Answered step by step

Verified Expert Solution

Question

1 Approved Answer

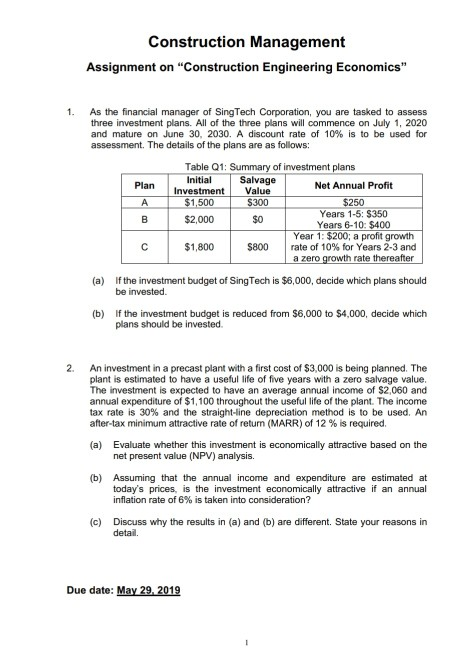

Construction Management Assignment on Construction Engineering Economics 1 As the financial manager of SingTech Corporation, you are tasked to assess three investment plans. All of

Construction Management Assignment on "Construction Engineering Economics" 1 As the financial manager of SingTech Corporation, you are tasked to assess three investment plans. All of the three plans will commence on July 1, 2020 and mature on June 30, 2030. A discount rate of 10% is to be used for assessment. The details of the plans are as follows: Table Q1: Summary of investment Initial Salvage Plan Net Annual Profit InvestmentValue 1,500 $250 Years 1-5: $350 Years 6-10: $400 Year 1: $200; a profit growth rate of 10% for Years 2-3 and 300 $2,000 $0 $1,800 $800 rate thereafter a zero (a) If the investment budget of SingTech is $6,000, decide which plans should be invested (b) If the investment budget is reduced from $6,000 to $4,000, decide which plans should be invested. 2. An investment in a precast plant with a first cost of $3,000 is being planned. The plant is estimated to have a useful life of five years with a zero salvage value The investment is expected to have an average annual income of $2,060 and annual expenditure of $1,100 throughout the useful life of the plant. The income tax rate is 30% and the straight-line depreciation method is to be used. An after-tax minimum attractive rate of return (MARR) of 12 % is required. (a) Evaluate whether this investment is economically attractive based on the net present value (NPV) analysis. (b) Assuming that the annual income and expenditure are estimated at today's prices, is the investment economically attractive if an annual inflation rate of 6% is taken into consideration? (c) Discuss why the results in (a) and (b) are different. State your reasons in detail. Due date

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started