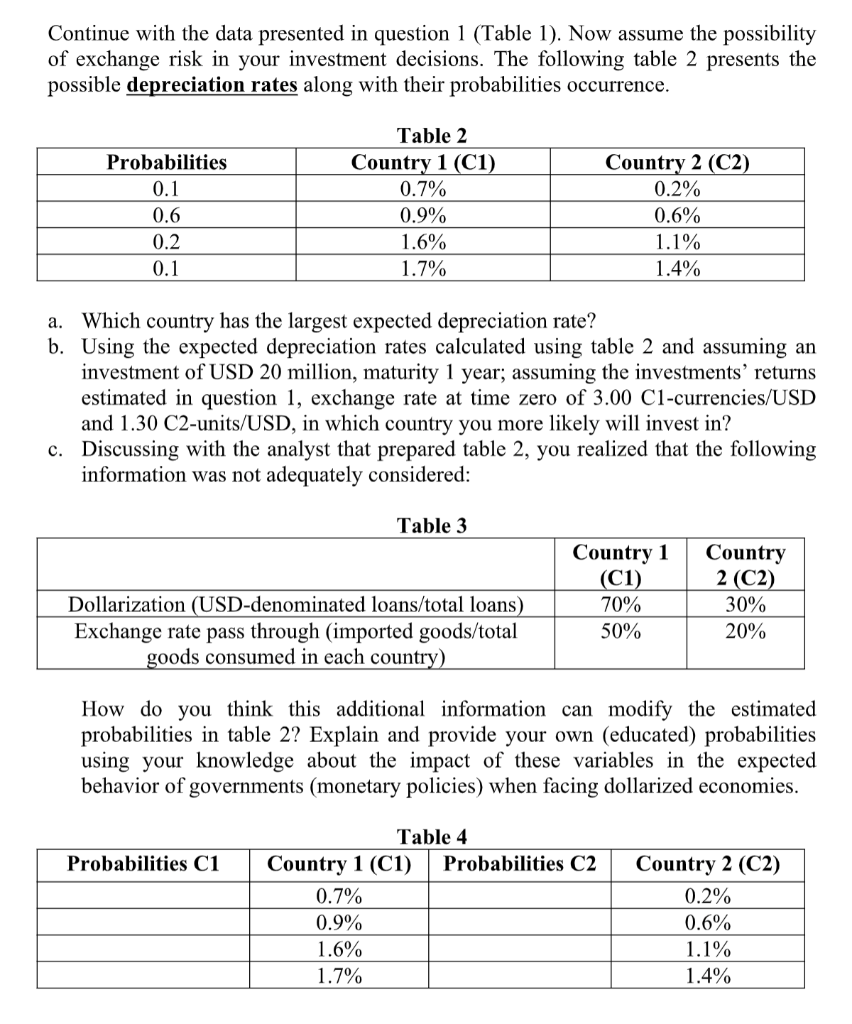

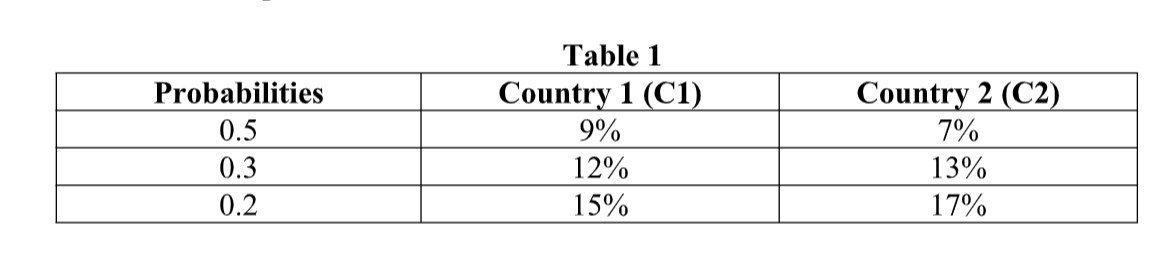

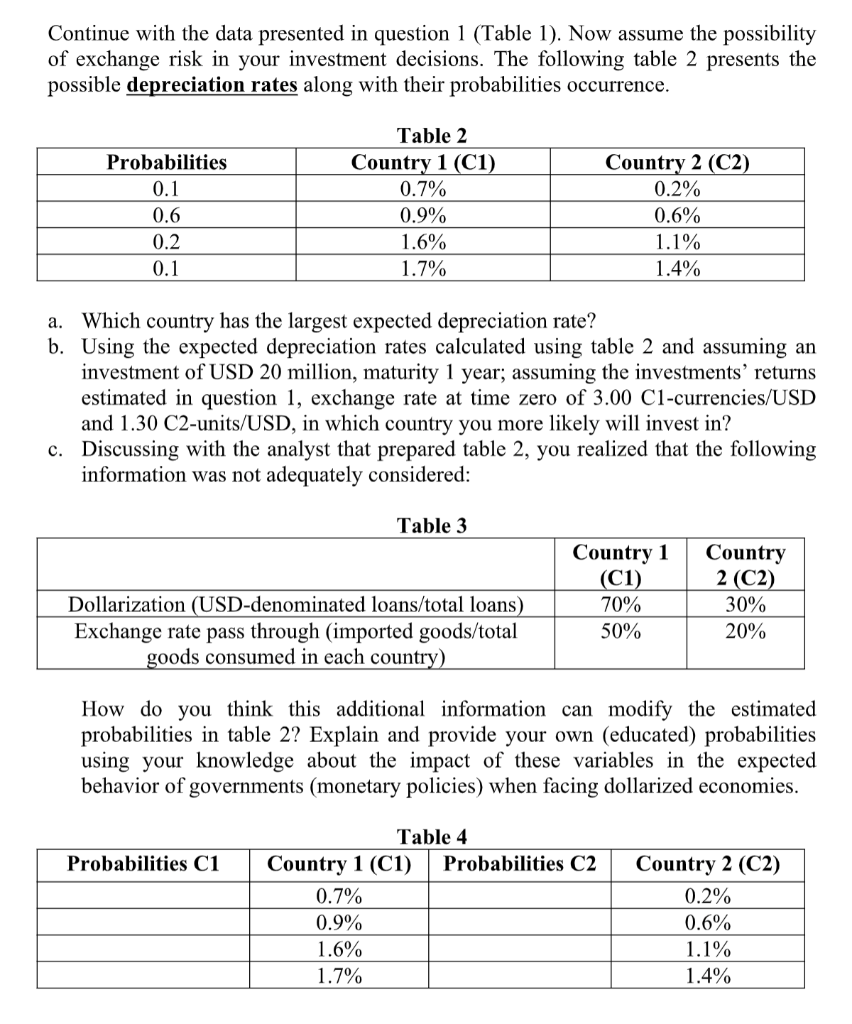

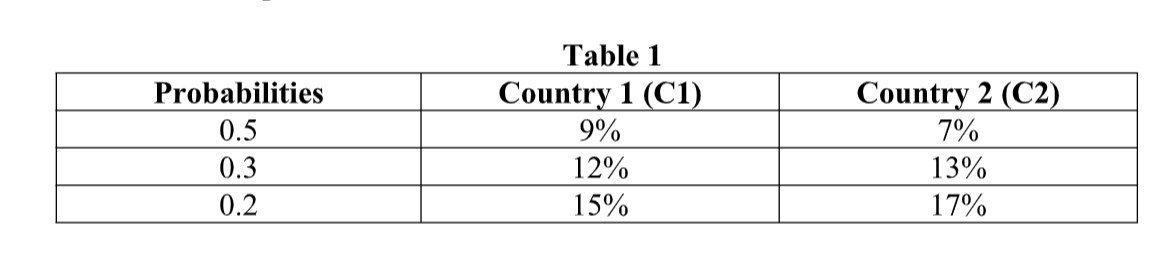

Continue with the data presented in question 1 (Table 1). Now assume the possibility of exchange risk in your investment decisions. The following table 2 presents the possible depreciation rates along with their probabilities occurrence. a. Which country has the largest expected depreciation rate? b. Using the expected depreciation rates calculated using table 2 and assuming an investment of USD 20 million, maturity 1 year; assuming the investments' returns estimated in question 1 , exchange rate at time zero of 3.00C1-currencies/USD and 1.30 C2-units/USD, in which country you more likely will invest in? c. Discussing with the analyst that prepared table 2 , you realized that the following information was not adequately considered: How do you think this additional information can modify the estimated probabilities in table 2? Explain and provide your own (educated) probabilities using your knowledge about the impact of these variables in the expected behavior of governments (monetary policies) when facing dollarized economies. Table 1 \begin{tabular}{|c|c|c|} \hline Probabilities & Country 1 (C1) & Country 2 (C2) \\ \hline 0.5 & 9% & 7% \\ \hline 0.3 & 12% & 13% \\ \hline 0.2 & 15% & 17% \\ \hline \end{tabular} Continue with the data presented in question 1 (Table 1). Now assume the possibility of exchange risk in your investment decisions. The following table 2 presents the possible depreciation rates along with their probabilities occurrence. a. Which country has the largest expected depreciation rate? b. Using the expected depreciation rates calculated using table 2 and assuming an investment of USD 20 million, maturity 1 year; assuming the investments' returns estimated in question 1 , exchange rate at time zero of 3.00C1-currencies/USD and 1.30 C2-units/USD, in which country you more likely will invest in? c. Discussing with the analyst that prepared table 2 , you realized that the following information was not adequately considered: How do you think this additional information can modify the estimated probabilities in table 2? Explain and provide your own (educated) probabilities using your knowledge about the impact of these variables in the expected behavior of governments (monetary policies) when facing dollarized economies. Table 1 \begin{tabular}{|c|c|c|} \hline Probabilities & Country 1 (C1) & Country 2 (C2) \\ \hline 0.5 & 9% & 7% \\ \hline 0.3 & 12% & 13% \\ \hline 0.2 & 15% & 17% \\ \hline \end{tabular}