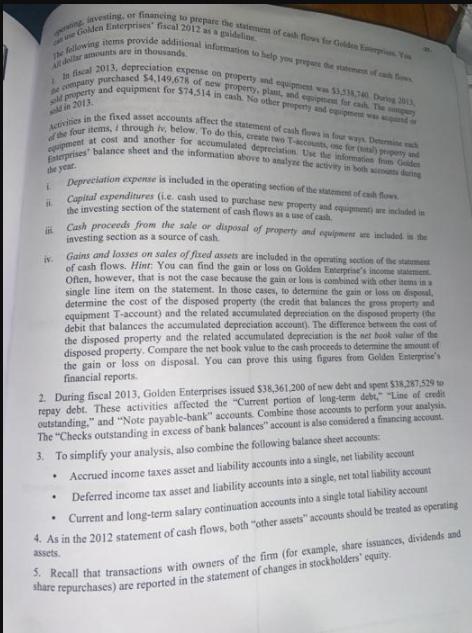

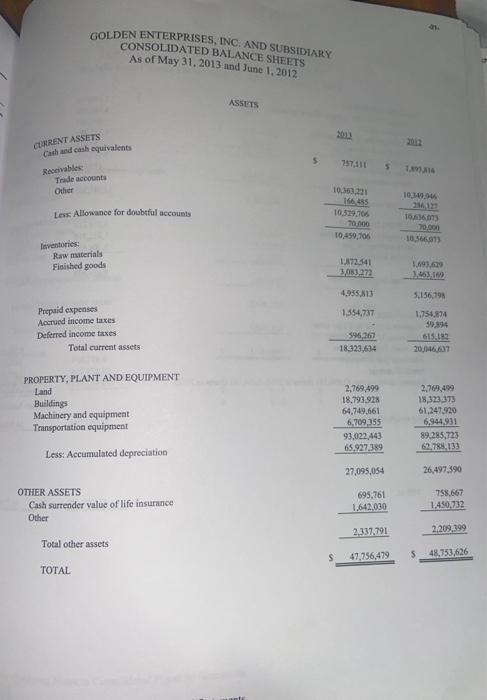

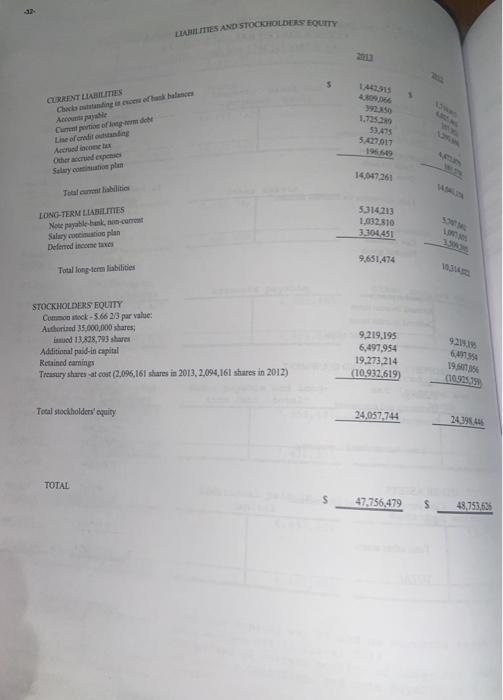

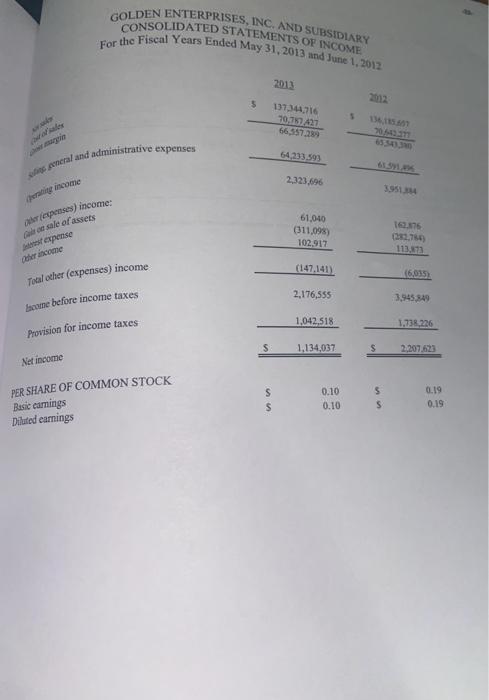

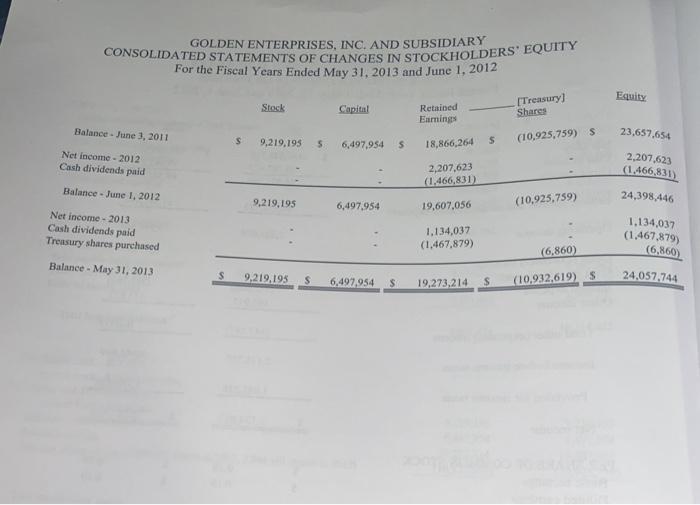

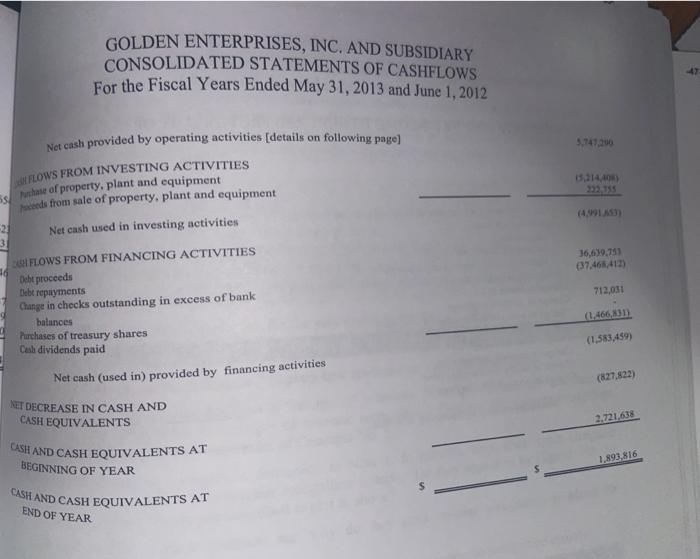

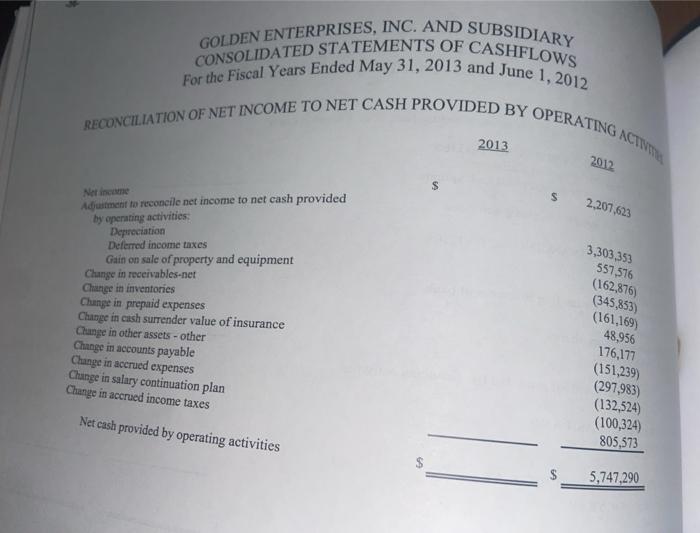

Recall that the change in cash (i.e., the statement of cash flows) is algebraically related to the balance g. Construct the 2013 statement of cash flows for Golden Enterprises using the indirect method sheet as follows: A Cash =A Liabilities + A Owners' Equity - A All Other Assets Thus, if you can "explain" the change in each of the noncash balance sheet accounts (and only he accounts), you will have generated a statement of cash flows. Use a set of T-accounts for the balance sheet accounts (T-accounts are included at the end of the caco or a spreadsheet to help you organize your efforts. For each balance sheet account, consider what transactions and activities explain the change in the account. Classify each transaction and activity as e Golden Enterprises" fiscal 2012 asa gaideline Depreciation expense is included in the operating section of the statement of cah flows of the four items, i through v, below. Te do this, create two T-accounts, ose for () ppeny and upment at cost and another for accumulated deprecistion Use the informatien tm Gdes Enterprises balance sheet and the information above to analyze the activity in both dring Activites in the fixed asset accounts affect the statemet of cash flrws in four ways Deterine sh The lellowing hems provide additional infutmation to belp you prepu de satemet ofco fs e company parchased $4,149,678 of sew property, plant, nd epipnen for cah. The s l property and equipment for $74,514 in eash. No other property and oipment w nd In fiscal 2013, depreciation expense on property snd equipmes wa 33740 Durng 2013 ing investing, or financing to prepare the statemem of ca fo for Gelden Epi Yo sold in 2013 the year. dal espenditures (ie cash used to purchase new property and equipment ue inclded in he investing section of the statement of cash flows as a use of cas Cash proceeds from the sale or disposal of property and equipmen ae included is the investing section as a source of cash iv. Gains and losses on sales of flzed assets are included in the operating section of the statment of cash flows. Hint: You can find the gain or loss on Golden Enterprise's income statement Offen, however, that is not the case because the gain or los is combined with other items in a single line item on the statement. In those cases, to deternine the gain or loss on disponal, determine the cost of the disposed property (the credit that balances the gross property and equipment T-account) and the related accumulated depreciation on the disposed property (the debit that balances the accumulated depreciation account). The differemce between the cost of the disposed property and the related accumulated depreciation is the net book valur of the disposed property. Compare the net book value to the cash proceeds to detemine the amount of the gain or loss on disposal. You can prove this using figures from Golden Enterprise's financial reports. 2 During fiscal 2013, Golden Enterprises issued S38,361,200 of new debt and spent $38,287,529 to repay debt. These activities affected the "Current portion of long-term debt," "Line of credit outstanding." and "Note payable-bank" accounts. Combine those accounts to perform your analysia. The "Checks outstanding in excess of bank balances" account is alse considered a financing accoust 3. To simplify your analysis, also combine the following balance sheet aecounts Accrued income taxes asset and liability mccounts into a single, net liability account Deferred income tax asset and liability accounts into a single, net total liability account *. As in the 2012 statement of cash flows, both "other assets" accounts should be treated as operating assets. Current and long-term salary continuation accounts into a single total liability account Kecall that transactions with owners of the firm (for example, share issuances, dividends and 41% GOLDEN ENTERPRISES, INC. AND SUBSIDIARY CONSOLIDATED BALANCE SHEETS As of May 31, 2013 and June 1, 2012 ASSETS 2013 CURRENT ASSETS Cash and cash equivalents 2012 757,1 Receivables Trade accounts 10,561221 166 485 10,529,706 70,000 Other 103404 24127 Less: Allowance for doubtful accounts 70,000 10,5660) 10,459,706 Inventories: Raw materials Finished goods LA72,541 3,083,272 1,93,629 3,463,169 4,955A13 S,156,798 Prepaid expenses Accrued income taxes Deferred income taxes 1,354,737 1,754,874 396.267 615.182 20,0437 Total current assets 18323,634 PROPERTY, PLANT AND EQUIPMENT Land 2,769,499 18,793,928 2,769,499 Buildings Machinery and equipment Transportation equipment 18,323 373 61,247,920 6,944.931 64,749,661 6,709355 89,285,723 62.788, 133 93,022,443 65.927.389 Less: Accumulated depreciation 27,095,054 26,497.590 758,667 1450,732 OTHER ASSETS 695,761 1,642,030 Cash surrender value of life insurance Other 2,337,791 2,209.399 Total other assets 47,756,479 48,753,626 TOTAL 32 LIAILITES AND STOCKHOLDERS EQUITY 2013 CURRENT LIABILITIES Checko ttanding in ece of hank halances Actote pajahle Curent ptioe of long-erm debr Line of eradit outtanding Accrud ipeome lax Other accned expenses Salay cotination plan 392350 1,72529 53,475 ARCAS 196649 14,047 261 140 Tetal cument liabilities LONG TERM LIABILITIES Note payable-hank, -curent Salary coecinuation plan Defemed inccene taxes 5314213 1,032810 3.304,45) LO s 9,651,474 10314 Total long-derm liabilities STOCKHOLDERS EQUITY Common steck - 5.66 2/3 par value: Authorized 35,000,000 shares; ianuod 13828,793 shares Additional paid-in capital Retained camings 9,219,195 92191 6,497,954 19.273,214 (10.932.619) 195 56 (1092579 Treasury shares at cost (2.096,161 shares in 2013, 2,094,161 shares in 2012) Total stockholders' oquity 24,057,744 2439 TOTAL 47,756,479 48,753,626 For the Fiscal Years Ended May 31, 2013 and June 1,2012 CONSOLIDATED STATEMENTS OF INCOME GOLDEN ENTERPRISES, INC. AND SUBSIDIARY 2013 2012 137,344,716 70,767 427 66,557.289 of saler 204 ain 45,541.3 64,233,593 2,323 6 gerating income 3.9514 aer fexpenses) income: Gr oe sale of assets st expense 61,040 (311,098) 102.917 16276 (282764) 113.873 Oer income Toal other (expenses) income (147,141) (6,035) lacome before income taxes 2,176,555 3,945 49 Provision for income taxes 1,042,518 1,738,226 Net income 1,134,037 2.207.623 PER SHARE OF COMMON STOCK Rasic earnings Diluted earnings 0.10 0.19 %24 0.10 0.19 CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY GOLDEN ENTERPRISES, INC. AND SUBSIDIARY For the Fiscal Years Ended May 31, 2013 and June 1, 2012 Equity Retained Earnings (Treasury) Shares Stock Capital Balance - June 3, 2011 (10,925,759)S 23,657,654 9,219,195 6,497,954 18,866,264 Net income - 2012 Cash dividends paid 2,207,623 (1,466,831) 2,207,623 (1,466,831) Balance - June 1, 2012 24,398,446 9,219,195 (10,925,759) 6,497,954 19,607,056 Net income - 2013 Cash dividends paid Treasury shares purchased 1,134,037 (1,467,879) (6,860) 1,134,037 (1,467,879) (6,860) Balance - May 31, 2013 9,219,195 6,497,954 19,273,214 (10,932,619) S 24,057,744 CASH AND CASH EQUIVALENTS AT CASH AND CASH EQUIVALENTS AT GOLDEN ENTERPRISES, INC. AND SUBSIDIARY CONSOLIDATED STATEMENTS OF CASHFLOWS For the Fiscal Years Ended May 31, 2013 and June 1, 2012 47 Net cash provided by operating activities [details on following page) 5,74120 hase of property, plant and equipment eds from sale of property, plant and equipment (4,991AS) -21 31 Net cash used in investing activities DA FLOWS FROM FINANCING ACTIVITIES Debt proceeds Debt repayments Change in checks outstanding in excess of bank balances Purchases of treasury shares Cash dividends paid 36,639,753 (37,468412) 712,031 (1,466,831) (1,583,459) Net cash (used in) provided by financing activities (827,822) NET DECREASE IN CASH AND CASH EQUIVALENTS 2,721,638 BEGINNING OF YEAR 1,893,816 END OF YEAR GOLDEN ENTERPRISES, INC. AND SUBSIDIARY CONSOLIDATED STATEMENTS OF CASHFLOWS For the Fiscal Years Ended May 31, 2013 and June 1, 2012 RECONCILIATION OF NET INCOME TO NET CASH PROVIDED BY OPERATING ACTIVITE 2013 2012 %24 2,207,623 Net income Adjustment to reconcile net income to net cash provided by operating activities: Depreciation Deferred income taxes Gain on sale of property and equipment Change in receivables-net Change in inventories Change in prepaid expenses Change in cash surrender value of insurance Change in other assets - other Change in accounts payable Change in accrued expenses Change in salary continuation plan Change in accrued income taxes 3,303,353 557,576 (162,876) (345,853) (161,169) 48,956 176,177 (151,239) (297,983) (132,524) (100,324) 805,573 Net cash provided by operating activities 5,747,290

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started