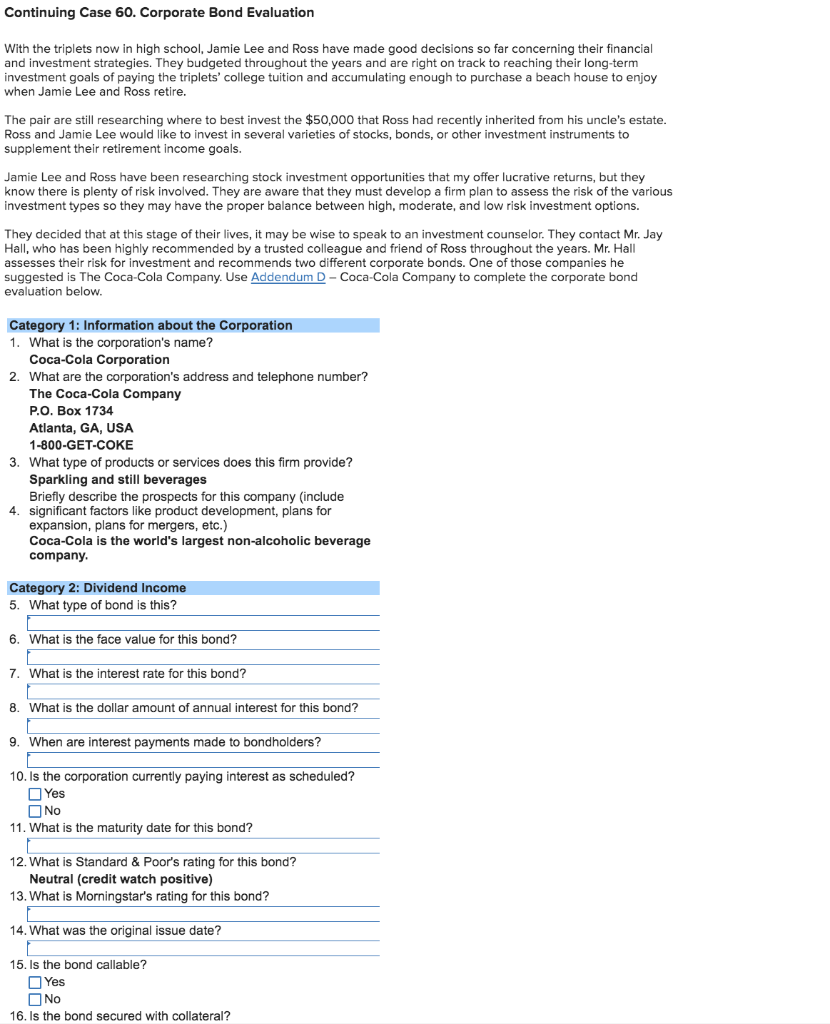

Continuing Case 60. Corporate Bond Evaluation With the triplets now in high school, Jamie Lee and Ross have made good decisions so far concerning their financial and investment strategies. They budgeted throughout the years and are right on track to reaching their long-term investment goals of paying the triplets' college tuition and accumulating enough to purchase a beach house to enjoy when Jamie Lee and Ross retire. The pair are still researching where to best invest the $50,000 that Ross had recently inherited from his uncle's estate. Ross and Jamie Lee would like to invest in several varieties of stocks, bonds, or other investment instruments to supplement their retirement income goals. Jamie Lee and Ross have been researching stock investment opportunities that my offer lucrative returns, but they know there is plenty of risk involved. They are aware that they must develop a firm plan to assess the risk of the various investment types so they may have the proper balance between high, moderate, and low risk investment options. They decided that at this stage of their lives, it may be wise to speak to an investment counselor. They contact Mr. Jay Hall, who has been highly recommended by a trusted colleague and friend of Ross throughout the years. Mr. Hall assesses their risk for investment and recommends two different corporate bonds. One of those companies he suggested is The Coca-Cola Company. Use Addendum D-Coca-Cola Company to complete the corporate bond evaluation below. Category 1: Information about the Corporation 1. What is the corporation's name? Coca-Cola Corporation 2. What are the corporation's address and telephone number? The Coca-Cola Company P.O. Box 1734 Atlanta, GA, USA 1-800-GET-COKE 3. What type of products or services does this firm provide? Sparkling and still beverages Briefly describe the prospects for this company (include 4. significant factors like product development, plans for expansion, plans for mergers, etc.) Coca-Cola is the world's largest non-alcoholic beverage company Category 2: Dividend Income 5. What type of bond is this? 6. What is the face value for this bond? 7. What is the interest rate for this bond? 8. What is the dollar amount of annual interest for this bond? 9. When are interest payments made to bondholders? 10. Is the corporation currently paying interest as scheduled? Yes No 11. What is the maturity date for this bond? 12. What is Standard & Poor's rating for this bond? Neutral (credit watch positive) 13. What is Morningstar's rating for this bond? 14. What was the original issue date? 15. Is the bond callable? Yes No 16. Is the bond secured with collateral? 16. Is the bond secured with collateral? Yes No Category 3: Financial Performance 47 What are the firm's basic earnings per share for the last 1 year? 18. Have the firm's earnings increased over the past five years? Yes 19. Have sales increased over the last five years? Yes No Continuing Case 60. Corporate Bond Evaluation With the triplets now in high school, Jamie Lee and Ross have made good decisions so far concerning their financial and investment strategies. They budgeted throughout the years and are right on track to reaching their long-term investment goals of paying the triplets' college tuition and accumulating enough to purchase a beach house to enjoy when Jamie Lee and Ross retire. The pair are still researching where to best invest the $50,000 that Ross had recently inherited from his uncle's estate. Ross and Jamie Lee would like to invest in several varieties of stocks, bonds, or other investment instruments to supplement their retirement income goals. Jamie Lee and Ross have been researching stock investment opportunities that my offer lucrative returns, but they know there is plenty of risk involved. They are aware that they must develop a firm plan to assess the risk of the various investment types so they may have the proper balance between high, moderate, and low risk investment options. They decided that at this stage of their lives, it may be wise to speak to an investment counselor. They contact Mr. Jay Hall, who has been highly recommended by a trusted colleague and friend of Ross throughout the years. Mr. Hall assesses their risk for investment and recommends two different corporate bonds. One of those companies he suggested is The Coca-Cola Company. Use Addendum D-Coca-Cola Company to complete the corporate bond evaluation below. Category 1: Information about the Corporation 1. What is the corporation's name? Coca-Cola Corporation 2. What are the corporation's address and telephone number? The Coca-Cola Company P.O. Box 1734 Atlanta, GA, USA 1-800-GET-COKE 3. What type of products or services does this firm provide? Sparkling and still beverages Briefly describe the prospects for this company (include 4. significant factors like product development, plans for expansion, plans for mergers, etc.) Coca-Cola is the world's largest non-alcoholic beverage company Category 2: Dividend Income 5. What type of bond is this? 6. What is the face value for this bond? 7. What is the interest rate for this bond? 8. What is the dollar amount of annual interest for this bond? 9. When are interest payments made to bondholders? 10. Is the corporation currently paying interest as scheduled? Yes No 11. What is the maturity date for this bond? 12. What is Standard & Poor's rating for this bond? Neutral (credit watch positive) 13. What is Morningstar's rating for this bond? 14. What was the original issue date? 15. Is the bond callable? Yes No 16. Is the bond secured with collateral? 16. Is the bond secured with collateral? Yes No Category 3: Financial Performance 47 What are the firm's basic earnings per share for the last 1 year? 18. Have the firm's earnings increased over the past five years? Yes 19. Have sales increased over the last five years? Yes No