Answered step by step

Verified Expert Solution

Question

1 Approved Answer

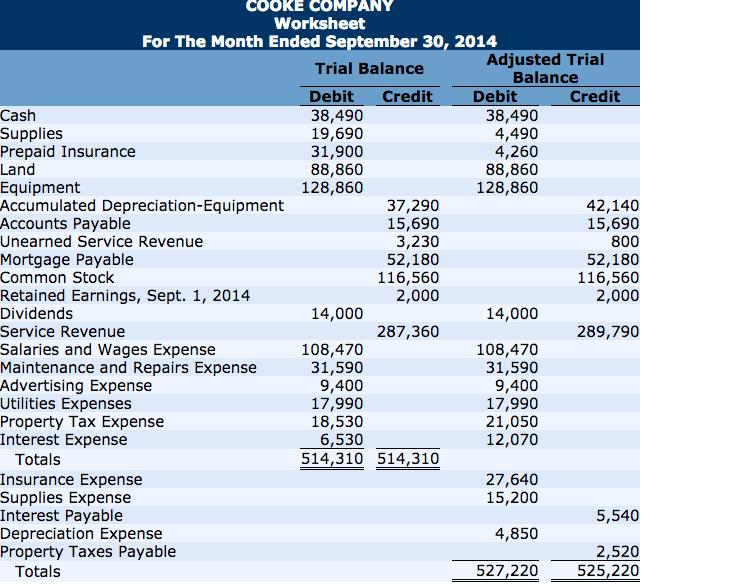

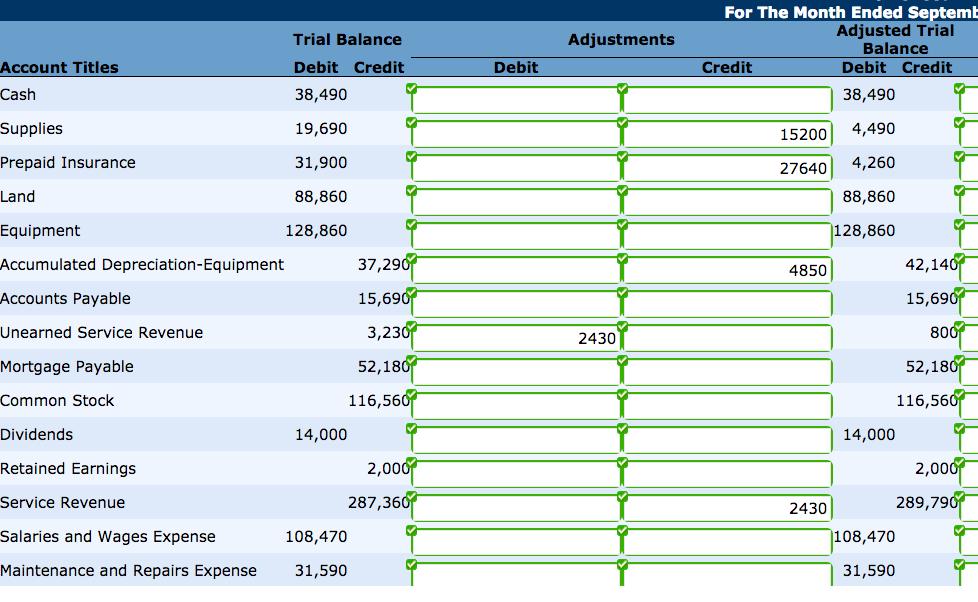

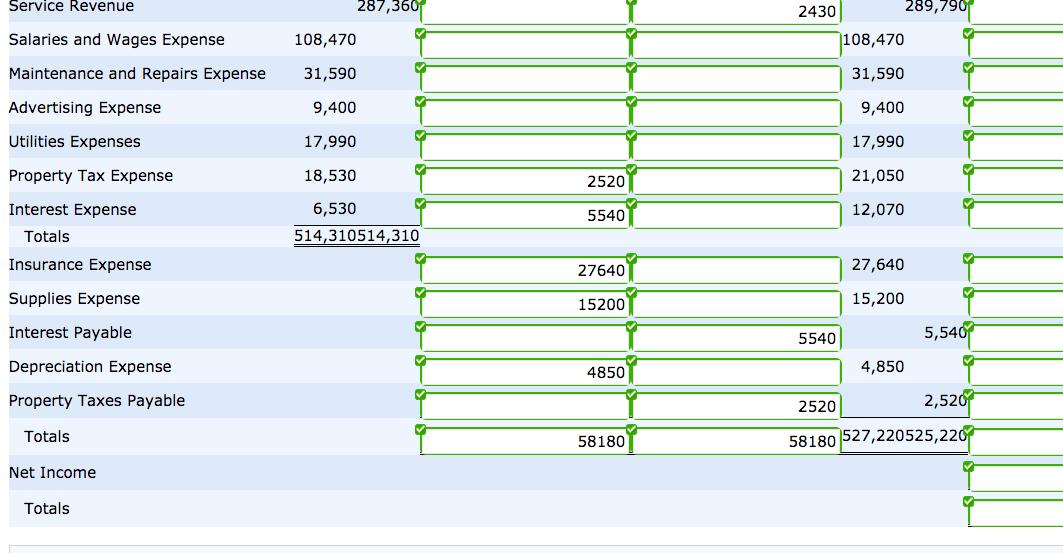

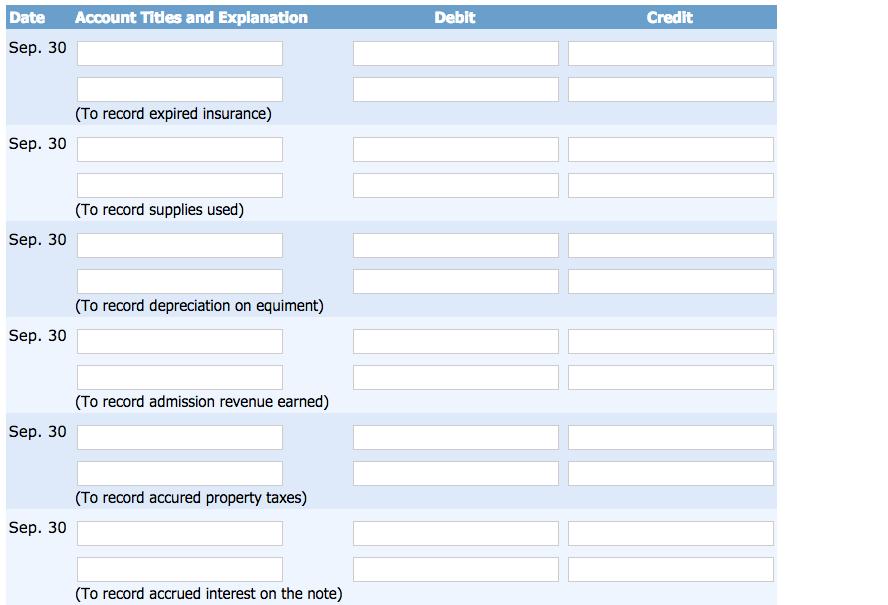

Cooke Company has a fiscal year ending on September 30. Selected data from the September 30 worksheet are presented below. c. Journalize the adjusting entries

Cooke Company has a fiscal year ending on September 30. Selected data from the September 30 worksheet are presented below.

c. Journalize the adjusting entries using the worksheet as a basis

COOKE COMPANY Worksheet For The Month Ended September 30, 2014 Trial Balance Adjusted Trial Balance Debit Credit Debit Credit Cash 38,490 38,490 Supplies 19,690 4,490 Prepaid Insurance 31,900 4,260 Land 88,860 88,860 Equipment 128,860 128,860 Accumulated Depreciation-Equipment 37,290 42,140 Accounts Payable 15,690 15,690 Unearned Service Revenue 3,230 800 Mortgage Payable 52,180 52,180 Common Stock 116,560 116,560 Retained Earnings, Sept. 1, 2014 2,000 2,000 Dividends 14,000 14,000 Service Revenue 287,360 289,790 Salaries and Wages Expense 108,470 108,470 Maintenance and Repairs Expense 31,590 31,590 Advertising Expense 9,400 9,400 Utilities Expenses 17,990 17,990 Property Tax Expense 18,530 21,050 Interest Expense Totals Insurance Expense Supplies Expense 6,530 12,070 514,310 514,310 27,640 15,200 Interest Payable Depreciation Expense Property Taxes Payable Totals 5,540 4,850 2,520 527,220 525,220

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started