Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Context You are an equity analyst in an investment bank. You need to the responsiveness of high vs low ESG firms to market, interest

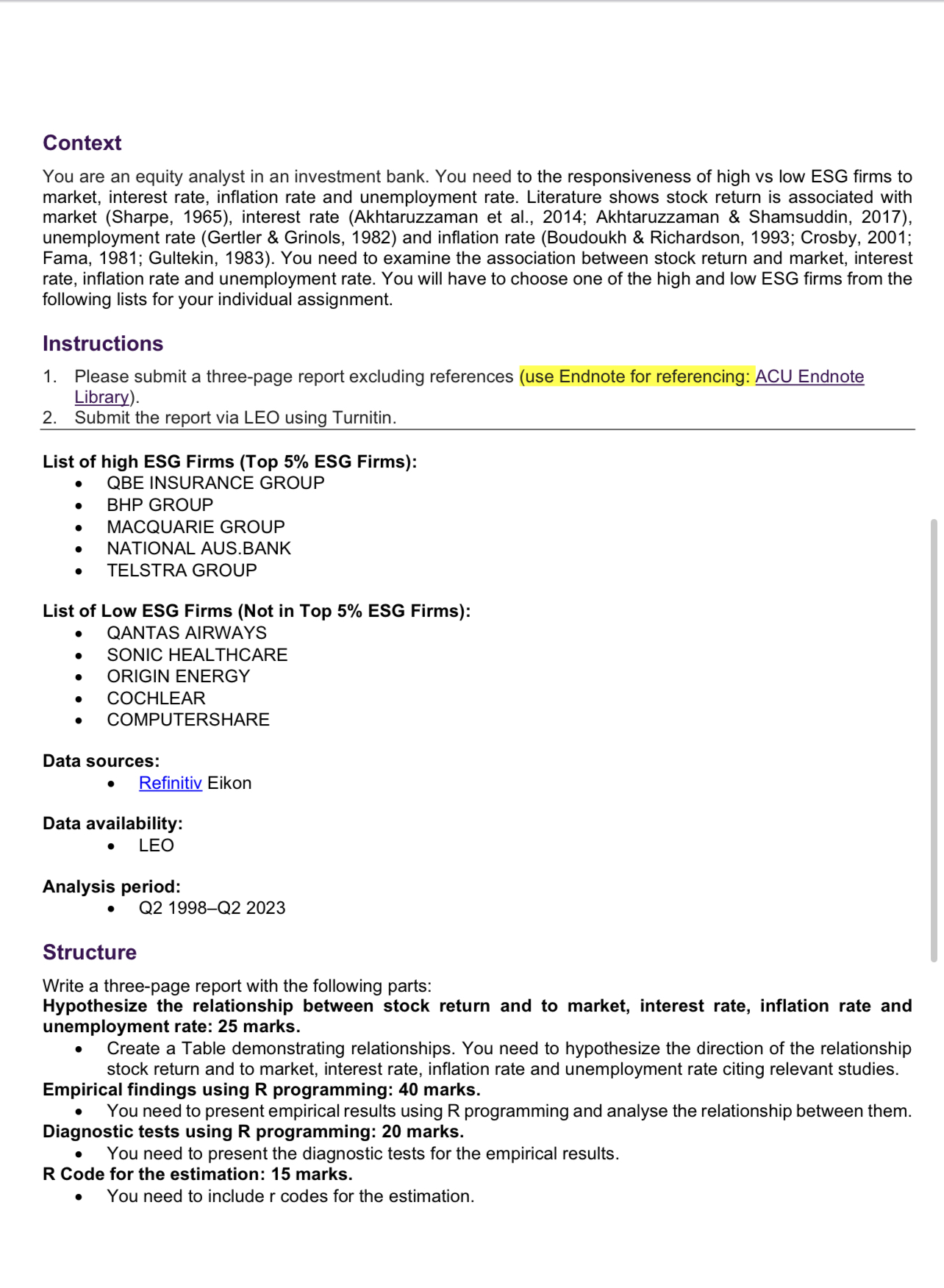

Context You are an equity analyst in an investment bank. You need to the responsiveness of high vs low ESG firms to market, interest rate, inflation rate and unemployment rate. Literature shows stock return is associated with market (Sharpe, 1965), interest rate (Akhtaruzzaman et al., 2014; Akhtaruzzaman & Shamsuddin, 2017), unemployment rate (Gertler & Grinols, 1982) and inflation rate (Boudoukh & Richardson, 1993; Crosby, 2001; Fama, 1981; Gultekin, 1983). You need to examine the association between stock return and market, interest rate, inflation rate and unemployment rate. You will have to choose one of the high and low ESG firms from the following lists for your individual assignment. Instructions Please submit a three-page report excluding references (use Endnote for referencing: ACU Endnote Library). 2. Submit the report via LEO using Turnitin. 1. List of high ESG Firms (Top 5% ESG Firms): QBE INSURANCE GROUP BHP GROUP MACQUARIE GROUP NATIONAL AUS.BANK TELSTRA GROUP List of Low ESG Firms (Not in Top 5% ESG Firms): QANTAS AIRWAYS SONIC HEALTHCARE ORIGIN ENERGY COCHLEAR COMPUTERSHARE Data sources: Refinitiv Eikon Data availability: LEO Analysis period: Q2 1998-Q2 2023 Structure Write a three-page report with the following parts: Hypothesize the relationship between stock return and to market, interest rate, inflation rate and unemployment rate: 25 marks. Create a Table demonstrating relationships. You need to hypothesize the direction of the relationship stock return and to market, interest rate, inflation rate and unemployment rate citing relevant studies. Empirical findings using R programming: 40 marks. You need to present empirical results using R programming and analyse the relationship between them. Diagnostic tests using R programming: 20 marks. You need to present the diagnostic tests for the empirical results. R Code for the estimation: 15 marks. You need to include r codes for the estimation.

Step by Step Solution

★★★★★

3.55 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

To Equity Analyst From Your Name Date Date Subject Analysis of Stock Return and Macroeconomic Factors for High and Low ESG Firms Hypothesize the Relat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started