Answered step by step

Verified Expert Solution

Question

1 Approved Answer

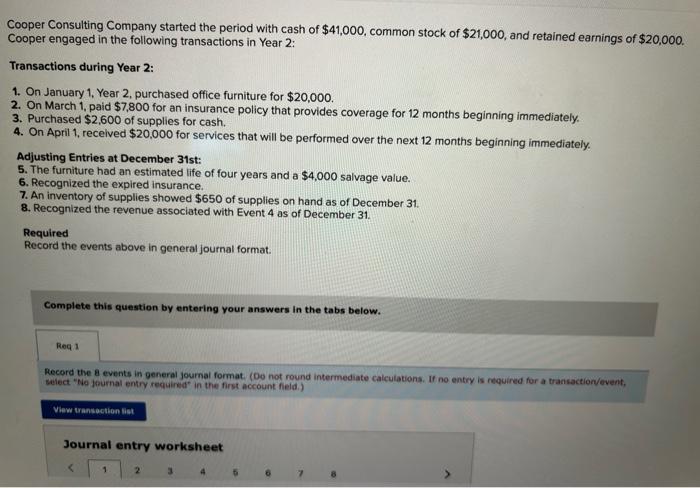

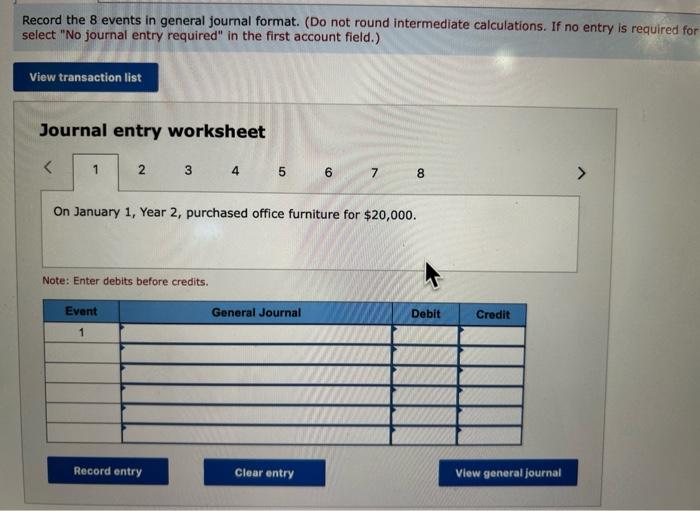

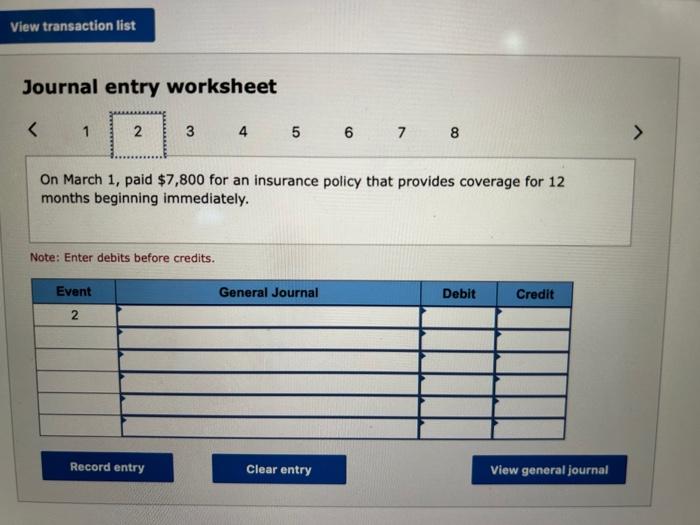

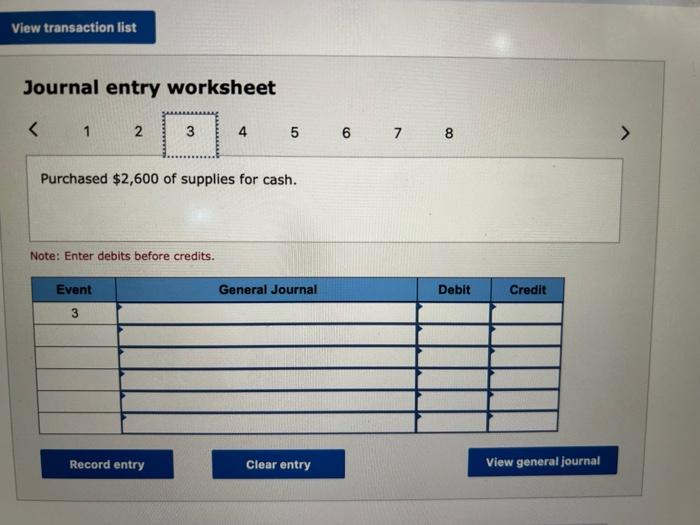

Cooper Consulting Company started the period with cash of $41,000, common stock of $21,000, and retained earnings of $20,000. Cooper engaged in the following

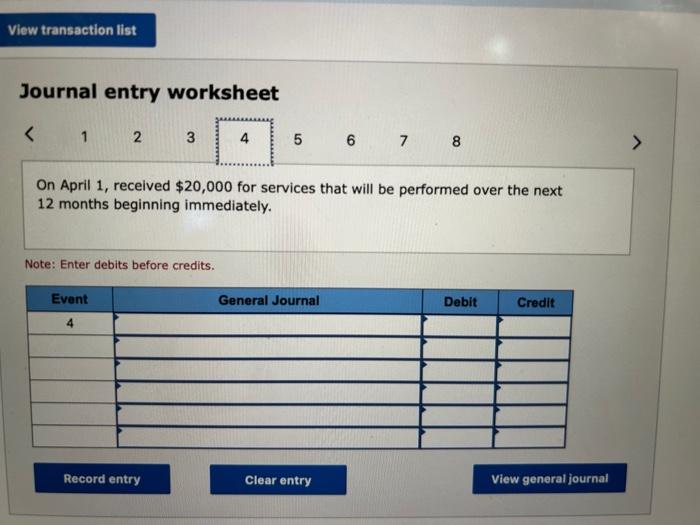

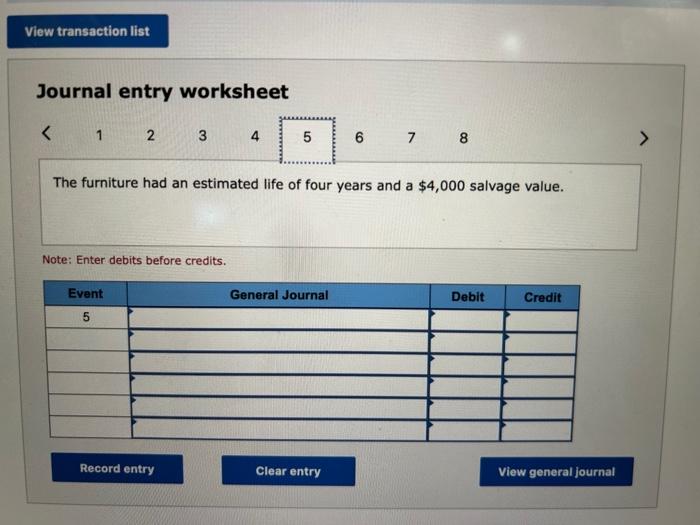

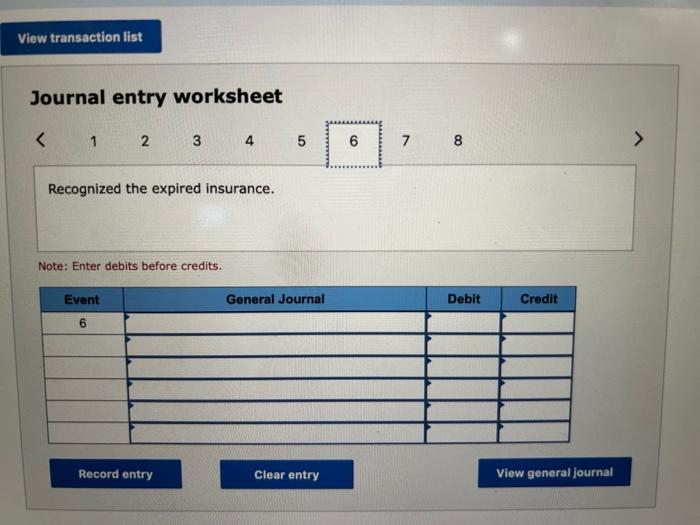

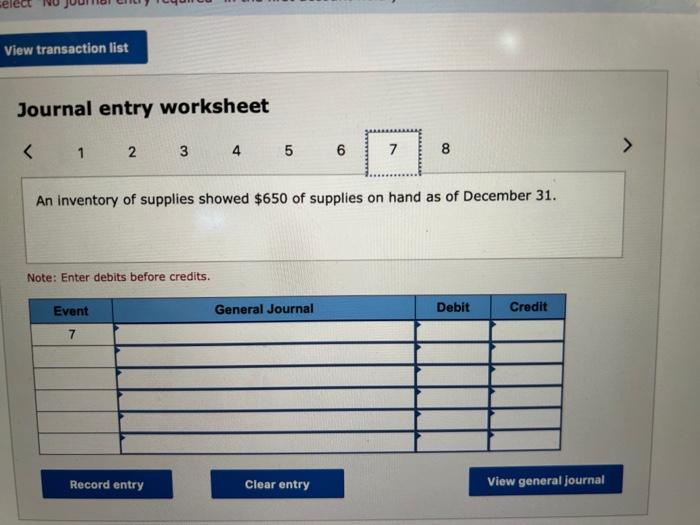

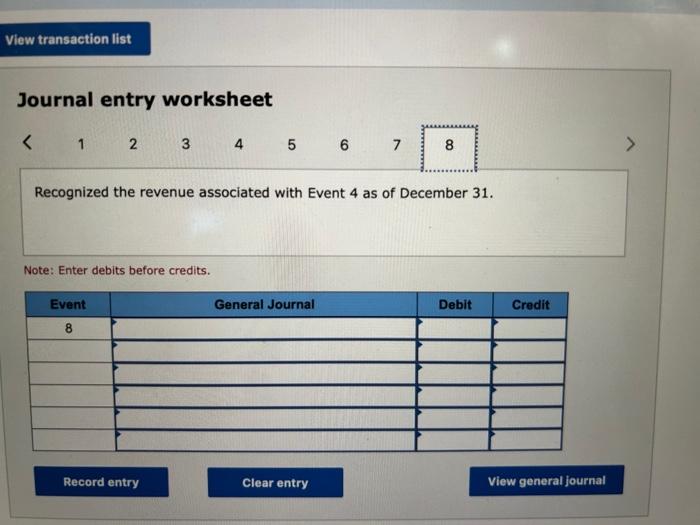

Cooper Consulting Company started the period with cash of $41,000, common stock of $21,000, and retained earnings of $20,000. Cooper engaged in the following transactions in Year 2: Transactions during Year 2: 1. On January 1, Year 2, purchased office furniture for $20,000. 2. On March 1, paid $7,800 for an insurance policy that provides coverage for 12 months beginning immediately. 3. Purchased $2,600 of supplies for cash. 4. On April 1, received $20,000 for services that will be performed over the next 12 months beginning immediately. Adjusting Entries at December 31st: 5. The furniture had an estimated life of four years and a $4,000 salvage value. 6. Recognized the expired insurance. 7. An inventory of supplies showed $650 of supplies on hand as of December 31. 8. Recognized the revenue associated with Event 4 as of December 31. Required Record the events above in general journal format. Complete this question by entering your answers in the tabs below. Req 1 Record the 8 events in general journal format. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet 1 2 3 Record the 8 events in general journal format. (Do not round intermediate calculations. If no entry is required for select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 Event 1 3 4 5 6 7 On January 1, Year 2, purchased office furniture for $20,000. Note: Enter debits before credits. Record entry General Journal 8 Clear entry Debit Credit View general journal View transaction list Journal entry worksheet < 1 2 Event 2 3 On March 1, paid $7,800 for an insurance policy that provides coverage for 12 months beginning immediately. Note: Enter debits before credits. Record entry 4 5 6 7 8 General Journal Clear entry Debit Credit View general journal View transaction list Journal entry worksheet < 1 2 Event 3 3 Note: Enter debits before credits. Purchased $2,600 of supplies for cash. Record entry 4 5 6 7 8 General Journal Clear entry Debit Credit View general journal View transaction list Journal entry worksheet < 1 2 3 Note: Enter debits before credits. Event 4 Record entry 4 5 On April 1, received $20,000 for services that will be performed over the next 12 months beginning immediately. General Journal 6 7 Clear entry 8 Debit Credit View general journal View transaction list Journal entry worksheet < 1 2 Event 5 3 Note: Enter debits before credits. Record entry 4 5 The furniture had an estimated life of four years and a $4,000 salvage value. General Journal 6 Clear entry 7 8 Debit Credit View general journal View transaction list Journal entry worksheet < 1 2 3 Recognized the expired insurance. Note: Enter debits before credits. Event 6 Record entry 4 5 General Journal Clear entry 6 7 8 Debit Credit View general journal > sele View transaction list Journal entry worksheet 1 2 Event 7 3 Note: Enter debits before credits. Record entry 4 5 6 An inventory of supplies showed $650 of supplies on hand as of December 31. General Journal 7 Clear entry 8 Debit Credit View general journal > View transaction list Journal entry worksheet < 1 2 Event 8 3 Note: Enter debits before credits. Recognized the revenue associated with Event 4 as of December 31. Record entry 4 5 6 7 General Journal 8 Clear entry Debit Credit View general journal Cooper Consulting Company started the period with cash of $41,000, common stock of $21,000, and retained earnings of $20,000. Cooper engaged in the following transactions in Year 2: Transactions during Year 2: 1. On January 1, Year 2, purchased office furniture for $20,000. 2. On March 1, paid $7,800 for an insurance policy that provides coverage for 12 months beginning immediately. 3. Purchased $2,600 of supplies for cash. 4. On April 1, received $20,000 for services that will be performed over the next 12 months beginning immediately. Adjusting Entries at December 31st: 5. The furniture had an estimated life of four years and a $4,000 salvage value. 6. Recognized the expired insurance. 7. An inventory of supplies showed $650 of supplies on hand as of December 31. 8. Recognized the revenue associated with Event 4 as of December 31. Required Record the events above in general journal format. Complete this question by entering your answers in the tabs below. Req 1 Record the 8 events in general journal format. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet 1 2 3 Record the 8 events in general journal format. (Do not round intermediate calculations. If no entry is required for select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 Event 1 3 4 5 6 7 On January 1, Year 2, purchased office furniture for $20,000. Note: Enter debits before credits. Record entry General Journal 8 Clear entry Debit Credit View general journal View transaction list Journal entry worksheet < 1 2 Event 2 3 On March 1, paid $7,800 for an insurance policy that provides coverage for 12 months beginning immediately. Note: Enter debits before credits. Record entry 4 5 6 7 8 General Journal Clear entry Debit Credit View general journal View transaction list Journal entry worksheet < 1 2 Event 3 3 Note: Enter debits before credits. Purchased $2,600 of supplies for cash. Record entry 4 5 6 7 8 General Journal Clear entry Debit Credit View general journal View transaction list Journal entry worksheet < 1 2 3 Note: Enter debits before credits. Event 4 Record entry 4 5 On April 1, received $20,000 for services that will be performed over the next 12 months beginning immediately. General Journal 6 7 Clear entry 8 Debit Credit View general journal View transaction list Journal entry worksheet < 1 2 Event 5 3 Note: Enter debits before credits. Record entry 4 5 The furniture had an estimated life of four years and a $4,000 salvage value. General Journal 6 Clear entry 7 8 Debit Credit View general journal View transaction list Journal entry worksheet < 1 2 3 Recognized the expired insurance. Note: Enter debits before credits. Event 6 Record entry 4 5 General Journal Clear entry 6 7 8 Debit Credit View general journal > sele View transaction list Journal entry worksheet 1 2 Event 7 3 Note: Enter debits before credits. Record entry 4 5 6 An inventory of supplies showed $650 of supplies on hand as of December 31. General Journal 7 Clear entry 8 Debit Credit View general journal > View transaction list Journal entry worksheet < 1 2 Event 8 3 Note: Enter debits before credits. Recognized the revenue associated with Event 4 as of December 31. Record entry 4 5 6 7 General Journal 8 Clear entry Debit Credit View general journal

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Journal entries to record the eight events are as follows Scenario On January 1 Year 2 purchased off...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started