Answered step by step

Verified Expert Solution

Question

1 Approved Answer

consumers math- loans In this problem, we will compare the merits of leasing vs. buying a car. When you lease a car, you will typically

consumers math- loans

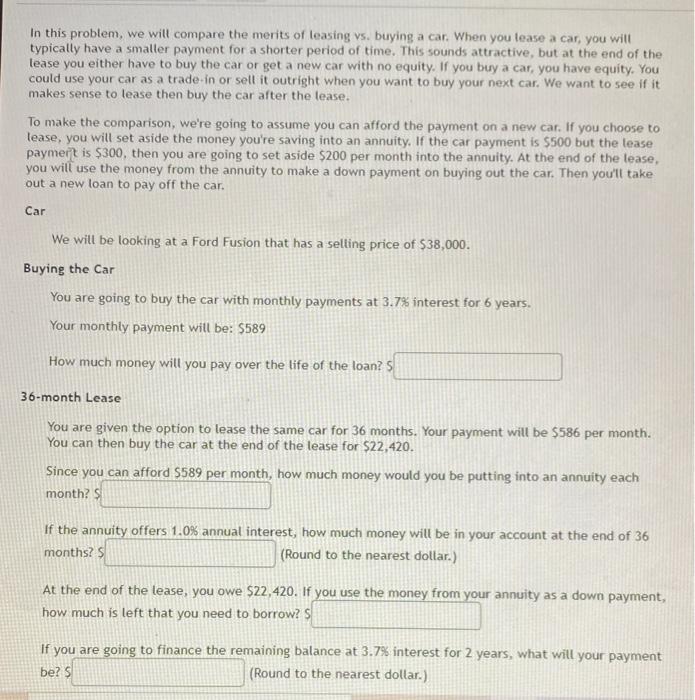

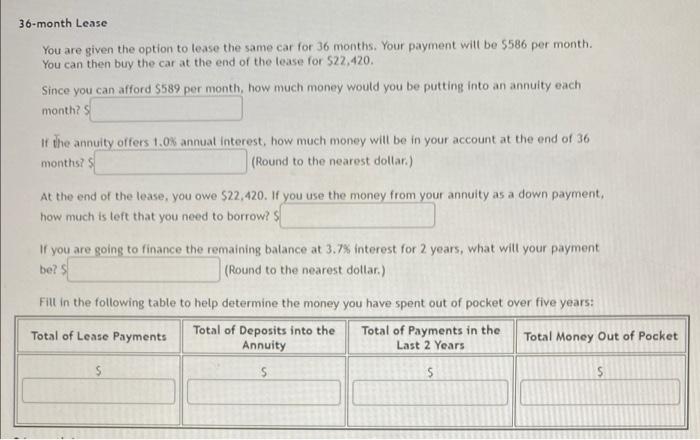

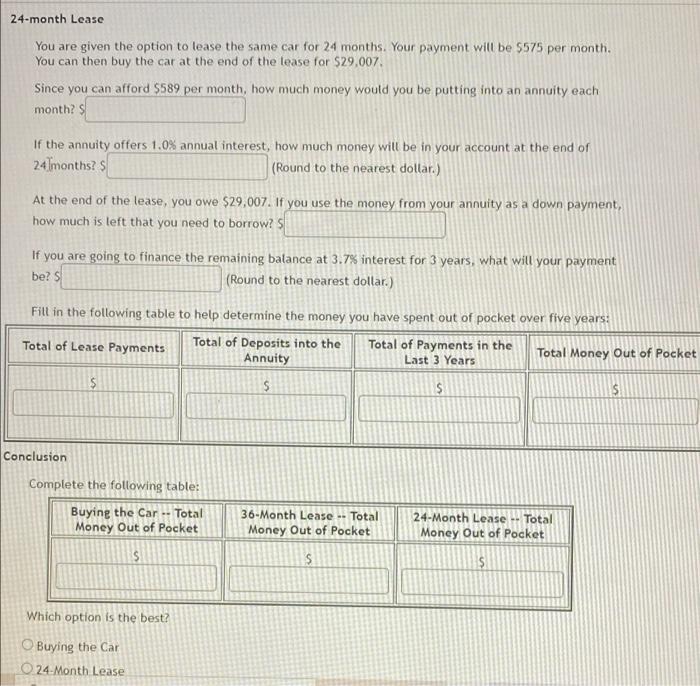

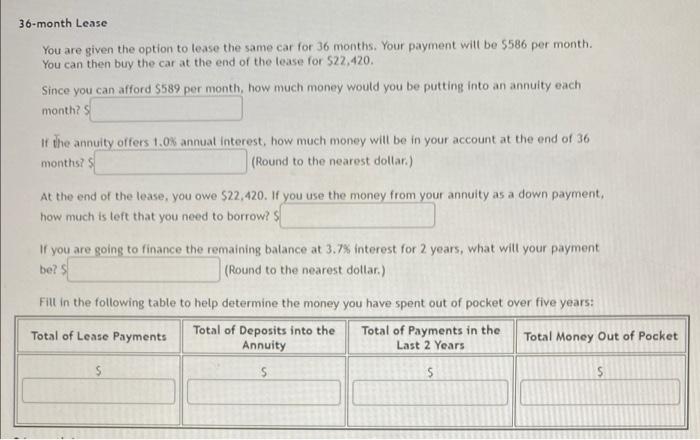

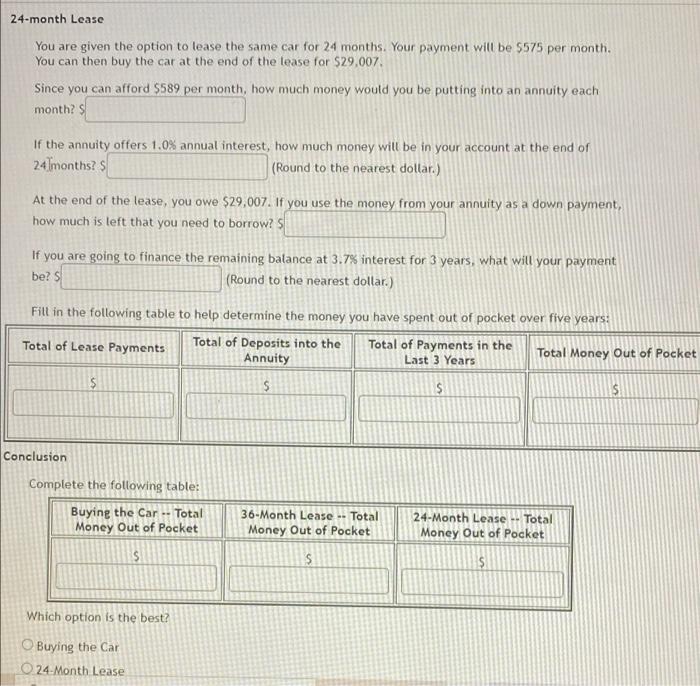

In this problem, we will compare the merits of leasing vs. buying a car. When you lease a car, you will typically have a smaller payment for a shorter period of time. This sounds attractive, but at the end of the lease you either have to buy the car or get a new car with no equity. If you buy a car, you have equity. You could use your car as a trade-in or sell it outright when you want to buy your next car. We want to see if it makes sense to lease then buy the car after the lease. To make the comparison, we're going to assume you can afford the payment on a new car. If you choose to lease, you will set aside the money you're saving into an annuity. If the car payment is $500 but the lease paymert is $300, then you are going to set aside $200 per month into the annuity. At the end of the lease, you will use the money from the annuity to make a down payment on buying out the car. Then you'll take out a new loan to pay off the car. Car We will be looking at a Ford Fusion that has a selling price of $38,000. Buying the Car You are going to buy the car with monthly payments at 3.7% interest for 6 years. Your monthly payment will be: $589 How much money will you pay over the life of the loan? 36-month Lease You are given the option to lease the same car for 36 months. Your payment will be $586 per month. You can then buy the car at the end of the lease for $22,420. Since you can afford S589 per month, how much money would you be putting into an annuity each month? I If the annuity offers 1.0% annual interest, how much money will be in your account at the end of 36 months? $ (Round to the nearest dollar.) At the end of the lease, you owe $22,420. If you use the money from your annuity as a down payment, how much is left that you need to borrow? S If you are going to finance the remaining balance at 3.7% interest for 2 years, what will your payment be? $ (Round to the nearest dollar.) 36-month Lease You are given the option to lease the same car for 36 months. Your payment will be $586 per month. You can then buy the car at the end of the lease for $22,420. Since you can afford $589 per month, how much money would you be putting into an annuity each month? If the annuity offers 1.0% annual Interest, how much money will be in your account at the end of 36 months? (Round to the nearest dollar) At the end of the lease, you owe $22,420. If you use the money from your annuity as a down payment, how much is left that you need to borrow? If you are going to finance the remaining balance at 3.7% interest for 2 years, what will your payment be? (Round to the nearest dollar.) Fill in the following table to help determine the money you have spent out of pocket over five years: Total of Lease Payments Total of Deposits into the Total of Payments in the Total Money Out of Pocket Annuity Last 2 years $ S $ S 24-month Lease You are given the option to lease the same car for 24 months. Your payment will be $575 per month You can then buy the car at the end of the lease for $29,007. Since you can afford $589 per month, how much money would you be putting into an annuity each months If the annuity offers 1.0% annual interest, how much money will be in your account at the end of 24 months? S (Round to the nearest dollar.) At the end of the lease, you owe $29,007. If you use the money from your annuity as a down payment, how much is left that you need to borrow? If you are going to finance the remaining balance at 3.7% interest for 3 years, what will your payment be? S (Round to the nearest dollar.) Fill in the following table to help determine the money you have spent out of pocket over five years: Total of Lease Payments Total of Deposits into the Total of Payments in the Total Money Out of Pocket Annuity Last 3 Years $ $ $ Conclusion Complete the following table: Buying the Car -- Total Money Out of Pocket 36-Month Lease Total Money Out of Pocket 24-Month Lease -- Total Money Out of Pocket $ S $ Which option is the best? Buying the Car O 24 Month Lease

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started