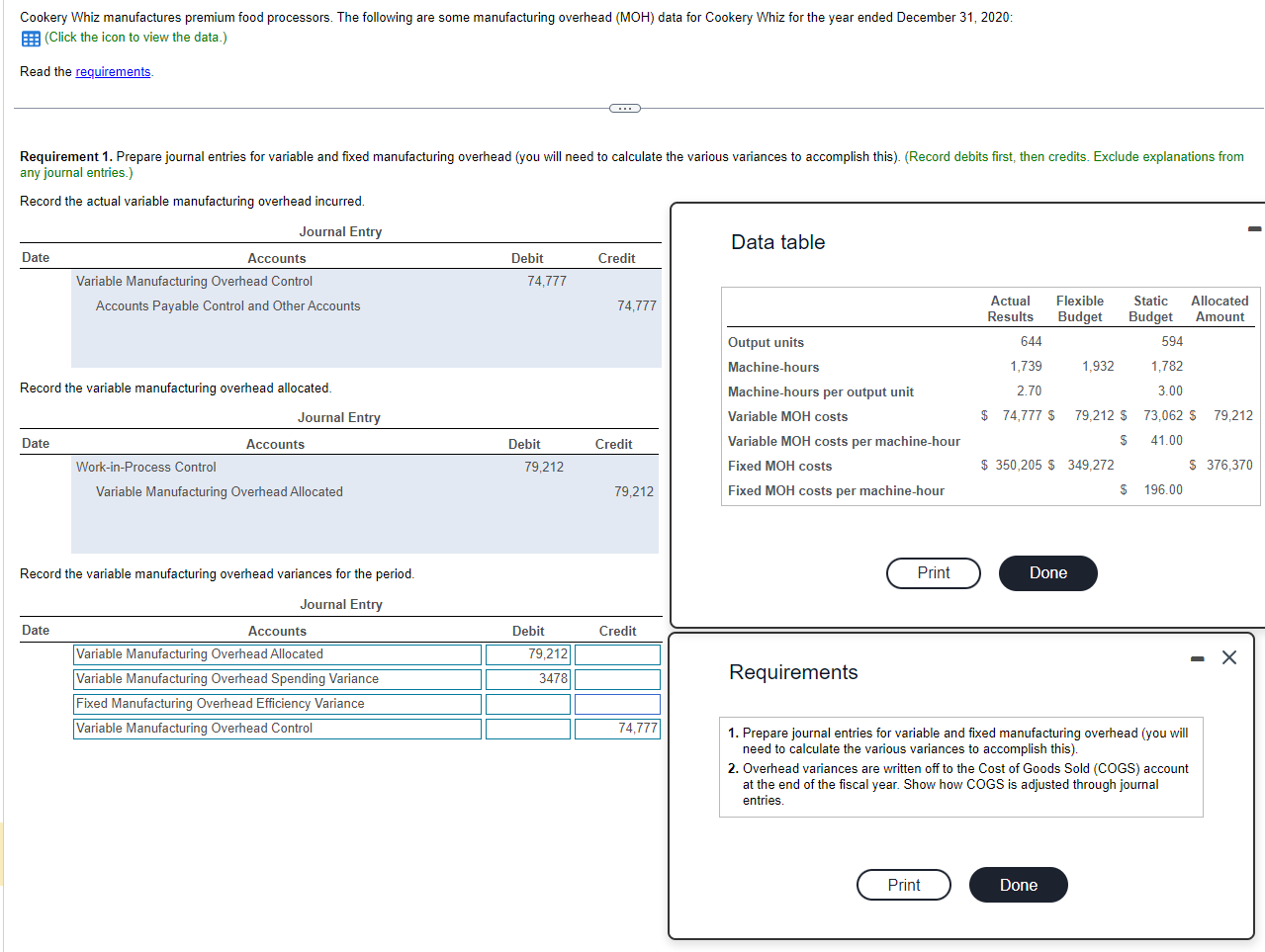

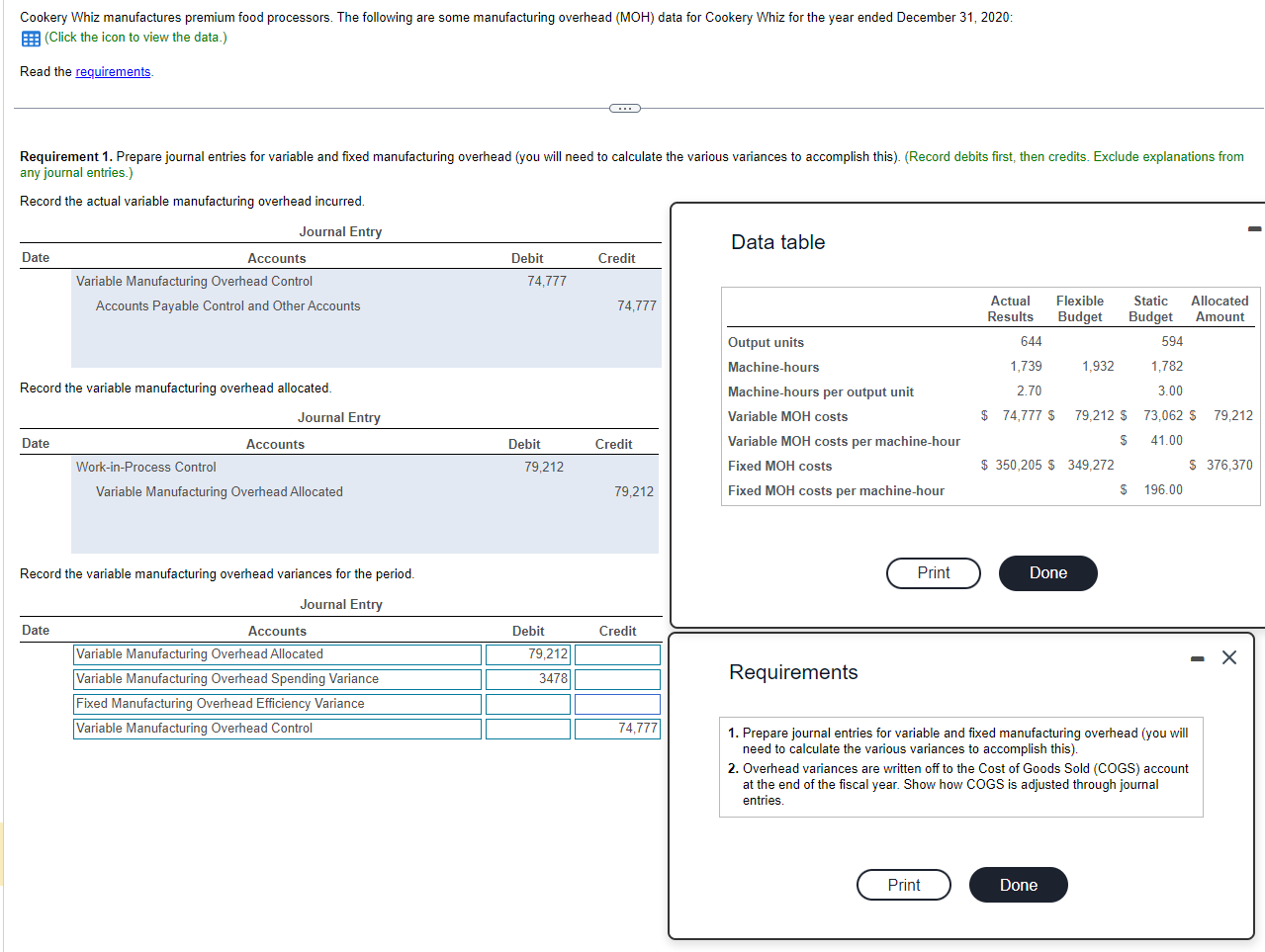

Cookery Whiz manufactures premium food processors. The following are some manufacturing overhead (MOH) data for Cookery Whiz for the year ended December 31,2020 : (Click the icon to view the data.) Read the requirements. any journal entries.) Record the actual variable manufacturing overhead incurred.

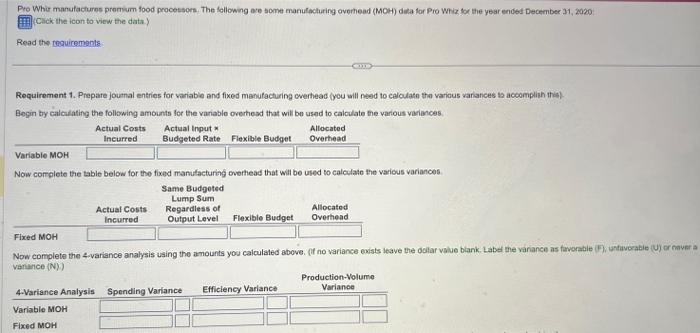

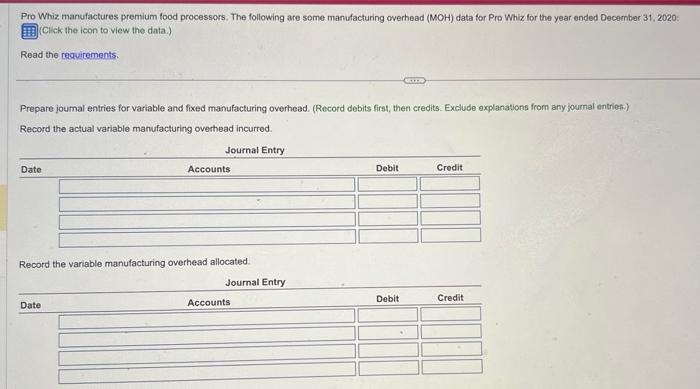

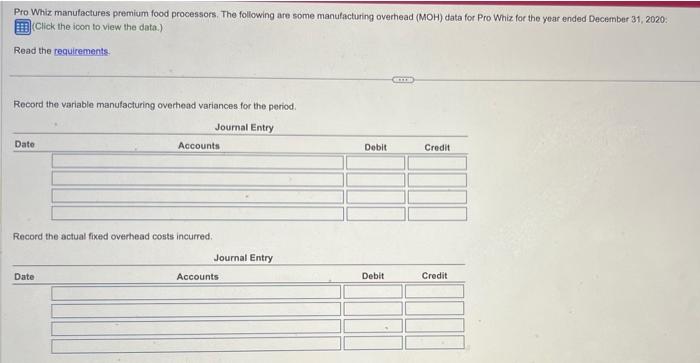

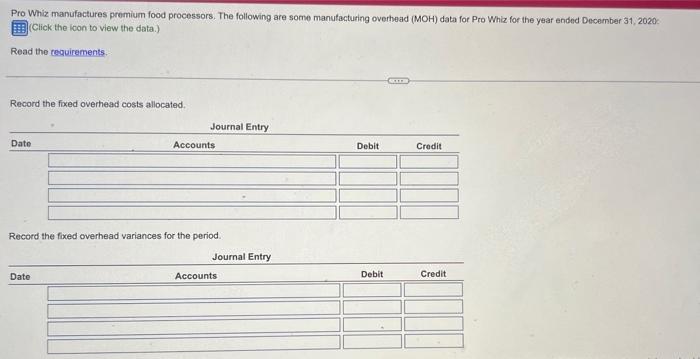

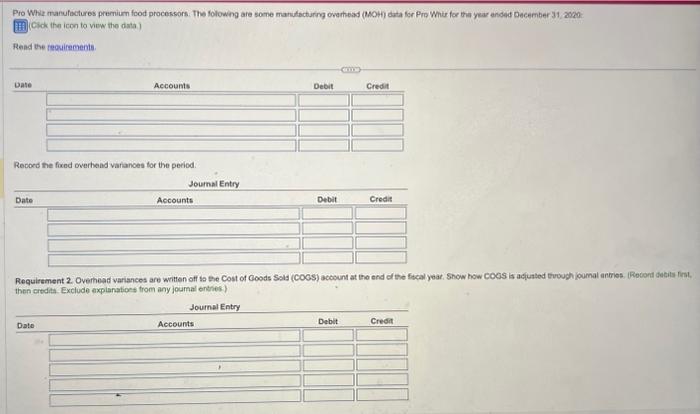

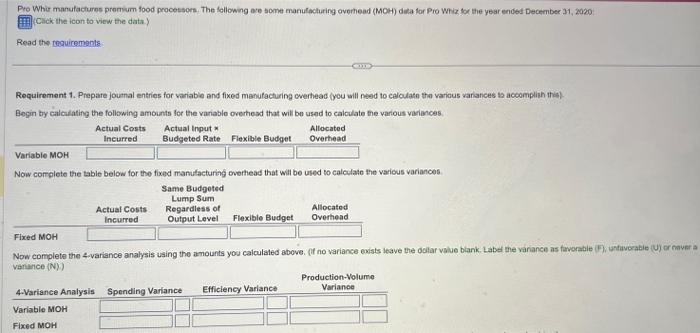

Cookery Whiz manufactures premium food processors. The following are some manufacturing overhead (MOH) data for Cookery Whiz for the year ended December 31,2020 : (Click the icon to view the data.) Read the requirements. any journal entries.) Record the actual variable manufacturing overhead incurred. Data table Record the variable manufacturing overhead allocated. 1-...--1 r..... Record the variable manufacturing overhead variances for the period. Requirements 1. Prepare journal entries for variable and fixed manufacturing overhead (you will need to calculate the various variances to accomplish this). 2. Overhead variances are written off to the Cost of Goods Sold (COGS) account at the end of the fiscal year. Show how COGS is adjusted through journal entries. Pro Whir manufactures promium food processors. The following ave some manufacturing ovpmead (MOH) difa for Pro Whiz tor the year ended December 31,2020 . (Click the ieon to view the dits.) Read the tequicements: Requirement 1. Prepare joumal entries for variable and fixed manufacturing overhead foou will need to celoulate the varicus variances is accomplish ithis) Begin by calculating the following amounts for the variable overhesd that will be used to calculate fhe various variances. Pro Whiz manufactures premium food processors. The following are some manufacturing overhead (MOH) data for Pro Whiz for the year ended December 31,2020 : [Click the icon to view the data.) Read the recuirements. Prepare journal entries for variable and fixed manufacturing overhead. (Record debits first, then credits. Exclude explanations from any journal entrief.) Record the actual variable manufacturing overhead incurred. Record the variable manufacturing overhead allocated. Pro Whiz manutactures premium food processors, The following are some manufacturing overhead (MOH) data for Pro Whiz for the year ended December 31,2020 : (Click the icon to view the data.) Read the requirements. Record the variable manufacturing overhead variances for the period. Record the actual fixed overhead costs incurred. Pro Whiz manufactures promium food processors. The following are some manufacturing overhead (MOH) data for Pro Whiz for the year ended December 31,2020 : [Click the icon to view the data.) Read the tequirements. Record the fixed overhead costs allocated. Record the fixed overhead variances for the period. cock the icon to new the dita? Read the reocilements Recoed the fixed owerhend variances for the period. then credita. Exclude explanations trom any joumal entenes) Cookery Whiz manufactures premium food processors. The following are some manufacturing overhead (MOH) data for Cookery Whiz for the year ended December 31,2020 : (Click the icon to view the data.) Read the requirements. any journal entries.) Record the actual variable manufacturing overhead incurred. Data table Record the variable manufacturing overhead allocated. 1-...--1 r..... Record the variable manufacturing overhead variances for the period. Requirements 1. Prepare journal entries for variable and fixed manufacturing overhead (you will need to calculate the various variances to accomplish this). 2. Overhead variances are written off to the Cost of Goods Sold (COGS) account at the end of the fiscal year. Show how COGS is adjusted through journal entries. Pro Whir manufactures promium food processors. The following ave some manufacturing ovpmead (MOH) difa for Pro Whiz tor the year ended December 31,2020 . (Click the ieon to view the dits.) Read the tequicements: Requirement 1. Prepare joumal entries for variable and fixed manufacturing overhead foou will need to celoulate the varicus variances is accomplish ithis) Begin by calculating the following amounts for the variable overhesd that will be used to calculate fhe various variances. Pro Whiz manufactures premium food processors. The following are some manufacturing overhead (MOH) data for Pro Whiz for the year ended December 31,2020 : [Click the icon to view the data.) Read the recuirements. Prepare journal entries for variable and fixed manufacturing overhead. (Record debits first, then credits. Exclude explanations from any journal entrief.) Record the actual variable manufacturing overhead incurred. Record the variable manufacturing overhead allocated. Pro Whiz manutactures premium food processors, The following are some manufacturing overhead (MOH) data for Pro Whiz for the year ended December 31,2020 : (Click the icon to view the data.) Read the requirements. Record the variable manufacturing overhead variances for the period. Record the actual fixed overhead costs incurred. Pro Whiz manufactures promium food processors. The following are some manufacturing overhead (MOH) data for Pro Whiz for the year ended December 31,2020 : [Click the icon to view the data.) Read the tequirements. Record the fixed overhead costs allocated. Record the fixed overhead variances for the period. cock the icon to new the dita? Read the reocilements Recoed the fixed owerhend variances for the period. then credita. Exclude explanations trom any joumal entenes)