Continue completing the worksheet by entering the following adjusting entries for the month of June

1. Record depreciation for the month of June for the tools and the vehicle. Depreciation expense is $130 for tools and $180 for the vehicle.

2. Prepare an adjusting entry for insurance expense to record amount expired during the month of June.

3. Accrue interest for the note payable. (5% simple interest annually on May 31)

At the end of the month, a physical count showed inventory on hand to be $42,700.

5. At the end of the month, a physical count showed office supplies on hand to be $500.

6. Accrued salaries and wages for the last two days in June amounted to $700.

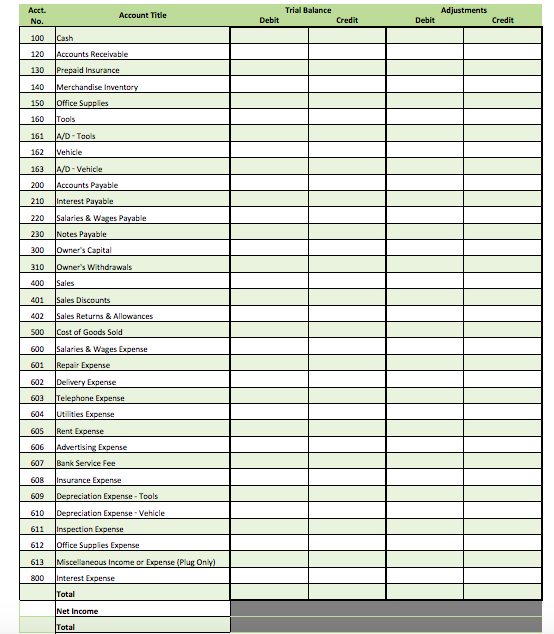

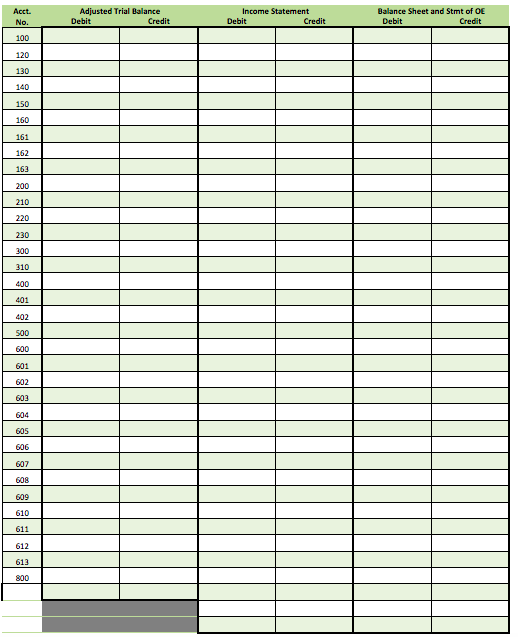

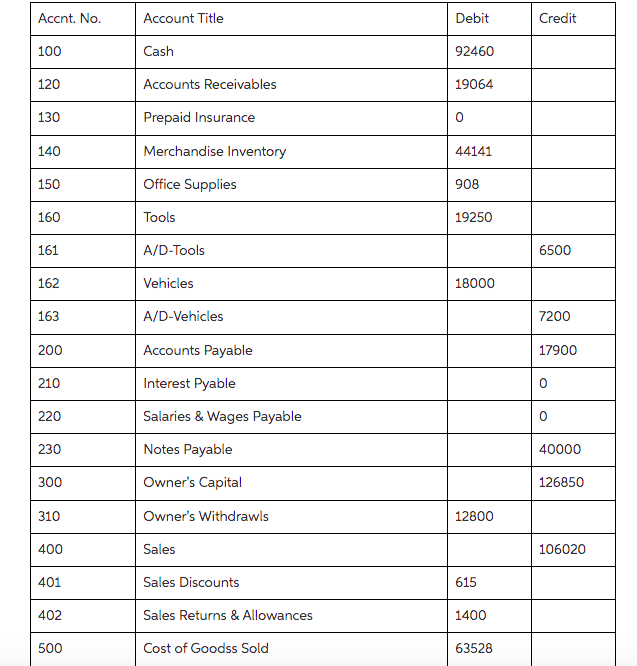

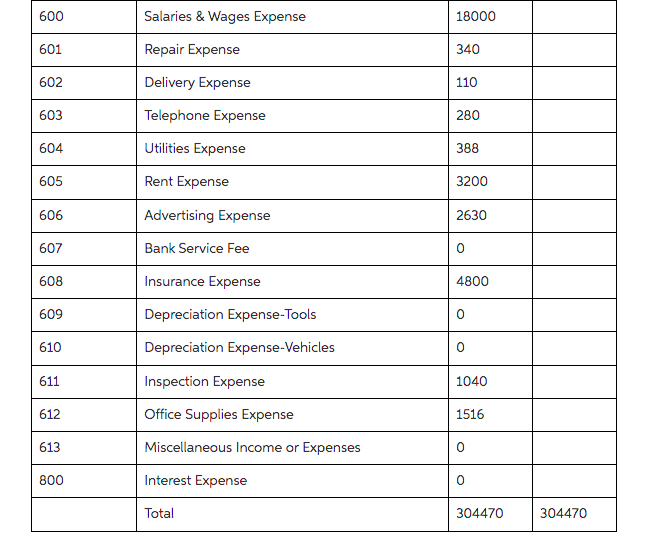

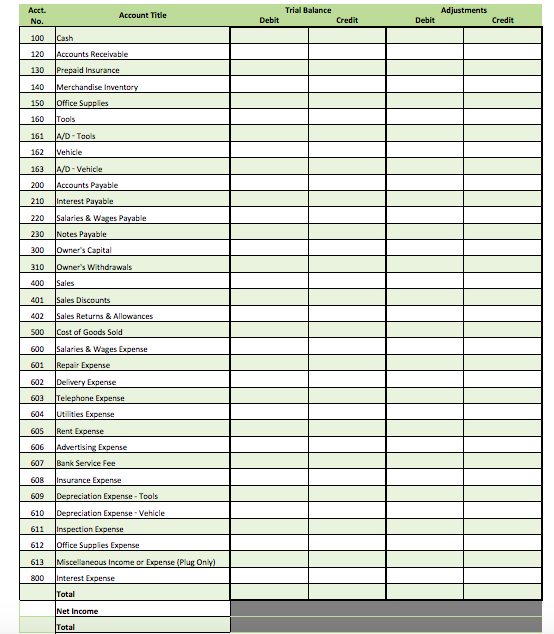

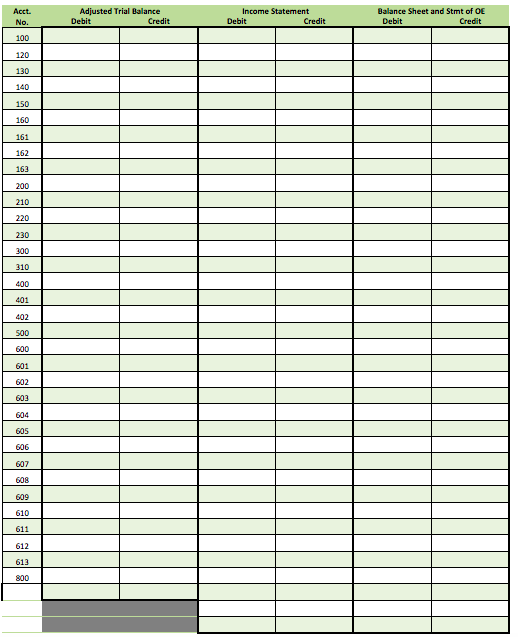

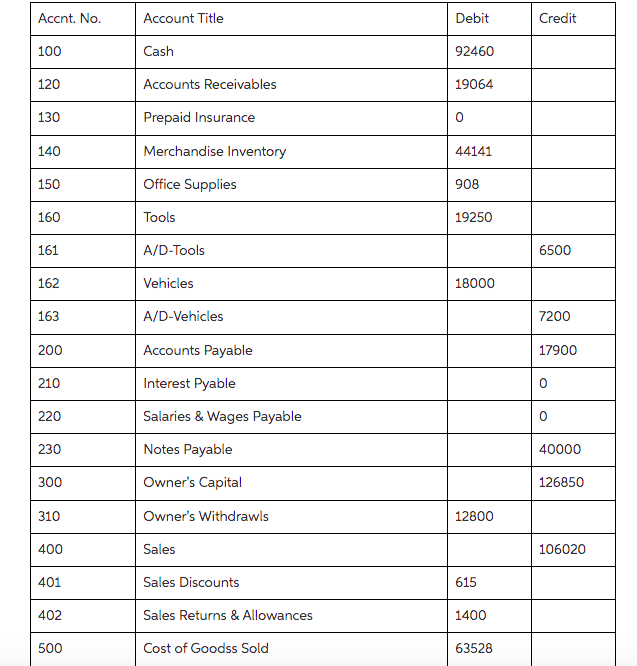

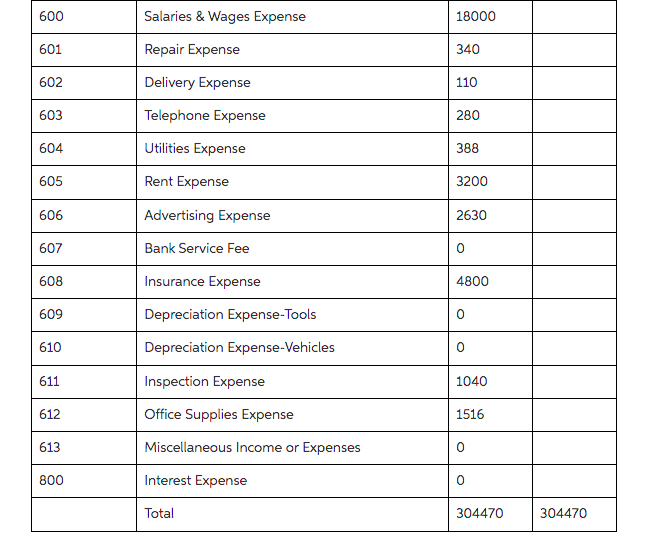

Trial Balance Acct. No. Account Title Adjustments Debit Credit Debit Credit 100 Cash 120 Accounts Receivable 130 Prepaid Insurance 140 Merchandise Inventory 150 JOffice Supplies 160 Tools 161 A/D-Tools Vehicle 162 163 A/D - Vehicle 200 Accounts Payable 210 Interest Payable 220 salaries & Wages Payable 230 Notes Payable Owner's Capital 310 Owner's Withdrawals 400 Sales 300 602 4 401 Sales Discounts 402 Sales Returns & Allowances 500 Cost of Goods Sold 600 Salaries & Wages Expense 601 Repair Expense Delivery Expense 603 Telephone Expense 604 Utilities Expense 605 Rent Expense 606 Advertising Expense 607 Bank Service Fee insurance Expense Depreciation Expense-Tools 610 Depreciation Expense - Vehicle 611 Inspection Expense 612 Office Supplies Expense 613 Miscellaneous Income or Expense (Plug Only 800 Interest Expense Total 608 609 Net Income Total Acct. No. Adjusted Trial Balance Debit Credit Income Statement Debit Credit Balance Sheet and Stmt of OE Debit Credit 100 120 130 140 150 160 161 162 163 200 210 220 230 300 310 400 401 402 500 600 601 602 603 604 605 606 607 608 609 610 611 612 613 800 Accnt. No. Account Title Debit Credit 100 Cash 92460 120 Accounts Receivables 19064 130 Prepaid Insurance 0 140 44141 Merchandise Inventory Office Supplies 150 908 160 Tools 19250 161 A/D-Tools 6500 162 Vehicles 18000 163 A/D-Vehicles 7200 200 Accounts Payable 17900 210 Interest Pyable 0 220 Salaries & Wages Payable 0 230 Notes Payable 40000 300 Owner's Capital 126850 310 Owner's Withdrawls 12800 400 Sales 106020 401 Sales Discounts 615 402 1400 Sales Returns & Allowances Cost of Goods Sold 500 63528 600 Salaries & Wages Expense 18000 601 Repair Expense 340 602 Delivery Expense 110 603 Telephone Expense 280 604 Utilities Expense 388 605 Rent Expense 3200 606 Advertising Expense 2630 607 Bank Service Fee 0 608 Insurance Expense 4800 609 Depreciation Expense-Tools 0 610 Depreciation Expense-Vehicles 0 611 1040 Inspection Expense Office Supplies Expense 612 1516 613 Miscellaneous Income or Expenses 0 800 Interest Expense Total 304470 304470