Answered step by step

Verified Expert Solution

Question

1 Approved Answer

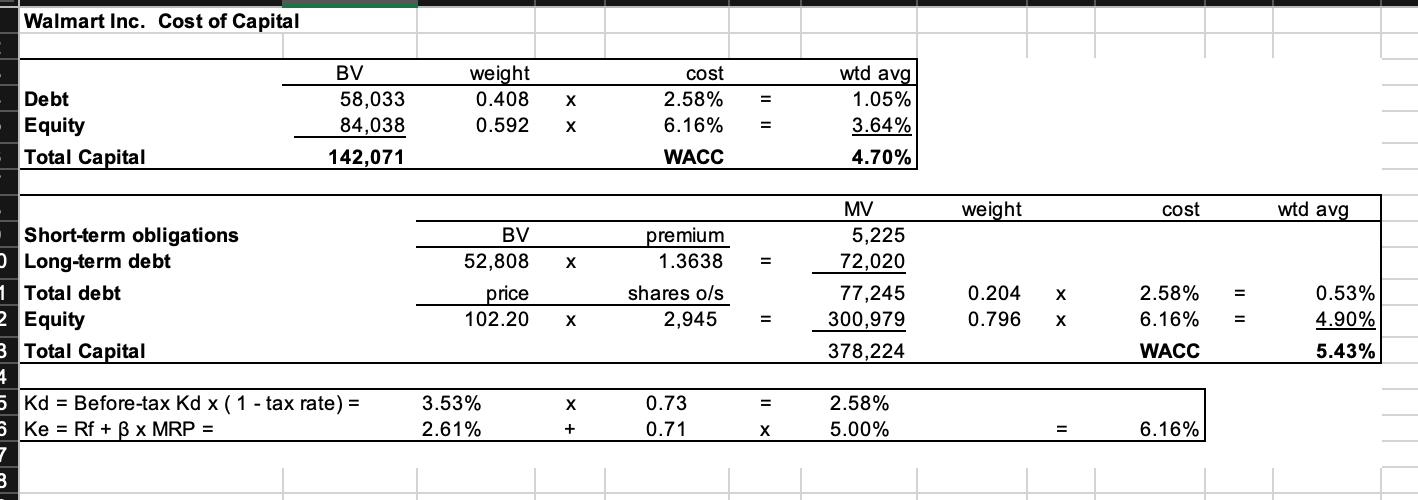

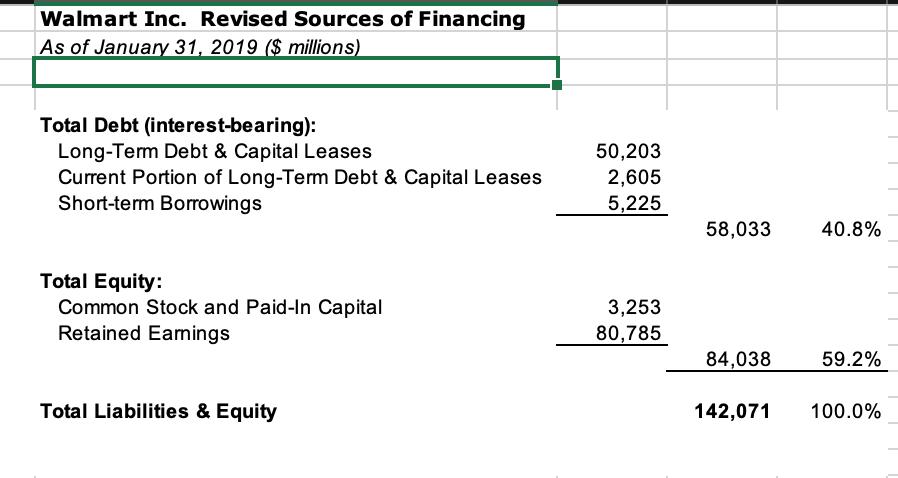

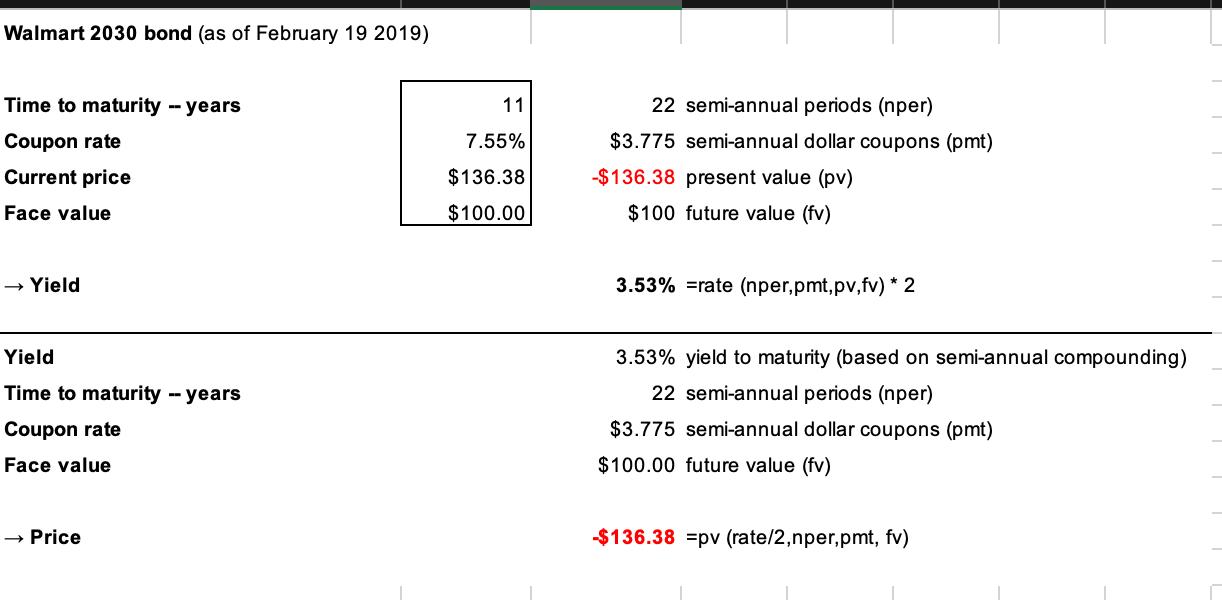

Consult the spreadsheet entitled Walmart Cost of Capital Supplement. Give an explanation of how Dale and Lee have calculated Walmart's cost of capital. Do you

Consult the spreadsheet entitled "Walmart Cost of Capital Supplement." Give an explanation of how Dale and Lee have calculated Walmart's cost of capital.

Do you agree with their estimate of Walmart's WACC? Why or why not? How could the estimate be improved?

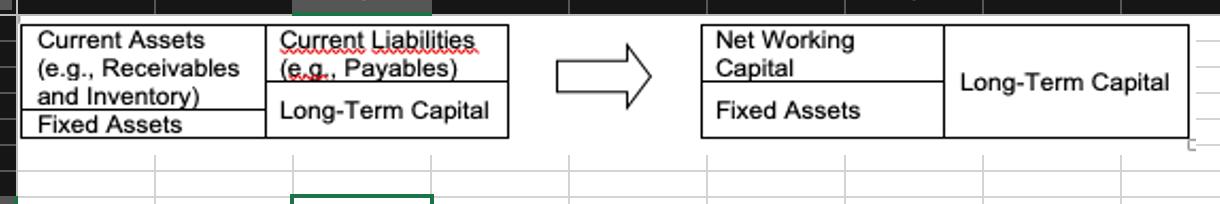

Walmart Inc. Cost of Capital Debt Equity Total Capital Short-term obligations O Long-term debt BV 58,033 84,038 142,071 1 Total debt 2 Equity 3 Total Capital 4 5 Kd Before-tax Kd x (1 - tax rate) = 5 Ke Rf + B x MRP = 7 3 weight 0.408 0.592 BV 52,808 price 102.20 3.53% 2.61% X X X X X + cost 2.58% 6.16% WACC premium 1.3638 shares o/s 2,945 0.73 0.71 = = = X wtd avg 1.05% 3.64% 4.70% MV 5,225 72,020 77,245 300,979 378,224 2.58% 5.00% weight 0.204 X 0.796 X cost 2.58% 6.16% WACC 6.16% = wtd avg 0.53% 4.90% 5.43%

Step by Step Solution

★★★★★

3.42 Rating (139 Votes )

There are 3 Steps involved in it

Step: 1

Dale and Lee have calculated Walmarts cost of capital or Weighted Average Cost of Capital WACC by considering the proportions of debt and equity in the companys capital structure and their respective ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started