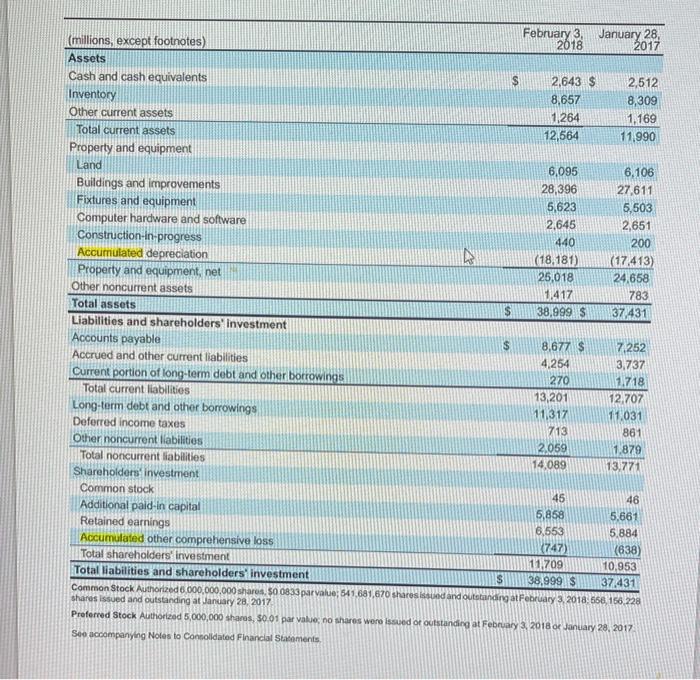

Continuing Cases Target Case L02-4, LO2-8 Target Corporation prepares its financial statements Icording to U.S. GAAP. Target's financial statements and disclosure notes for the year ended February 3, 2018. are available in Connect. This material also is available under the Investor Relations link at the company's website (www.targel.com) Required: 1. Refer to Target's balance sheet for the years ended February 3, 2018, and January 28, 2017. Based on the amounts reported for accumulated depreciation, and assuming no depreciable assets were sold during the year, prepare an adjusting entry to record Target's depreciation for the year ON 1 The Role of Accounting as an Information System 2. Refer to Target's statement of cash flows for the year ended February 3, 2018. Assuming your answer to requirement includes all depreciation expense recognized during the year, how much amortization expense was recognized during the year! 3. Note 13 provides information on Target's current assets. Assume all prepaid expenses are for prepaid insur ance and the insurance expense comprises S50 million of the $14.248 million of selling general, and admin istrative expenses reported in the income statement for the year ended February 3, 2018. How much cash did Target pay for insurance coverage during the year? Prepare the adjusting entry Targer would make to record all insurance expense for the year. What would be the effect on the income statement and balance sheet i Tar get didn't record an adjusting entry for prepaid expenses? 200 February 3, January 28, (millions, except footnotes) 2018 2017 Assets Cash and cash equivalents 2,643 $ 2,512 Inventory 8,657 8,309 Other current assets 1,264 1.169 Total current assets 12,564 11,990 Property and equipment Land 6,095 6,106 Buildings and improvements 28,396 27.611 Fixtures and equipment 5,623 5,503 Computer hardware and software 2,645 2,651 Construction-in-progress 440 Accumulated depreciation (18,181) (17.413) Property and equipment, net 25.018 24,658 Other noncurrent assets 1.417 783 Total assets 38,999 $ 37.431 Liabilities and shareholders' Investment Accounts payable $ 8,677 $ 7,252 Accrued and other current liabilities 4,254 3,737 Current portion of long-term debt and other borrowings 270 2.718 Total current liabilities 13,201 12,707 Long-term debt and other borrowings 11,317 11.031 Deferred income taxes 713 861 Other noncurrent liabilities 2.059 1.879 Total noncurrent liabilities 14,089 13,771 Shareholders investment Common stock 45 46 Additional paid-in capital 5,858 5,661 Retained earnings 6,553 5.884 Accumulated other comprehensive loss (747) (638 Total shareholders Investment 11.709 10,953 Total liabilities and shareholders investment S 38.999 $ 37.431 Common Stock Authorized 6,000,000,000 shares. $0 0833 par value; 541.681,670 shares issued and outstanding at February 3, 2018, 568, 156 228 share issued and outstanding at January 28, 2017 Preferred Stock Authorized 5,000,000 shares, 30.01 par value, no shares were issued or outstanding at February 3, 2018 0 January 28, 2017 Se accompanying Noles to consolidated Financial Statements Continuing Cases Target Case L02-4, LO2-8 Target Corporation prepares its financial statements Icording to U.S. GAAP. Target's financial statements and disclosure notes for the year ended February 3, 2018. are available in Connect. This material also is available under the Investor Relations link at the company's website (www.targel.com) Required: 1. Refer to Target's balance sheet for the years ended February 3, 2018, and January 28, 2017. Based on the amounts reported for accumulated depreciation, and assuming no depreciable assets were sold during the year, prepare an adjusting entry to record Target's depreciation for the year ON 1 The Role of Accounting as an Information System 2. Refer to Target's statement of cash flows for the year ended February 3, 2018. Assuming your answer to requirement includes all depreciation expense recognized during the year, how much amortization expense was recognized during the year! 3. Note 13 provides information on Target's current assets. Assume all prepaid expenses are for prepaid insur ance and the insurance expense comprises S50 million of the $14.248 million of selling general, and admin istrative expenses reported in the income statement for the year ended February 3, 2018. How much cash did Target pay for insurance coverage during the year? Prepare the adjusting entry Targer would make to record all insurance expense for the year. What would be the effect on the income statement and balance sheet i Tar get didn't record an adjusting entry for prepaid expenses? 200 February 3, January 28, (millions, except footnotes) 2018 2017 Assets Cash and cash equivalents 2,643 $ 2,512 Inventory 8,657 8,309 Other current assets 1,264 1.169 Total current assets 12,564 11,990 Property and equipment Land 6,095 6,106 Buildings and improvements 28,396 27.611 Fixtures and equipment 5,623 5,503 Computer hardware and software 2,645 2,651 Construction-in-progress 440 Accumulated depreciation (18,181) (17.413) Property and equipment, net 25.018 24,658 Other noncurrent assets 1.417 783 Total assets 38,999 $ 37.431 Liabilities and shareholders' Investment Accounts payable $ 8,677 $ 7,252 Accrued and other current liabilities 4,254 3,737 Current portion of long-term debt and other borrowings 270 2.718 Total current liabilities 13,201 12,707 Long-term debt and other borrowings 11,317 11.031 Deferred income taxes 713 861 Other noncurrent liabilities 2.059 1.879 Total noncurrent liabilities 14,089 13,771 Shareholders investment Common stock 45 46 Additional paid-in capital 5,858 5,661 Retained earnings 6,553 5.884 Accumulated other comprehensive loss (747) (638 Total shareholders Investment 11.709 10,953 Total liabilities and shareholders investment S 38.999 $ 37.431 Common Stock Authorized 6,000,000,000 shares. $0 0833 par value; 541.681,670 shares issued and outstanding at February 3, 2018, 568, 156 228 share issued and outstanding at January 28, 2017 Preferred Stock Authorized 5,000,000 shares, 30.01 par value, no shares were issued or outstanding at February 3, 2018 0 January 28, 2017 Se accompanying Noles to consolidated Financial Statements