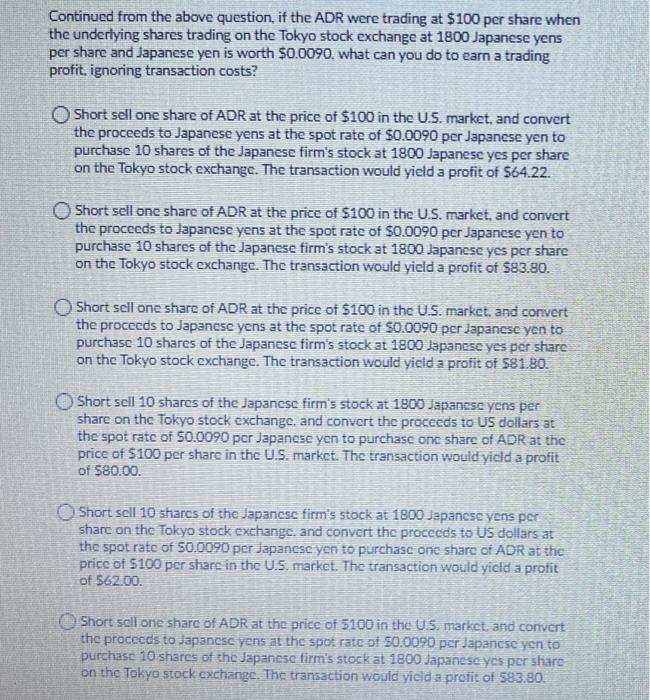

Continued from the above question, if the ADR were trading at $100 per share when the underlying shares trading on the Tokyo stock exchange at 1800 Japanese yens per share and Japanese yen is worth $0.0090. what can you do to earn a trading profit. ignoring transaction costs? Short sell one share of ADR at the price of $100 in the U.S. market, and convert the proceeds to Japanese yens at the spot rate of $0.0090 per Japanese yen to purchase 10 shares of the Japanese firm's stock at 1800 Japanese yes per share on the Tokyo stock exchange. The transaction would yield a profit of $64.22. Short sell one share of ADR at the price of $100 in the U.S. market, and convert the proceeds to Japanese yens at the spot rate of $0.0090 per Japanese yen to purchase 10 shares of the Japanese firm's stock at 1800 Japanese yes por share on the Tokyo stock exchange. The transaction would yield a profit of 583.80. Short sell one share of ADR at the price of $100 in the U.S. market, and convert the proceeds to Japanese yens at the spot rate of $0.0090 per Japanese yen to purchase 10 shares of the Japanese firm's stock at 1800 Japanese yes per share on the Tokyo stock exchange. The transaction would yield a profit of 581.80. Short sell 10 shares of the Japanese firm's stock at 1800 Japanese yens per share on the Tokyo stock exchange and convert the proceeds to US dollars at the spot rate of 50.0090 per Japanese yen to purchase one share of ADR at the price of $100 per share in the U.S. market. The transaction would yield a profit of $80.00. Short sell 10 shares of the Japanese firm's stock at 1800 Japanese yens per share on the Tokyo stock exchange, and convert the proceeds to US dollars at the spot rate of 50.0090 per Japanese yen to purchase one share of ADR at the price of $100 por share in the U.S. market. The transaction would yield a profit of 562.00. Short soll one share of ADR at the price of 5100 in the U.S. market, and convert the proceeds to Japanese yens at the spot rate of 50.0090 per Japanese yen to purchase 10 shares of the Japanese firm's stock at 1800 Japanese yes per share on the Tokyo stock exchange. The transaction would yicid a profit of 583.80