Question

d. Construct diagrams representing the spot exchange market for the euro relative to the U.S. dollar, the forward exchange market for the euro relative to

d. Construct diagrams representing the spot exchange market for the euro relative to the U.S. dollar, the forward exchange market for the euro relative to the U.S. dollar, the loanable funds market in Germany, and the loanable funds market in the United States. Based on your answer to Problem 1, show the potential effects within each of these markets as individuals reallocate their portfolios.

e. Suppose the spot exchange rate between the dollar and the euro is 1.08 $/€. The dollar can be borrowed for one year at 1.75 percent and the euro can be lent for one year 3.25 percent. What should be the forward premium or discount? What should be the one year forward rate?

f. Use the information in Problem 3. Assume, however, that the maturity period is six months as opposed to one year. What should the forward premium or discount be now? What should the forward rate be now?

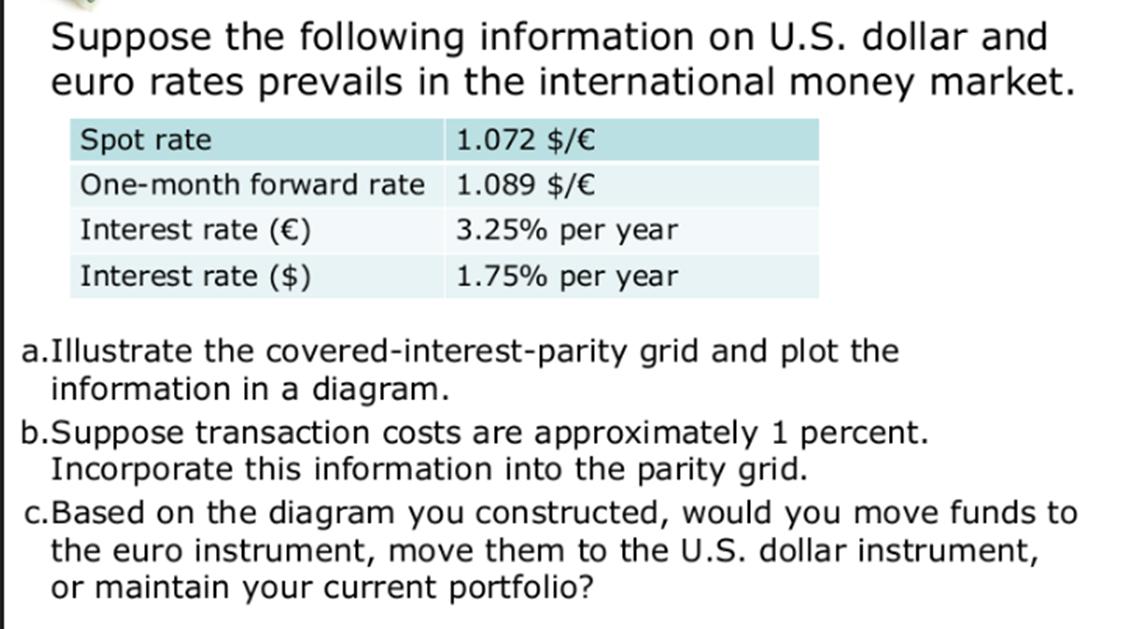

Suppose the following information on U.S. dollar and euro rates prevails in the international money market. Spot rate 1.072 $/ One-month forward rate 1.089 $/ Interest rate () Interest rate ($) 3.25% per year 1.75% per year a.Illustrate the covered-interest-parity grid and plot the information in a diagram. b.Suppose transaction costs are approximately 1 percent. Incorporate this information into the parity grid. c. Based on the diagram you constructed, would you move funds to the euro instrument, move them to the U.S. dollar instrument, or maintain your current portfolio?

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a CoveredInterestParity Grid Spot Rate S Forward Rate F Interest Rate Interest Rate US Dollar 1 1089 175 Euro 1072 1 325 b Updated CoveredInterestPari...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started