Question

The demand of stringing services declined significantly since the outbreak of COVID-19. Option 1: making no change to the depreciation method but re-evaluating the remaining

The demand of stringing services declined significantly since the outbreak of COVID-19.

Option 1: making no change to the depreciation method but re-evaluating the remaining useful life of each machine

Original Practice: recognize depreciation using the straight-line method

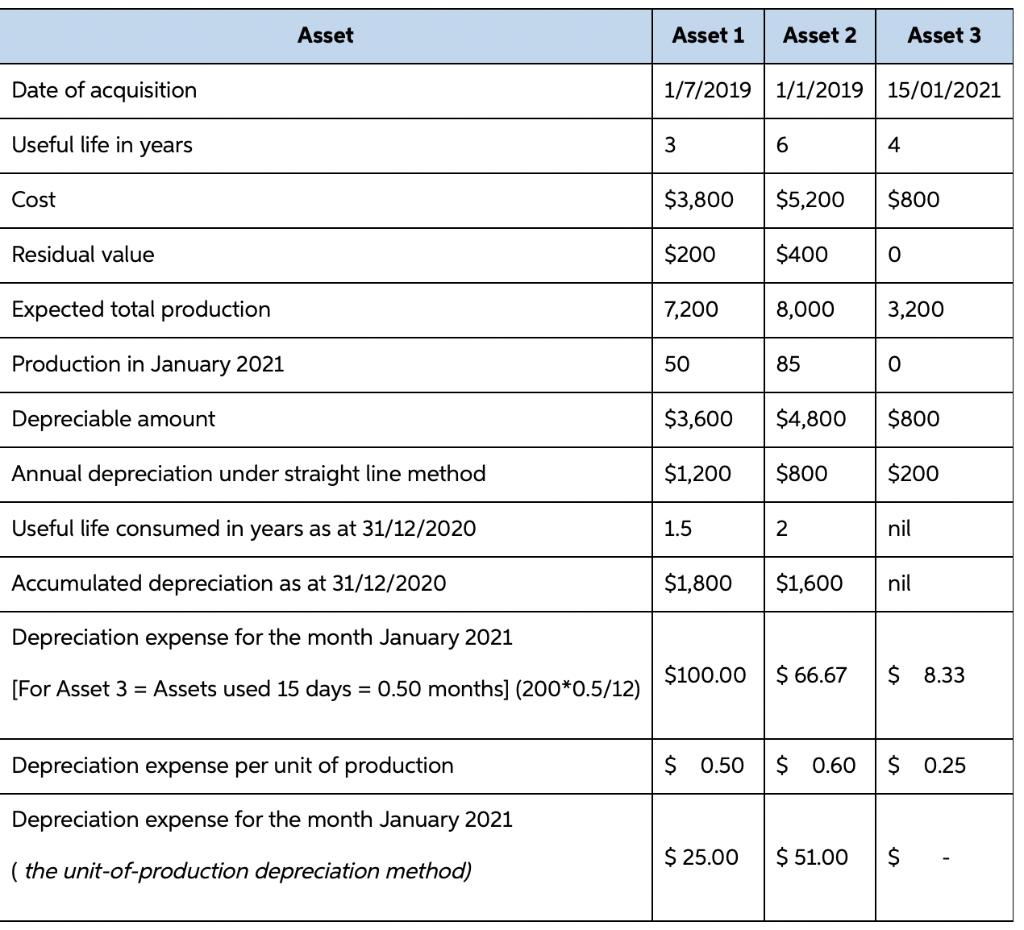

Table 1. Depreciation table for 3 stringing machines

Discuss how may Option 1 be more appropriate than the Original Practice (i.e. to recognize depreciation using the straight-line method based on the information in Table 1):

a) the reasons why the Original Practice may not be appropriate

b) the outcome if continues with the Original Practice

c) how to implement Option 1 to more accurately account for depreciation

d) the outcome if implements Option 1 properly

Asset Asset 1 Asset 2 Asset 3 Date of acquisition 1/7/2019 1/1/2019 15/01/2021 Useful life in years 3 4 Cost $3,800 $5,200 $800 Residual value $200 $400 Expected total production 7,200 8,000 3,200 Production in January 2021 50 85 Depreciable amount $3,600 $4,800 $800 Annual depreciation under straight line method $1,200 $800 $200 Useful life consumed in years as at 31/12/2020 1.5 2 nil Accumulated depreciation as at 31/12/2020 $1,800 $1,600 nil Depreciation expense for the month January 2021 $100.00 $ 66.67 $ 8.33 [For Asset 3 = Assets used 15 days = 0.50 months] (200*0.5/12) Depreciation expense per unit of production $ 0.50 $ 0.60 $ 0.25 Depreciation expense for the month January 2021 $ 25.00 $ 51.00 2$ ( the unit-of-production depreciation method)

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Since the full use of the asset was not made during the month of Jan 21 and production was also not ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started