Answered step by step

Verified Expert Solution

Question

1 Approved Answer

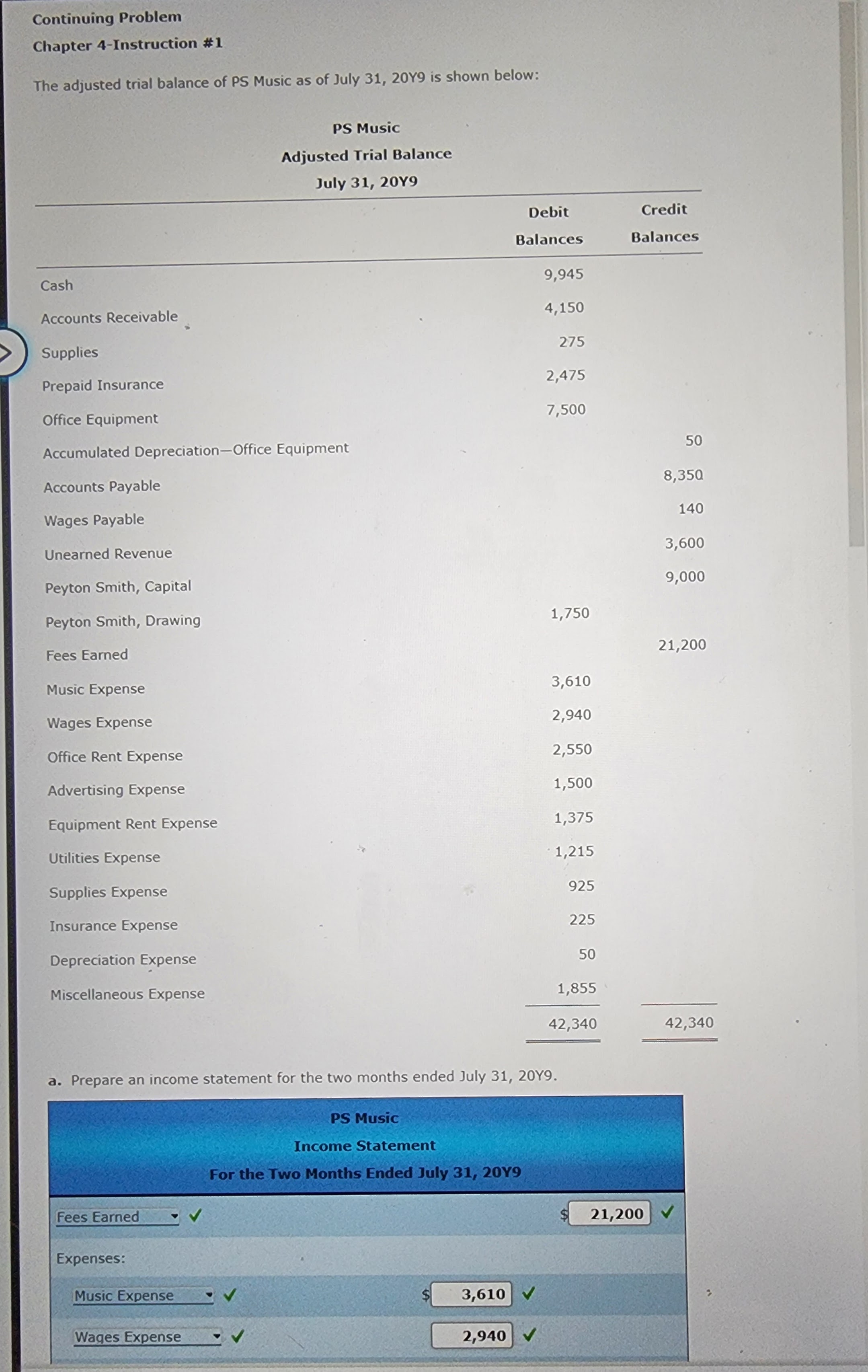

Continuing Problem Chapter 4-Instruction #1 The adjusted trial balance of PS Music as of July 31, 20Y9 is shown below: PS Music Adjusted Trial

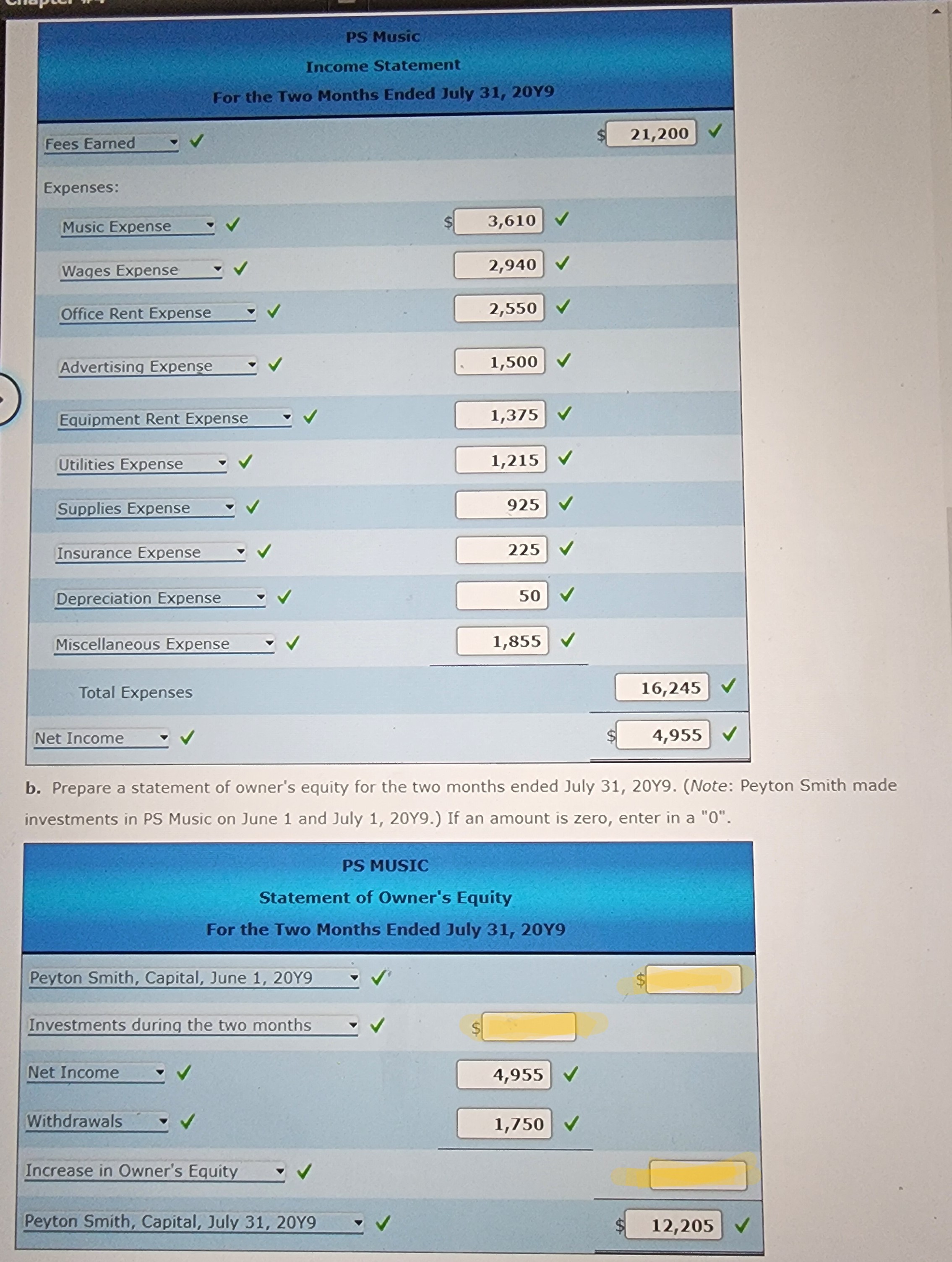

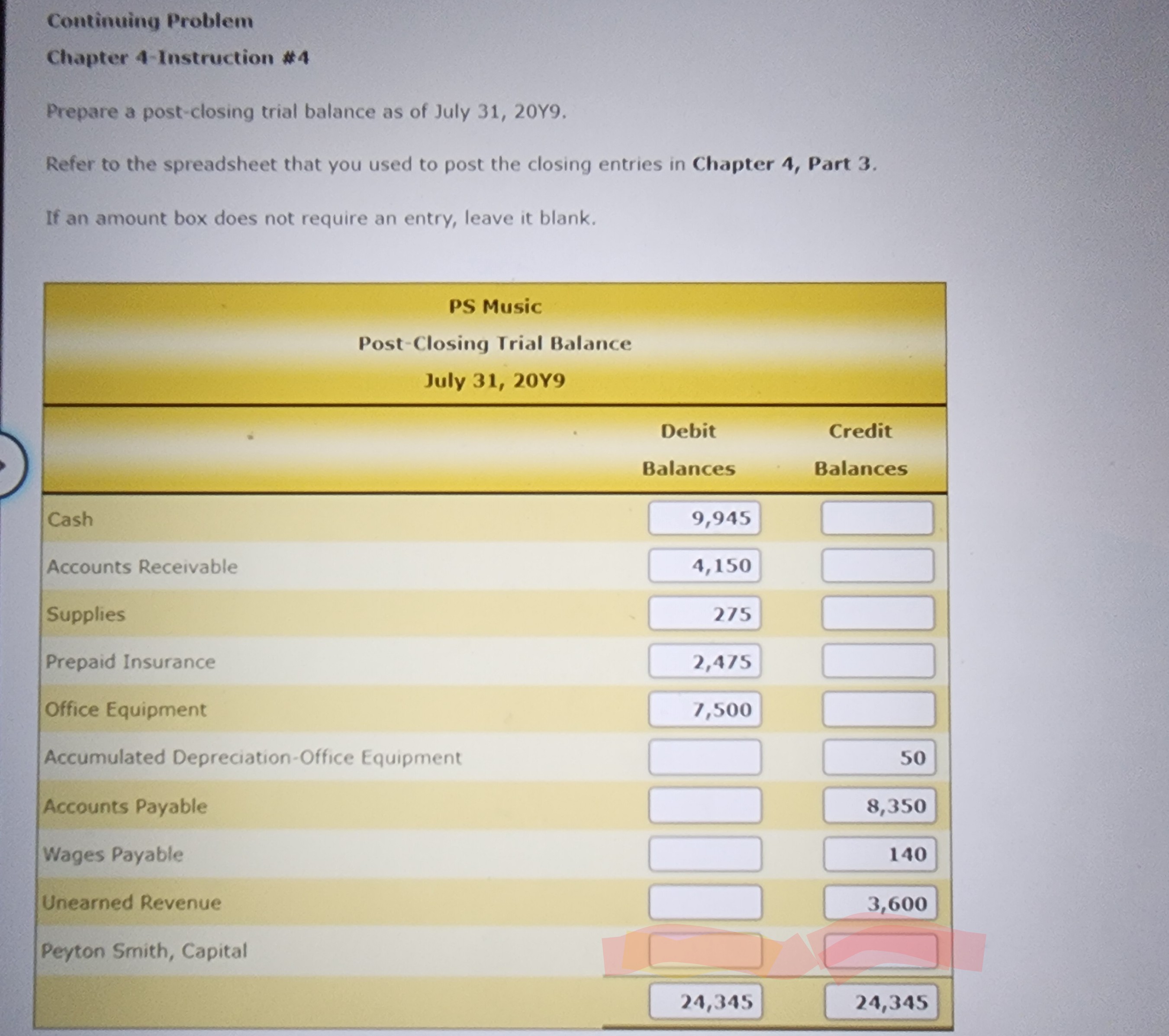

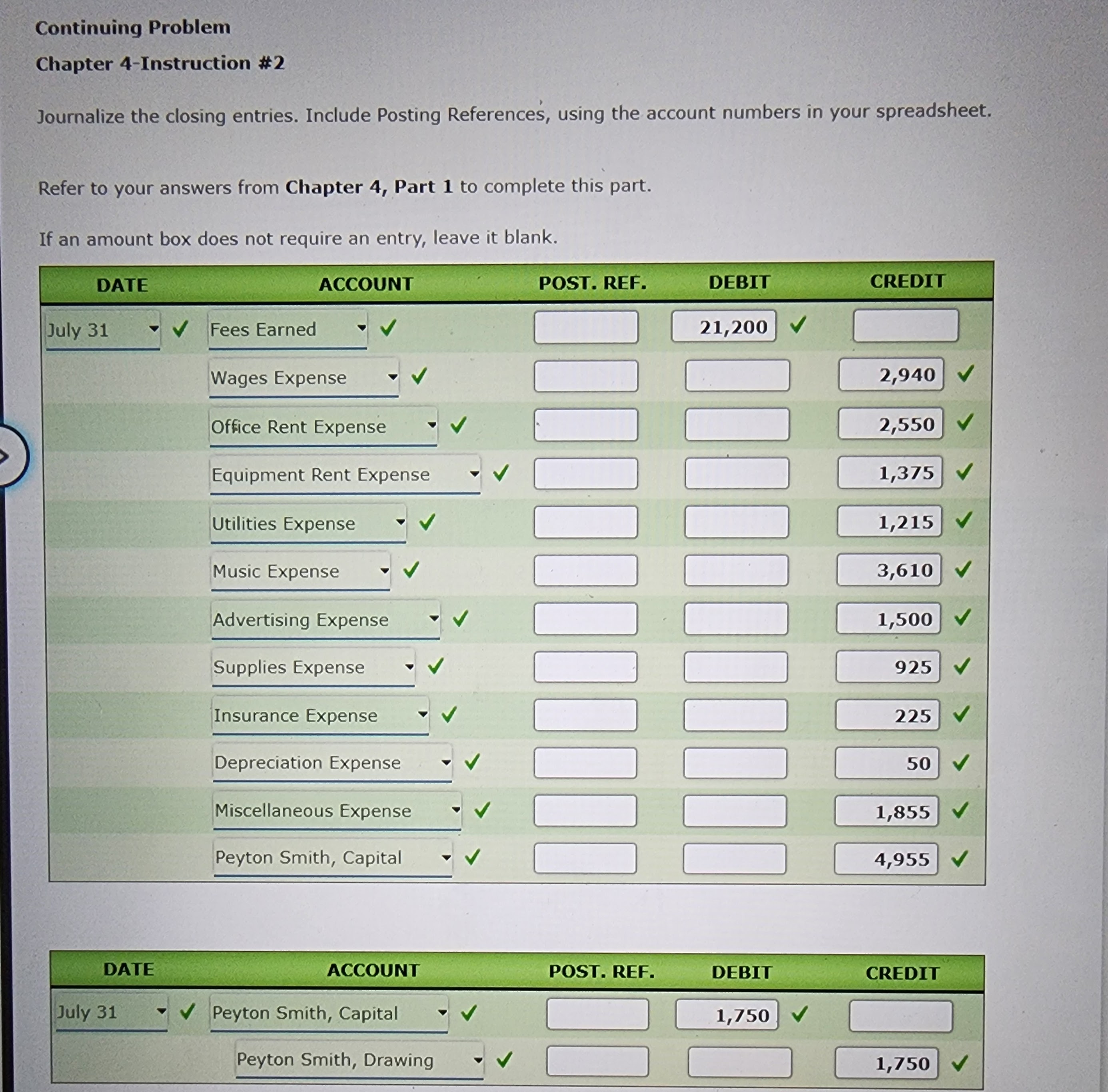

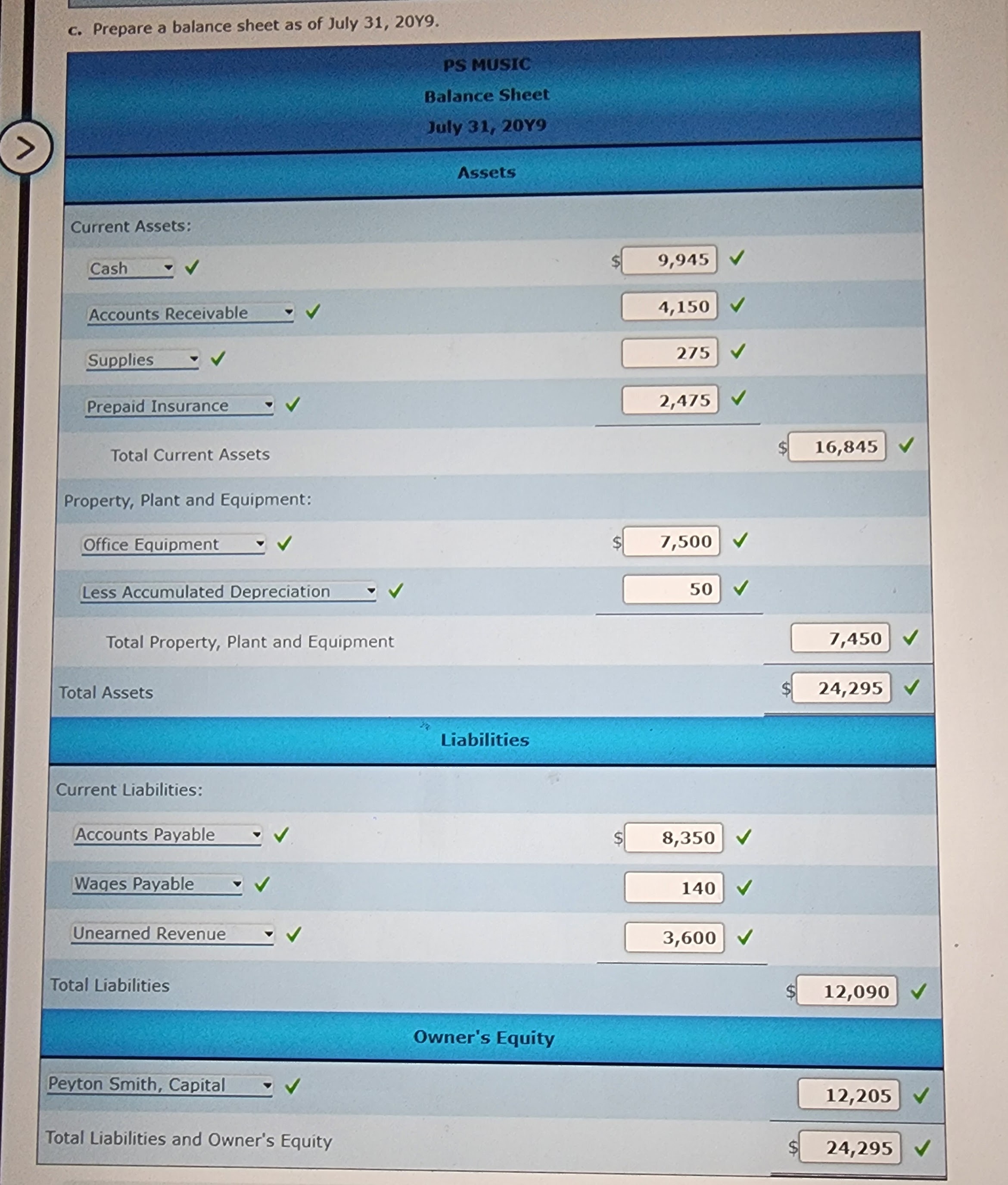

Continuing Problem Chapter 4-Instruction #1 The adjusted trial balance of PS Music as of July 31, 20Y9 is shown below: PS Music Adjusted Trial Balance July 31, 20Y9 Debit Credit Balances Balances Cash Accounts Receivable Supplies 9,945 4,150 275 Prepaid Insurance 2,475 Office Equipment Accumulated Depreciation-Office Equipment 7,500 50 Accounts Payable Wages Payable Unearned Revenue Peyton Smith, Capital Peyton Smith, Drawing Fees Earned Music Expense 8,350 140 3,600 9,000 1,750 21,200 3,610 Wages Expense 2,940 Office Rent Expense 2,550 Advertising Expense 1,500 Equipment Rent Expense 1,375 Utilities Expense 1,215 Supplies Expense 925 Insurance Expense 225 Depreciation Expense 50 Miscellaneous Expense 1,855 42,340 42,340 a. Prepare an income statement for the two months ended July 31, 20Y9. Fees Earned Expenses: Music Expense Wages Expense PS Music Income Statement For the Two Months Ended July 31, 20Y9 3,610 V 2,940 V 21,200 Fees Earned Expenses: PS Music Income Statement For the Two Months Ended July 31, 20Y9 Music Expense Wages Expense 3,610 V Office Rent Expense 2,940 V 2,550 21,200 Advertising Expense 1,500 V Equipment Rent Expense 1,375 V Utilities Expense 1,215 Supplies Expense 925 Insurance Expense 225 Depreciation Expense Miscellaneous Expense Total Expenses Net Income 50 1,855 V 16,245 4,955 V b. Prepare a statement of owner's equity for the two months ended July 31, 20Y9. (Note: Peyton Smith made investments in PS Music on June 1 and July 1, 20Y9.) If an amount is zero, enter in a "0". PS MUSIC Statement of Owner's Equity For the Two Months Ended July 31, 20Y9 Peyton Smith, Capital, June 1, 20Y9 Investments during the two months Net Income Withdrawals Increase in Owner's Equity 4,955 1,750 V Peyton Smith, Capital, July 31, 20Y9 12,205 Continuing Problem Chapter 4-Instruction #4 Prepare a post-closing trial balance as of July 31, 20Y9. Refer to the spreadsheet that you used to post the closing entries in Chapter 4, Part 3. If an amount box does not require an entry, leave it blank. PS Music Post-Closing Trial Balance July 31, 20Y9 Cash Accounts Receivable Supplies Prepaid Insurance Office Equipment Accumulated Depreciation-Office Equipment Accounts Payable Wages Payable Unearned Revenue Peyton Smith, Capital Debit Credit Balances Balances 9,945 4,150 275 2,475 7,500 50 8,350 140 3,600 24,345 24,345 Continuing Problem Chapter 4-Instruction #2 Journalize the closing entries. Include Posting References, using the account numbers in your spreadsheet. Refer to your answers from Chapter 4, Part 1 to complete this part. If an amount box does not require an entry, leave it blank. DATE ACCOUNT July 31 Fees Earned Wages Expense Office Rent Expense Equipment Rent Expense Utilities Expense Music Expense Advertising Expense Supplies Expense Insurance Expense Depreciation Expense Miscellaneous Expense Peyton Smith, Capital POST. REF. DEBIT CREDIT 21,200 2,940 2,550 V 1,375 V 1,215 V 3,610 V 1,500 925 V 225 V 50 1,855 V 4,955 DATE ACCOUNT POST. REF. DEBIT CREDIT July 31 Peyton Smith, Capital 1,750 Peyton Smith, Drawing 1,750 Continuing Problem Chapter 4-Instruction #3 Post the closing entries completed in Chapter 4 Part 2 to the ledgers in the spreadsheet you saved in Chapter 3 Part 2. Extend the account balance to the appropriate balance column after each posting. Be sure to save your work in the spreadsheet. > c. Prepare a balance sheet as of July 31, 20Y9. PS MUSIC Balance Sheet July 31, 20Y9 Assets Current Assets: Cash Accounts Receivable Supplies Prepaid Insurance Total Current Assets Property, Plant and Equipment: Office Equipment Less Accumulated Depreciation Total Property, Plant and Equipment Total Assets Current Liabilities: Accounts Payable Wages Payable Unearned Revenue Total Liabilities Peyton Smith, Capital Total Liabilities and Owner's Equity Liabilities Owner's Equity S 9,945 V 4,150 V 275 2,475 V 7,500 V 50 $ 8,350 140 16,845 7,450 24,295 3,600 12,090 12,205 24,295

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started