Answered step by step

Verified Expert Solution

Question

1 Approved Answer

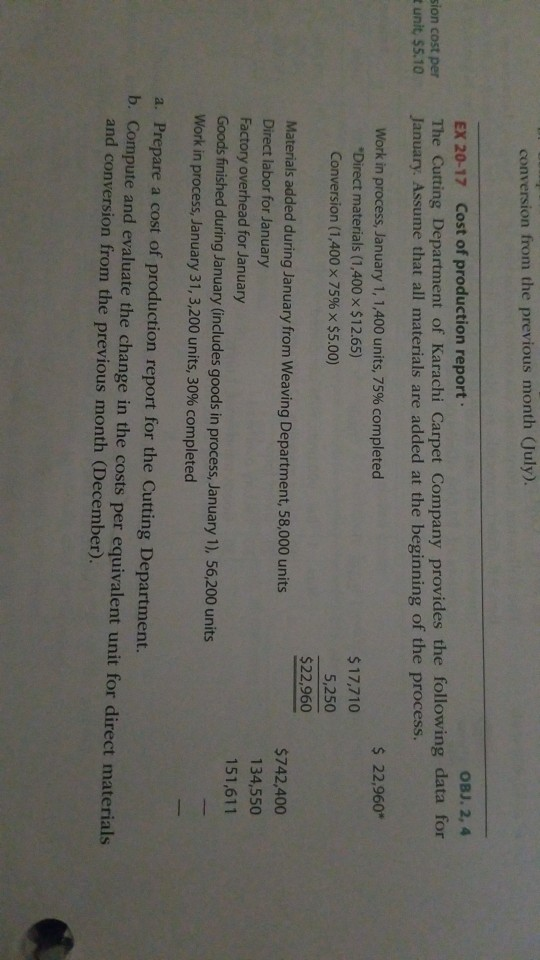

conversion from the previous month July OBJ. 2, 4 EX 20-17 Cost of production report sion cost perThe Cutting Department of Karachi Carpet Company provides

conversion from the previous month July OBJ. 2, 4 EX 20-17 Cost of production report sion cost perThe Cutting Department of Karachi Carpet Company provides the following data for t unit $5.10January. Assume that all materials are added at the beginning of the process. Work in process, January 1, 1,400 units, 75% completed s 22,960* $ 17,710 5,250 Direct materials (1,400 x $12.65) Conversion (1,400 x 75% $5.00) 58,00 umits $229860 Materials added during January from Weaving Department, 58,000 units Direct labor for January Factory overhead for January Goods finished during January includes goods in process, January 1), 56,200 units Work in process, January 31, 3,200 units, 30% completed $742,400 134,550 151,611 a. Prepare a cost of production report for the Cutting Department b. Compute and evaluate the change in the costs per equivalent unit for direct materials and conversion from the previous month (December). conversion from the previous month July OBJ. 2, 4 EX 20-17 Cost of production report sion cost perThe Cutting Department of Karachi Carpet Company provides the following data for t unit $5.10January. Assume that all materials are added at the beginning of the process. Work in process, January 1, 1,400 units, 75% completed s 22,960* $ 17,710 5,250 Direct materials (1,400 x $12.65) Conversion (1,400 x 75% $5.00) 58,00 umits $229860 Materials added during January from Weaving Department, 58,000 units Direct labor for January Factory overhead for January Goods finished during January includes goods in process, January 1), 56,200 units Work in process, January 31, 3,200 units, 30% completed $742,400 134,550 151,611 a. Prepare a cost of production report for the Cutting Department b. Compute and evaluate the change in the costs per equivalent unit for direct materials and conversion from the previous month (December)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started