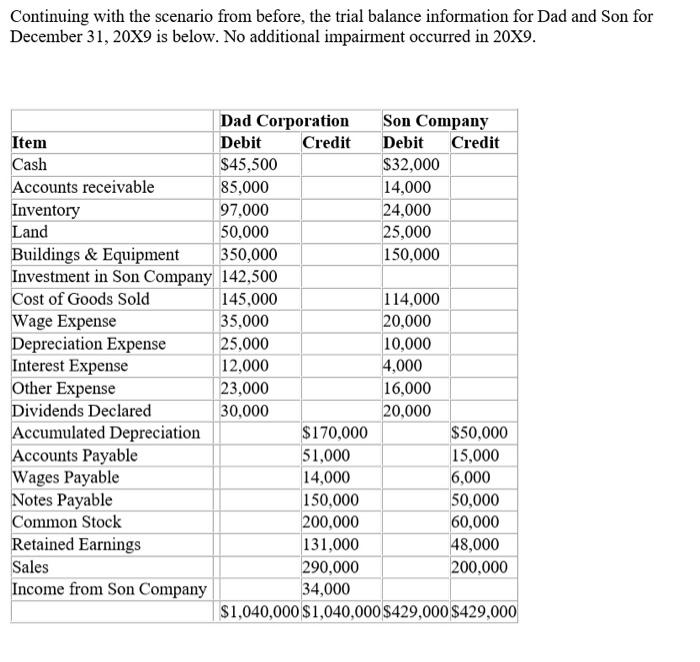

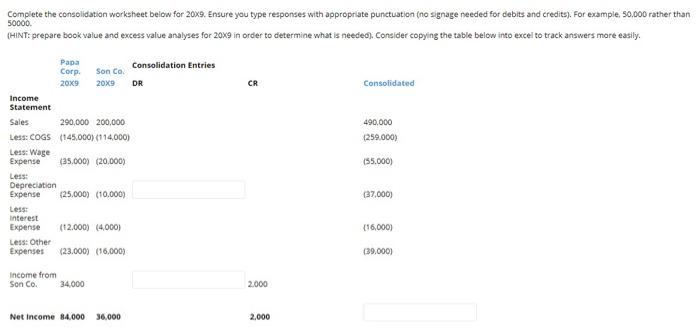

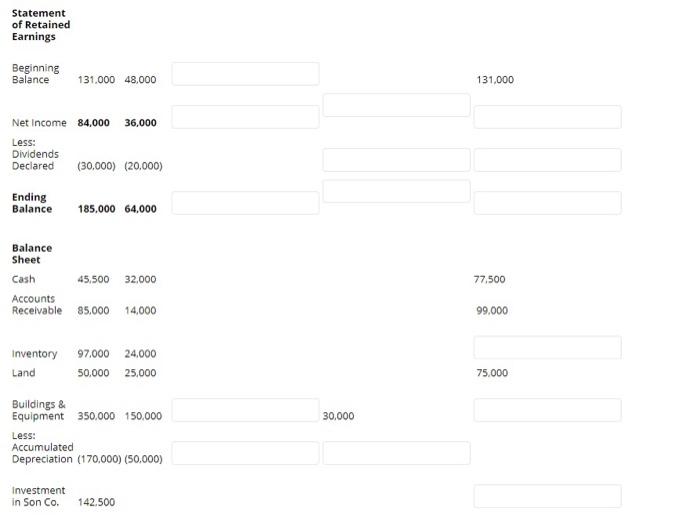

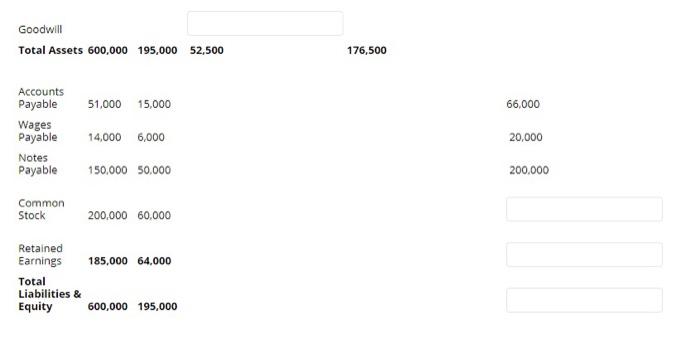

Continuing with the scenario from before, the trial balance information for Dad and Son for December 31, 20X9 is below. No additional impairment occurred in 20X9. Dad Corporation Son Company Item Debit Credit Debit Credit Cash $45,500 $32,000 Accounts receivable 85,000 14,000 Inventory 97,000 24,000 Land 50,000 25,000 Buildings & Equipment 350,000 150,000 Investment in Son Company 142,500 Cost of Goods Sold 145,000 114,000 Wage Expense 35,000 20,000 Depreciation Expense 25,000 10,000 Interest Expense 12,000 4,000 Other Expense 23,000 16,000 Dividends Declared 30,000 20,000 Accumulated Depreciation $170,000 $50,000 Accounts Payable 51,000 15,000 Wages Payable 14,000 6,000 Notes Payable 150,000 50,000 Common Stock 200,000 60,000 Retained Earnings 131,000 48,000 Sales 290,000 200,000 Income from Son Company 34,000 $1,040,000 $1,040,000 $429,000 $429,000 Complete the consolidation worksheet below for 20X9. Ensure you type responses with appropriate punctuation (no signage needed for debits and credits). For example 50.000 rather than 50000 (HINT: prepare book value and excess value analyses for 2019 in order to determine what is needed). Consider copying the table below into excel to track answers more easily. CR Consolidated 490,000 (259,000) Papa Corp. Son Co. Consolidation Entries 20x9 2009 DR Income Statement Sales 290,000 200,000 Less: COGS (145,000) (1 14.000) Less: Wage Expense (35.000) (20,000) Less: Depreciation Expense (25.000) (10.000) Less: Interest Expense (12.000) (4000) Less: Other Expenses (23.000) (16,000) (55.000) (37,000) 116.000) (39.000) Income from Son Co. 34.000 2.000 Net Income 34.000 36.000 2.000 Statement of Retained Earnings Beginning Balance 131.000 48.000 131,000 Net Income 84,000 36,000 Less: Dividends Declared (30,000) (20.000) Ending Balance 185,000 64.000 Balance Sheet 77.500 Cash 45.500 32.000 Accounts Receivable 85.000 14,000 99.000 Inventory 97.000 24.000 Land 50,000 25,000 75.000 30,000 Buildings & Equipment 350.000 150.000 Less: Accumulated Depreciation (170.000) (50,000) Investment in Son Co. 142.500 Goodwill Total Assets 600,000 195,000 52,500 176,500 51,000 15.000 66,000 Accounts Payable Wages Payable Notes Payable 14,000 6,000 20,000 150.000 50.000 200.000 Common Stock 200,000 60,000 185,000 64,000 Retained Earnings Total Liabilities & Equity 600,000 195,000 Continuing with the scenario from before, the trial balance information for Dad and Son for December 31, 20X9 is below. No additional impairment occurred in 20X9. Dad Corporation Son Company Item Debit Credit Debit Credit Cash $45,500 $32,000 Accounts receivable 85,000 14,000 Inventory 97,000 24,000 Land 50,000 25,000 Buildings & Equipment 350,000 150,000 Investment in Son Company 142,500 Cost of Goods Sold 145,000 114,000 Wage Expense 35,000 20,000 Depreciation Expense 25,000 10,000 Interest Expense 12,000 4,000 Other Expense 23,000 16,000 Dividends Declared 30,000 20,000 Accumulated Depreciation $170,000 $50,000 Accounts Payable 51,000 15,000 Wages Payable 14,000 6,000 Notes Payable 150,000 50,000 Common Stock 200,000 60,000 Retained Earnings 131,000 48,000 Sales 290,000 200,000 Income from Son Company 34,000 $1,040,000 $1,040,000 $429,000 $429,000 Complete the consolidation worksheet below for 20X9. Ensure you type responses with appropriate punctuation (no signage needed for debits and credits). For example 50.000 rather than 50000 (HINT: prepare book value and excess value analyses for 2019 in order to determine what is needed). Consider copying the table below into excel to track answers more easily. CR Consolidated 490,000 (259,000) Papa Corp. Son Co. Consolidation Entries 20x9 2009 DR Income Statement Sales 290,000 200,000 Less: COGS (145,000) (1 14.000) Less: Wage Expense (35.000) (20,000) Less: Depreciation Expense (25.000) (10.000) Less: Interest Expense (12.000) (4000) Less: Other Expenses (23.000) (16,000) (55.000) (37,000) 116.000) (39.000) Income from Son Co. 34.000 2.000 Net Income 34.000 36.000 2.000 Statement of Retained Earnings Beginning Balance 131.000 48.000 131,000 Net Income 84,000 36,000 Less: Dividends Declared (30,000) (20.000) Ending Balance 185,000 64.000 Balance Sheet 77.500 Cash 45.500 32.000 Accounts Receivable 85.000 14,000 99.000 Inventory 97.000 24.000 Land 50,000 25,000 75.000 30,000 Buildings & Equipment 350.000 150.000 Less: Accumulated Depreciation (170.000) (50,000) Investment in Son Co. 142.500 Goodwill Total Assets 600,000 195,000 52,500 176,500 51,000 15.000 66,000 Accounts Payable Wages Payable Notes Payable 14,000 6,000 20,000 150.000 50.000 200.000 Common Stock 200,000 60,000 185,000 64,000 Retained Earnings Total Liabilities & Equity 600,000 195,000