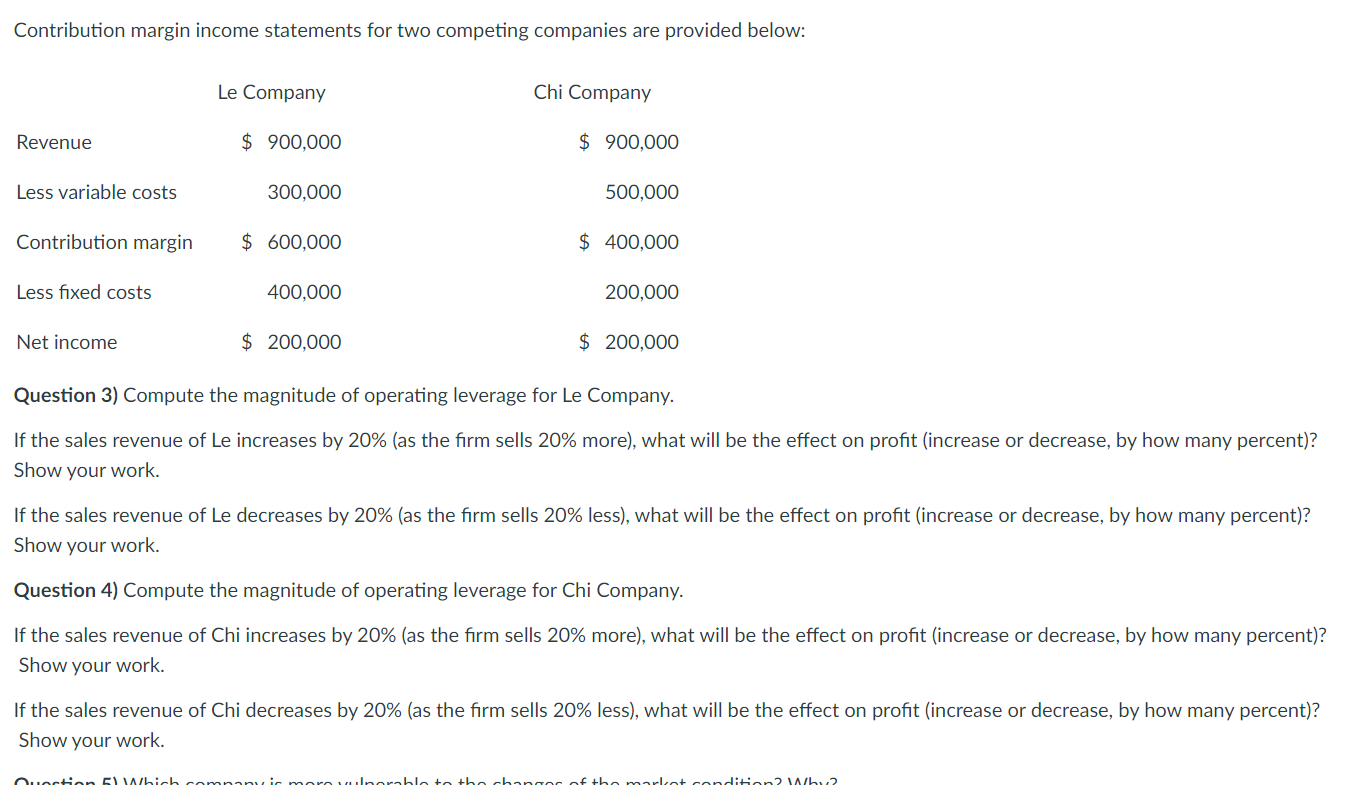

Question: Contribution margin income statements for two competing companies are provided below: Revenue Less variable costs Contribution margin Less fixed costs Net income Le Company

Contribution margin income statements for two competing companies are provided below: Revenue Less variable costs Contribution margin Less fixed costs Net income Le Company $ 900,000 300,000 $ 600,000 Question 5) Which 400,000 $ 200,000 Chi Company $ 900,000 500,000 $400,000 200,000 $ 200,000 Question 3) Compute the magnitude of operating leverage for Le Company. If the sales revenue of Le increases by 20% (as the firm sells 20% more), what will be the effect on profit (increase or decrease, by how many percent)? Show your work. If the sales revenue of Le decreases by 20% (as the firm sells 20% less), what will be the effect on profit (increase or decrease, by how many percent)? Show your work. Question 4) Compute the magnitude of operating leverage for Chi Company. If the sales revenue of Chi increases by 20% (as the firm sells 20% more), what will be the effect on profit (increase or decrease, by how many percent)? Show your work. If the sales revenue of Chi decreases by 20% (as the firm sells 20% less), what will be the effect on profit (increase or decrease, by how many percent)? Show your work. more vulnerable to the changes of the market condition? Why? Contribution margin income statements for two competing companies are provided below: Revenue Less variable costs Contribution margin Less fixed costs Net income Le Company $ 900,000 300,000 $ 600,000 Question 5) Which 400,000 $ 200,000 Chi Company $ 900,000 500,000 $400,000 200,000 $ 200,000 Question 3) Compute the magnitude of operating leverage for Le Company. If the sales revenue of Le increases by 20% (as the firm sells 20% more), what will be the effect on profit (increase or decrease, by how many percent)? Show your work. If the sales revenue of Le decreases by 20% (as the firm sells 20% less), what will be the effect on profit (increase or decrease, by how many percent)? Show your work. Question 4) Compute the magnitude of operating leverage for Chi Company. If the sales revenue of Chi increases by 20% (as the firm sells 20% more), what will be the effect on profit (increase or decrease, by how many percent)? Show your work. If the sales revenue of Chi decreases by 20% (as the firm sells 20% less), what will be the effect on profit (increase or decrease, by how many percent)? Show your work. more vulnorable to the changes of the market condition? Why2 Contribution margin income statements for two competing companies are provided below: Revenue Less variable costs Contribution margin Less fixed costs Net income Le Company $ 900,000 300,000 $ 600,000 Question 5) Which 400,000 $ 200,000 Chi Company $ 900,000 500,000 $400,000 200,000 $ 200,000 Question 3) Compute the magnitude of operating leverage for Le Company. If the sales revenue of Le increases by 20% (as the firm sells 20% more), what will be the effect on profit (increase or decrease, by how many percent)? Show your work. If the sales revenue of Le decreases by 20% (as the firm sells 20% less), what will be the effect on profit (increase or decrease, by how many percent)? Show your work. Question 4) Compute the magnitude of operating leverage for Chi Company. If the sales revenue of Chi increases by 20% (as the firm sells 20% more), what will be the effect on profit (increase or decrease, by how many percent)? Show your work. If the sales revenue of Chi decreases by 20% (as the firm sells 20% less), what will be the effect on profit (increase or decrease, by how many percent)? Show your work. more vulnerable to the changes of the market condition? Why?

Step by Step Solution

There are 3 Steps involved in it

Operating Leverage Contribution Margin Net Income 3 Le Company For Le Company Contribution Margin 600000 Net Income 200000 Operating Leverage 600000 2... View full answer

Get step-by-step solutions from verified subject matter experts