Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cool is unexpectedly approached by a leading global HVAC player that expresses its interest in acquiring the company to strengthen its position in the ventilation

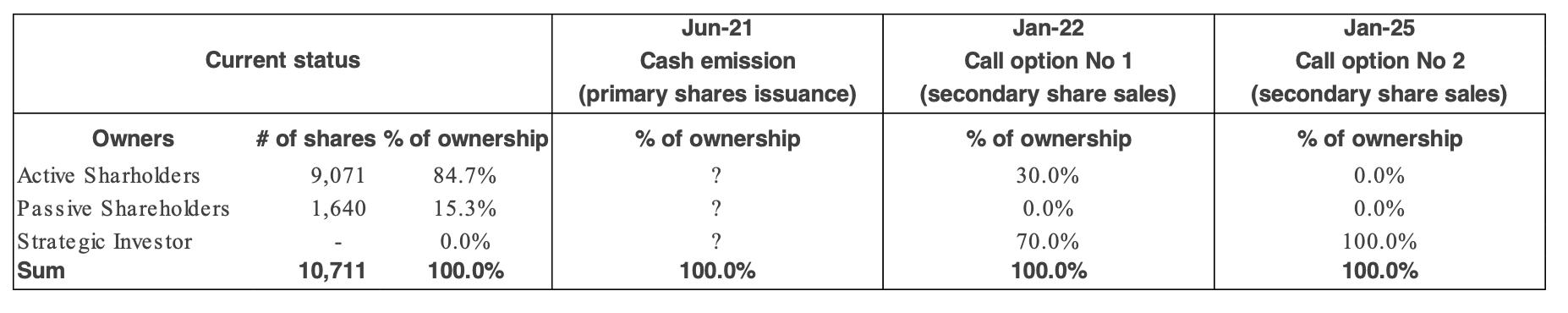

- Cool is unexpectedly approached by a leading global HVAC player that expresses its interest in acquiring the company to strengthen its position in the ventilation sector. Even though it is not their original plan, Cool’s shareholders have considered the intangible values and synergies to be backed by an industry giant, thus considering to let the strategic investor come in, but the acquisition must be done in phases. The proposed earn-out structure is as below. Determine the equity valuation at each transaction phase that seems attractive enough so that shareholders are willing to give up their stake.

*Determine the proportions of each "% of ownership" on Jun-21 section and give the specific reasons and apply analysis/theory/researches and supportive evidences that can be logical in this answers**

Current status Owners Active Sharholders Passive Shareholders Strategic Investor Sum # of shares % of ownership 9,071 1,640 10,711 84.7% 15.3% 0.0% 100.0% Jun-21 Cash emission (primary shares issuance) % of ownership ? ? ? 100.0% Jan-22 Call option No 1 (secondary share sales) % of ownership 30.0% 0.0% 70.0% 100.0% Jan-25 Call option No 2 (secondary share sales) % of ownership 0.0% 0.0% 100.0% 100.0%

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer Jun21 Cash emission primary shares issuance The owners should retain a 70 ownership to maintain control of the company while the strategic inve...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started