Answered step by step

Verified Expert Solution

Question

1 Approved Answer

consumer math project questions 1-5 consumer math project question 1-5 For each problem provide the formula to bed and variable in the formula with its

consumer math project

questions 1-5

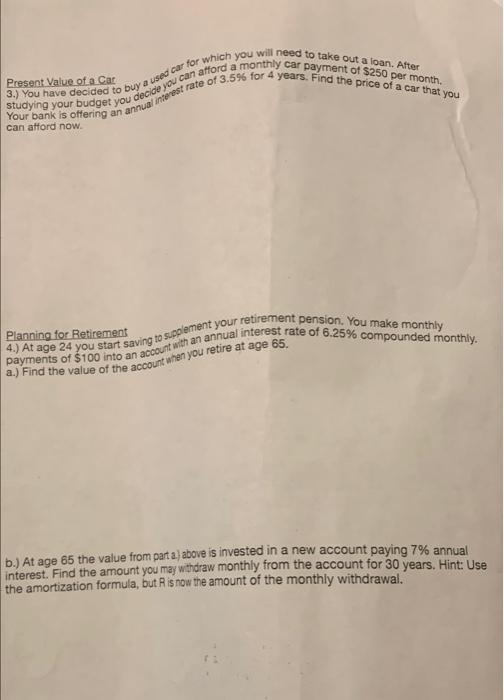

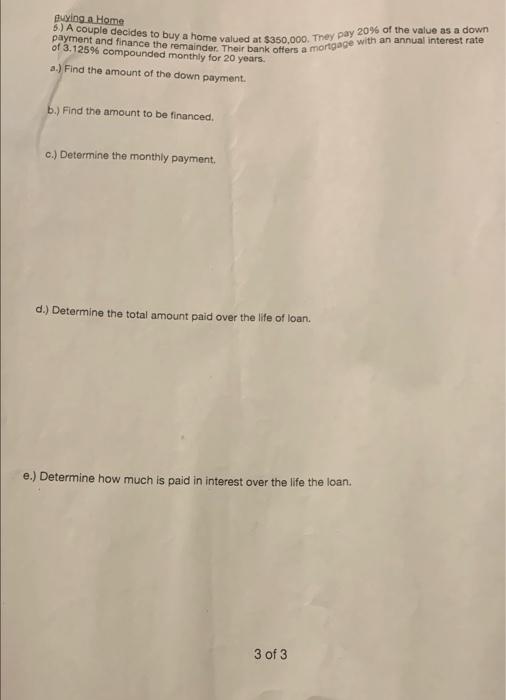

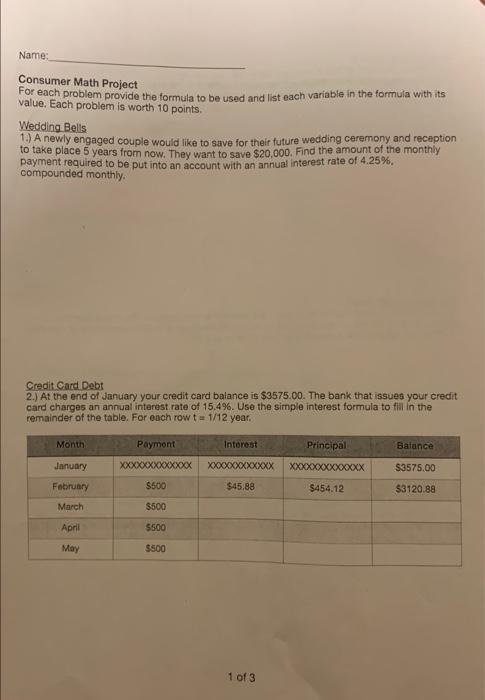

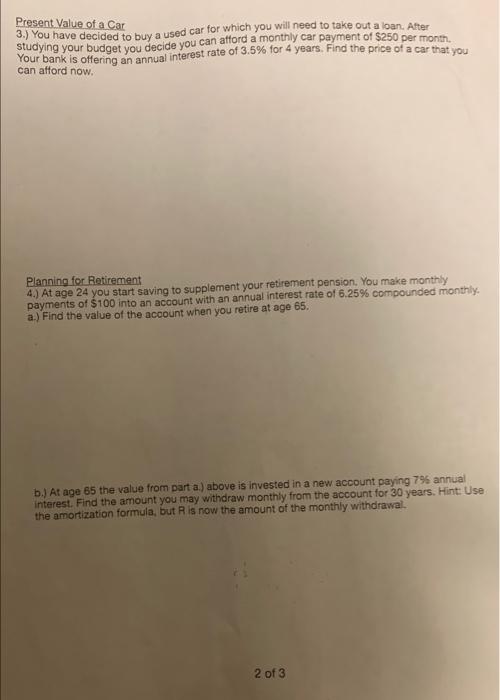

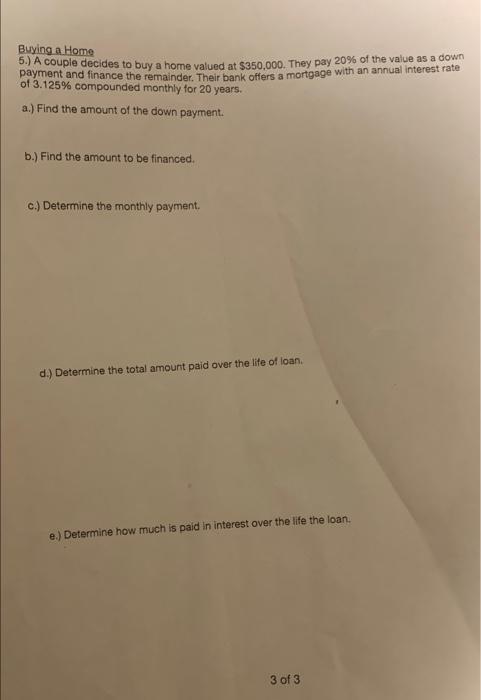

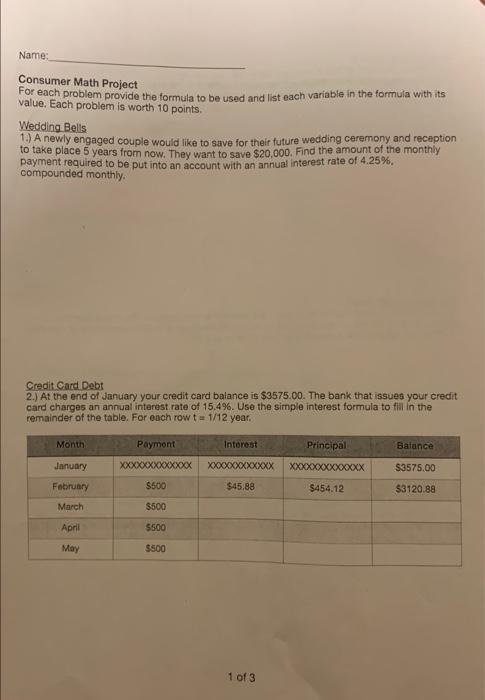

consumer math project

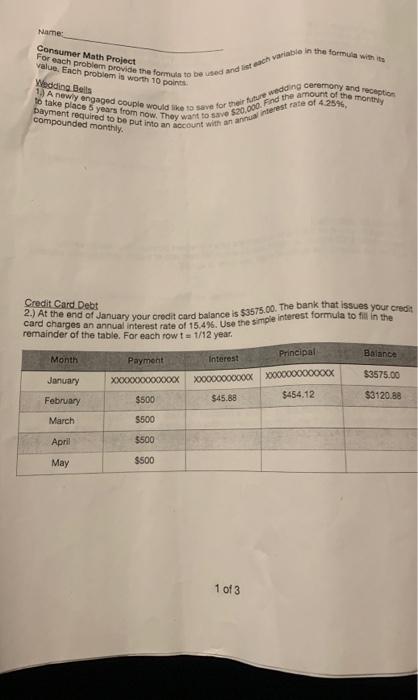

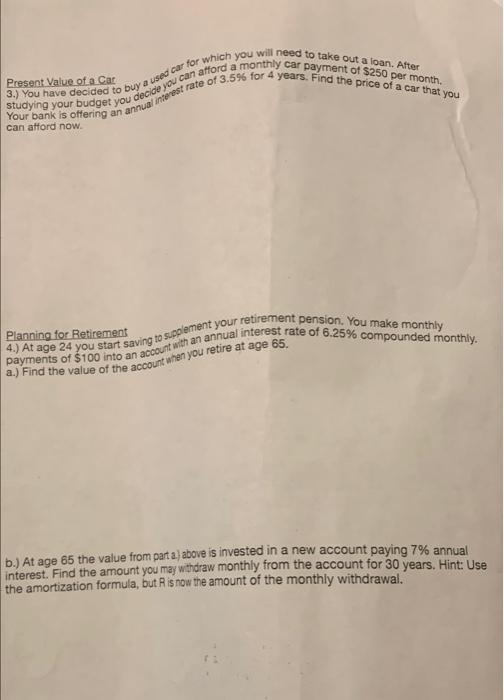

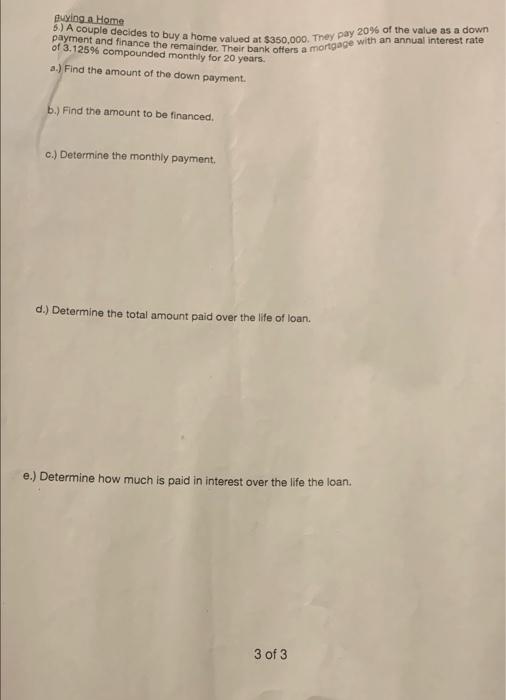

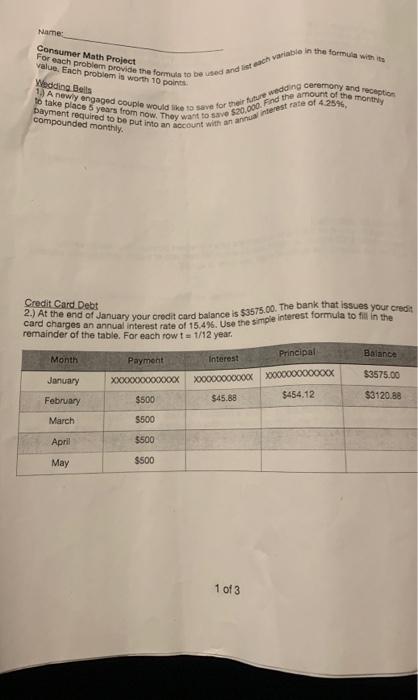

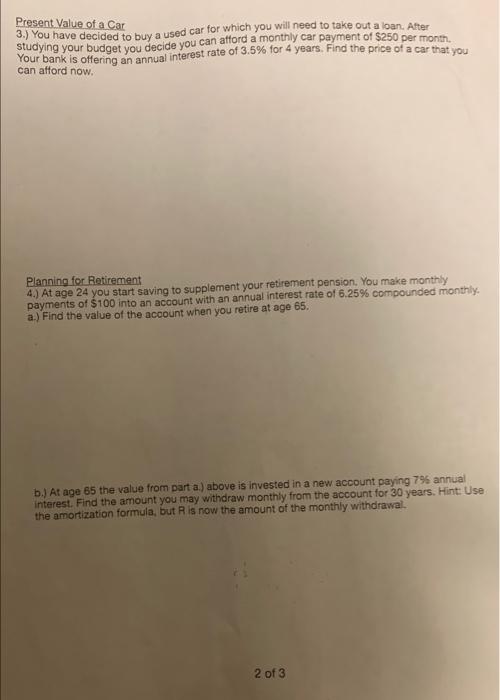

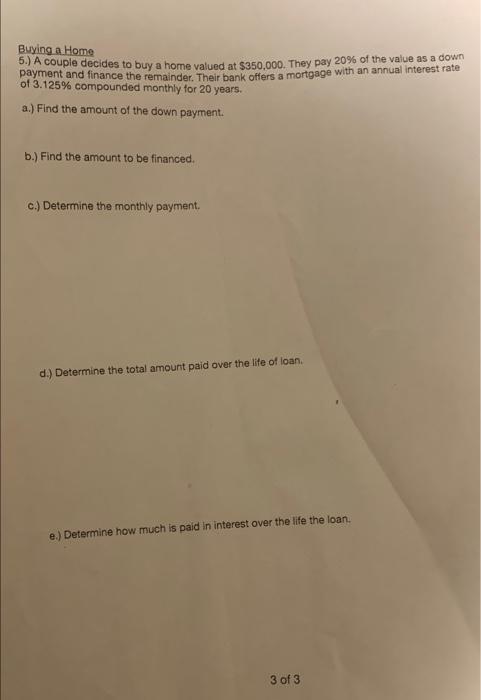

For each problem provide the formula to bed and variable in the formula with its to take place 5 years from now. They want to save $20.000. Find the amount of the monthly 1) A newly engaged couple would leave for their future wedang ceremony and reception Dayment required to be put into an account with an annual interest rate of 4.2596 Name: Consumer Math Project value. Each problem is worth 10 points Wedding Baits compounded monthly Credit Card Debt 2.) At the end of January your credit card balance is $3575.00. The bank that issues your credit remainder of the table. For each row t = 1/12 year. Balance Month Payment Interest January XXXXXXC000ocx xo 000000 X0000000000cx $3575.00 February $500 $45.88 $454.12 $3120.88 Principal March 5500 April $500 May $500 1 of 3 studying your budget you decide you can afford a monthly car payment of $250 per month, Present Value of a Car Your bank is offering an annual interest rate of 3.596 for 4 years. Find the price of a car that you 3.) You have decided to buy a used car for which you will need to take out a loan. After can afford now 4.) At age 24 you start saving to supplement your retirement pension. You make monthly Planning for Retirement payments of $100 into an account with an annual interest rate of 6.25% compounded monthly. a.) Find the value of the account when you retire at age 65. b.) At age 65 the value from parta) above is invested in a new account paying 7% annual interest. Find the amount you may withdraw monthly from the account for 30 years. Hint: Use the amortization formula, but is now the amount of the monthly withdrawal. buying a Home payment and finance the remainder. Their bank offers a mortgage with an annual interest rate 5.) A couple decides to buy a home valued at $350.000. They pay 20% of the value as a down of 3.125% compounded monthly for 20 years. a.) Find the amount of the down payment. b.) Find the amount to be financed. c.) Determine the monthly payment. d.) Determine the total amount paid over the life of loan e.) Determine how much is paid in interest over the life the loan. 3 of 3 Name: Consumer Math Project value. Each problem is worth 10 points. For each problem provide the formula to be used and list each variable in the formula with its Wedding Bells 1. A newly engaged couple would like to save for their future wedding ceremony and reception to take place 5 years from now. They want to save $20,000. Find the amount of the monthly payment required to be put into an account with an annual interest rate of 4.25%. compounded monthly Credit Card Debt 2.) At the end of January your credit card balance is $3575.00. The bank that issues your credit card charges an annual interest rate of 15.4%. Use the simple interest formula to fill in the remainder of the table. For each row t = 1/12 year. Month Paymont Interest Principal Balance January xxxxxxxxxxx XXX $3575.00 February $500 $45.88 $454.12 $3120.88 March $500 April $500 May $500 1 of 3 Present Value of a Car 3.) You have decided to buy a used car for which you will need to take out a loan. After studying your budget you decide you can attord a monthly car payment of $250 per month. Your bank is offering an annual interest rate of 3.5% for 4 years. Find the price of a car that you Planning for Retirement 4.) At age 24 you start saving to supplement your retirement pension. You make monthly payments of $100 into an account with an annual interest rate of 6.25% compounded monthly. a.) Find the value of the account when you retire at age 65. b.) At age 65 the value from part a.) above is invested in a new account paying 7% annual interest. Find the amount you may withdraw monthly from the account for 30 years. Hint: Use the amortization formula, but is now the amount of the monthly withdrawal. 2 of 3 Buying a Home 6.) A couple decides to buy a home valued at $360,000. They pay 20% of the value as a down payment and finance the remainder. Their bank offers a mortgage with an annual interest rate of 3.125% compounded monthly for 20 years. a.) Find the amount of the down payment. b.) Find the amount to be financed. c.) Determine the monthly payment. d.) Determine the total amount paid over the life of loan e.) Determine how much is paid in interest over the life the loan. 3 of 3 question 1-5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started