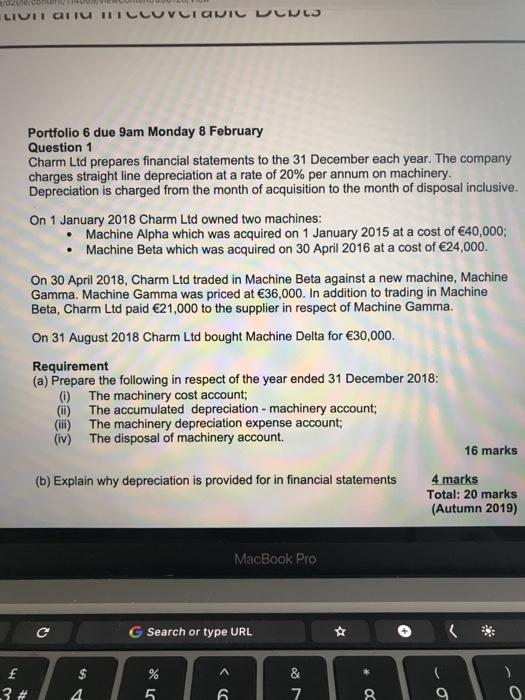

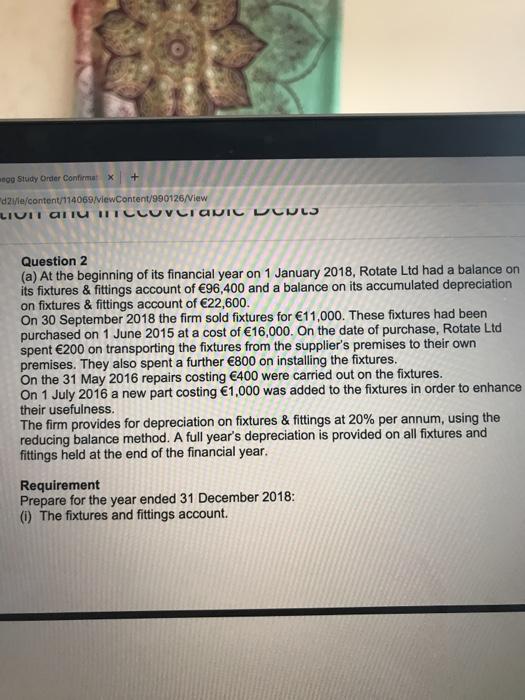

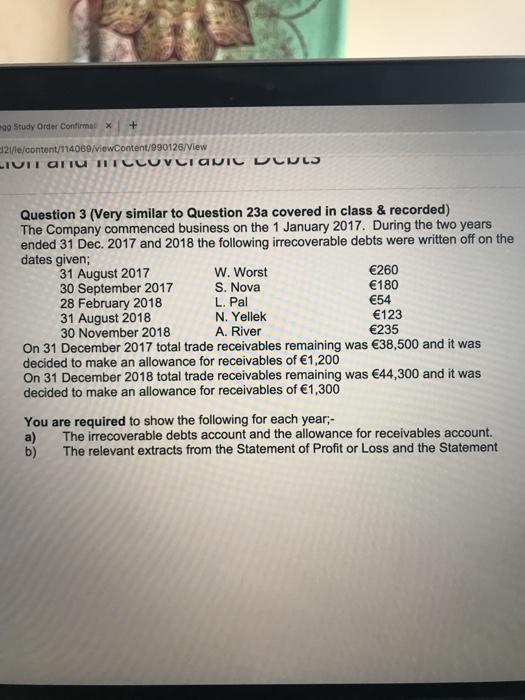

/conto LIUIlari III VLINIC LLLS Portfolio 6 due 9am Monday 8 February Question 1 Charm Ltd prepares financial statements to the 31 December each year. The company charges straight line depreciation at a rate of 20% per annum on machinery. Depreciation is charged from the month of acquisition to the month of disposal inclusive. On 1 January 2018 Charm Ltd owned two machines: Machine Alpha which was acquired on 1 January 2015 at a cost of 40,000; Machine Beta which was acquired on 30 April 2016 at a cost of 24,000. On 30 April 2018, Charm Ltd traded in Machine Beta against a new machine, Machine Gamma. Machine Gamma was priced at 36,000. In addition to trading in Machine Beta, Charm Ltd paid 21,000 to the supplier in respect of Machine Gamma. On 31 August 2018 Charm Ltd bought Machine Delta for 30,000. Requirement (a) Prepare the following in respect of the year ended 31 December 2018: 0 The machinery cost account; (ii) The accumulated depreciation - machinery account; (iii) The machinery depreciation expense account: (iv) The disposal of machinery account. 16 marks (b) Explain why depreciation is provided for in financial statements 4 marks Total: 20 marks (Autumn 2019) MacBook Pro G Search or type URL * ( 3 # % 5 & 7 4 6 oc 0 ng Study Order Confirmat X + d21/1/content/114069/ViewContent/990126/View LIVICIU III Question 2 (a) At the beginning of its financial year on 1 January 2018, Rotate Ltd had a balance on its fixtures & fittings account of 96,400 and a balance on its accumulated depreciation on fixtures & fittings account of 22,600. On 30 September 2018 the firm sold fixtures for 11,000. These fixtures had been purchased on 1 June 2015 at a cost of 16,000. On the date of purchase, Rotate Ltd spent 200 on transporting the fixtures from the supplier's premises to their own premises. They also spent a further 800 on installing the fixtures. On the 31 May 2016 repairs costing 400 were carried out on the fixtures. On 1 July 2016 a new part costing 1,000 was added to the fixtures in order to enhance their usefulness. The firm provides for depreciation on fixtures & fittings at 20% per annum, using the reducing balance method. A full year's depreciation is provided on all fixtures and fittings held at the end of the financial year. Requirement Prepare for the year ended 31 December 2018: The fixtures and fittings account. Study Order Confirmatx + 21/e/content/114069/viewContent/990126/View LIUIT aru THE Question 3 (Very similar to Question 23a covered in class & recorded) The Company commenced business on the 1 January 2017. During the two years ended 31 Dec. 2017 and 2018 the following irrecoverable debts were written off on the dates given; 31 August 2017 W. Worst 260 30 September 2017 S. Nova 180 28 February 2018 L. Pal 54 31 August 2018 N. Yellek 123 30 November 2018 A. River 235 On 31 December 2017 total trade receivables remaining was 38,500 and it was decided to make an allowance for receivables of 1,200 On 31 December 2018 total trade receivables remaining was 44,300 and it was decided to make an allowance for receivables of 1,300 You are required to show the following for each year- a) The irrecoverable debts account and the allowance for receivables account. b) The relevant extracts from the Statement of Profit or Loss and the Statement