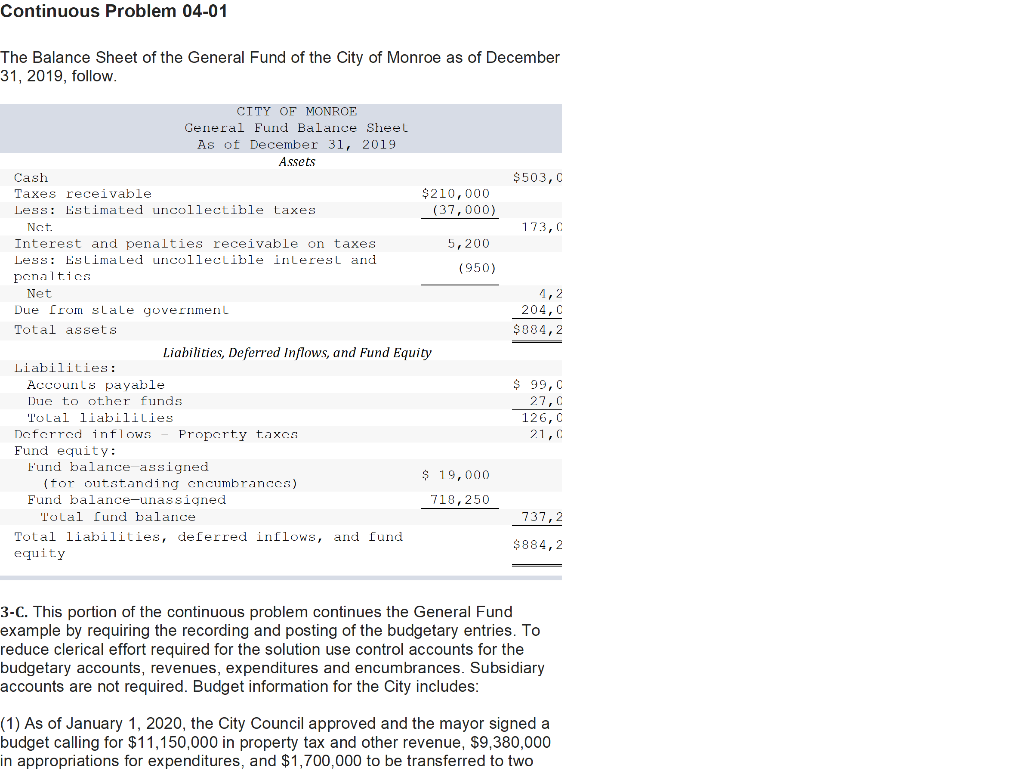

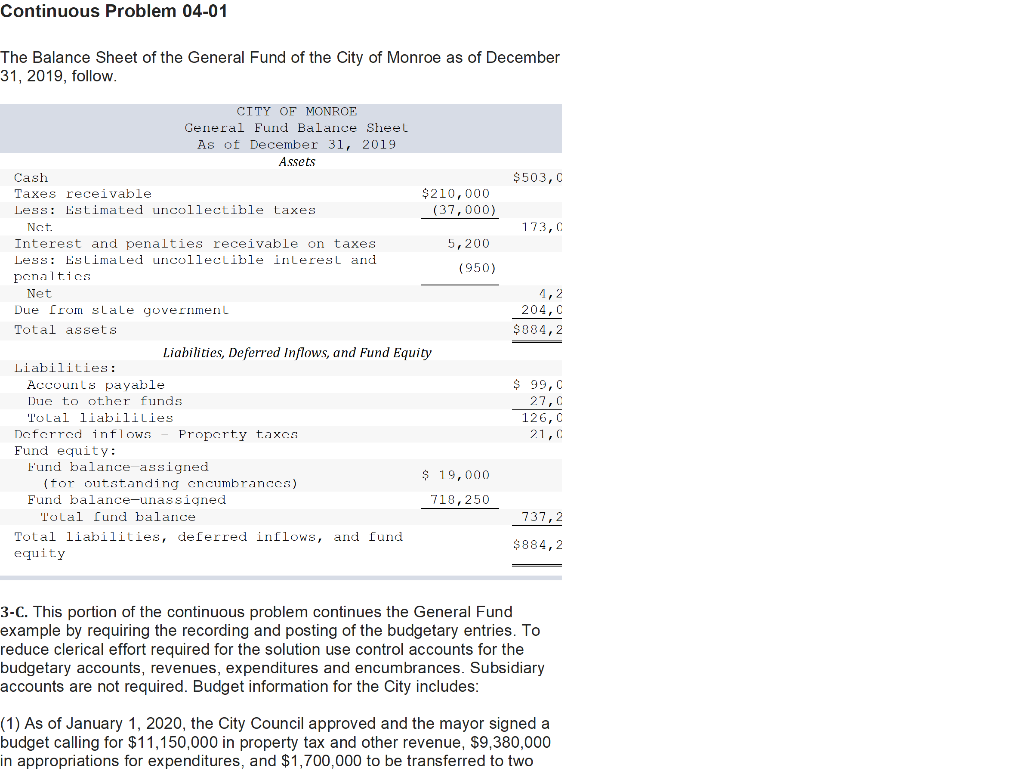

Continuous Problem 04-01 The Balance Sheet of the General Fund of the City of Monroe as of December 31, 2019, follow $503,0 173, CITY OF MONROE General Fund Balance Sheel As of December 31, 2019 Assets Cash Taxes receivable $210,000 Less: Estimated uncollectible taxes (37,000) Not Interest and penalties receivable on taxes 5,200 Less: EslimaLed uncolleclible inleres L and (950) penalties Net Due from slale governmenL Total assets Liabilities, Deferred Inflows, and Fund Equity Liabilities: Accounts payable Due to other funds Tolal liabililies Deferred inflows Property taxes Fund equity: L'und balance assigned (tor outstanding encumbrances) $ 19,000 Fund balance-unassigned 718,250 Tolal fund balance Total liabilities, deferred inlows, and fund equity 204,0 $084,2 $ 99,0 27,0 126,0 21,0 737,2 $884,2 3-C. This portion of the continuous problem continues the General Fund example by requiring the recording and posting of the budgetary entries. To reduce clerical effort required for the solution use control accounts for the budgetary accounts, revenues, expenditures and encumbrances. Subsidiary accounts are not required. Budget information for the City includes: (1) As of January 1, 2020, the City Council approved and the mayor signed a budget calling for $11,150,000 in property tax and other revenue, $9,380,000 in appropriations for expenditures, and $1,700,000 to be transferred to two Continuous Problem 04-01 The Balance Sheet of the General Fund of the City of Monroe as of December 31, 2019, follow $503,0 173, CITY OF MONROE General Fund Balance Sheel As of December 31, 2019 Assets Cash Taxes receivable $210,000 Less: Estimated uncollectible taxes (37,000) Not Interest and penalties receivable on taxes 5,200 Less: EslimaLed uncolleclible inleres L and (950) penalties Net Due from slale governmenL Total assets Liabilities, Deferred Inflows, and Fund Equity Liabilities: Accounts payable Due to other funds Tolal liabililies Deferred inflows Property taxes Fund equity: L'und balance assigned (tor outstanding encumbrances) $ 19,000 Fund balance-unassigned 718,250 Tolal fund balance Total liabilities, deferred inlows, and fund equity 204,0 $084,2 $ 99,0 27,0 126,0 21,0 737,2 $884,2 3-C. This portion of the continuous problem continues the General Fund example by requiring the recording and posting of the budgetary entries. To reduce clerical effort required for the solution use control accounts for the budgetary accounts, revenues, expenditures and encumbrances. Subsidiary accounts are not required. Budget information for the City includes: (1) As of January 1, 2020, the City Council approved and the mayor signed a budget calling for $11,150,000 in property tax and other revenue, $9,380,000 in appropriations for expenditures, and $1,700,000 to be transferred to two