Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Coolio Pty Ltd (Coolio) is an Australian tax resident company that is not a base rate entity and only derives foreign-sourced income. For the

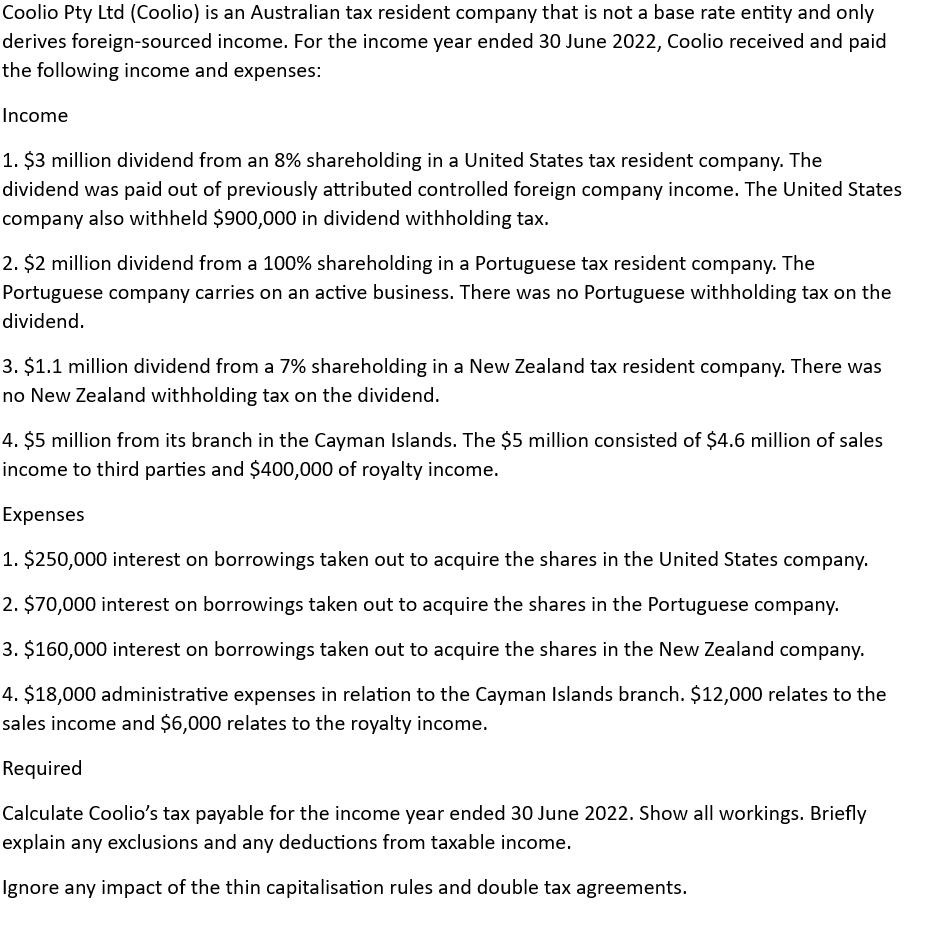

Coolio Pty Ltd (Coolio) is an Australian tax resident company that is not a base rate entity and only derives foreign-sourced income. For the income year ended 30 June 2022, Coolio received and paid the following income and expenses: Income 1. $3 million dividend from an 8% shareholding in a United States tax resident company. The dividend was paid out of previously attributed controlled foreign company income. The United States company also withheld $900,000 in dividend withholding tax. 2. $2 million dividend from a 100% shareholding in a Portuguese tax resident company. The Portuguese company carries on an active business. There was no Portuguese withholding tax on the dividend. 3. $1.1 million dividend from a 7% shareholding in a New Zealand tax resident company. There was no New Zealand withholding tax on the dividend. 4. $5 million from its branch in the Cayman Islands. The $5 million consisted of $4.6 million of sales income to third parties and $400,000 of royalty income. Expenses 1. $250,000 interest on borrowings taken out to acquire the shares in the United States company. 2. $70,000 interest on borrowings taken out to acquire the shares in the Portuguese company. 3. $160,000 interest on borrowings taken out to acquire the shares in the New Zealand company. 4. $18,000 administrative expenses in relation to the Cayman Islands branch. $12,000 relates to the sales income and $6,000 relates to the royalty income. Required Calculate Coolio's tax payable for the income year ended 30 June 2022. Show all workings. Briefly explain any exclusions and any deductions from taxable income. Ignore any impact of the thin capitalisation rules and double tax agreements.

Step by Step Solution

★★★★★

3.28 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Coolio Pty Ltds tax payable for the income year ended 30 June 2022 we need to consider the income and expenses provided I will break down ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started