Question

Continuing with the facts from question 1. Your clients, the Smiths, want to claim a tax deduction on their S Corporation return for the

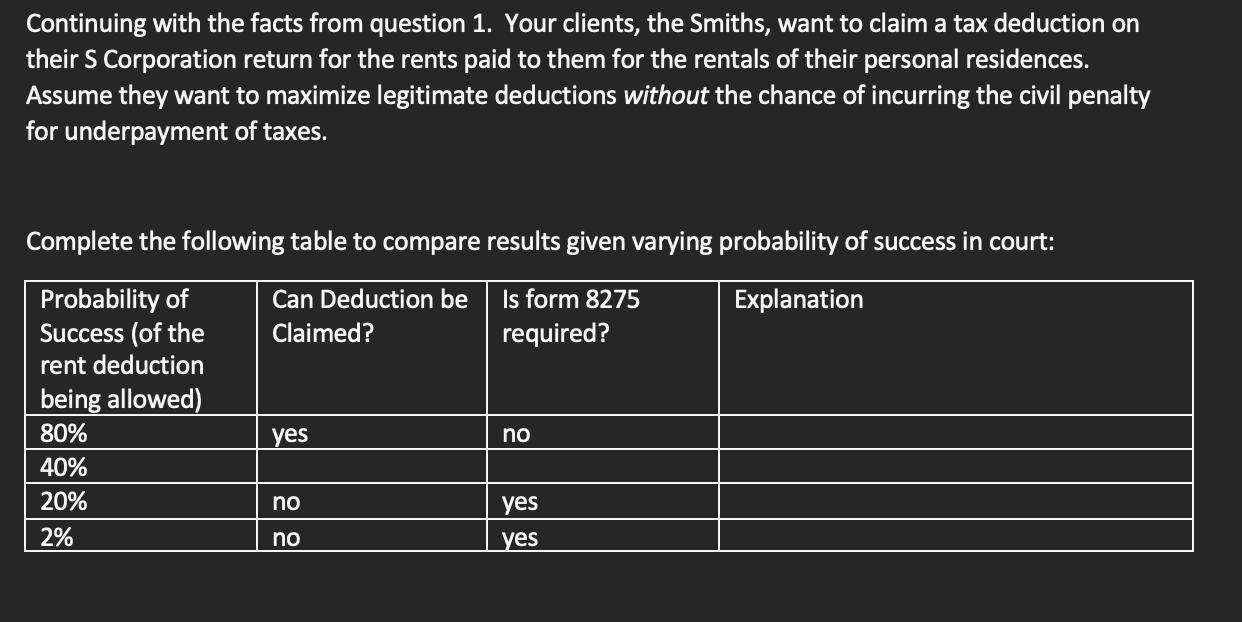

Continuing with the facts from question 1. Your clients, the Smiths, want to claim a tax deduction on their S Corporation return for the rents paid to them for the rentals of their personal residences. Assume they want to maximize legitimate deductions without the chance of incurring the civil penalty for underpayment of taxes. Complete the following table to compare results given varying probability of success in court: Probability of Success (of the Can Deduction be Is form 8275 Claimed? required? Explanation rent deduction being allowed) 80% yes no 40% 20% 2% no yes no yes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Heres a breakdown with explanations for each scenario Probability of Success of the rent ded...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App