Answered step by step

Verified Expert Solution

Question

1 Approved Answer

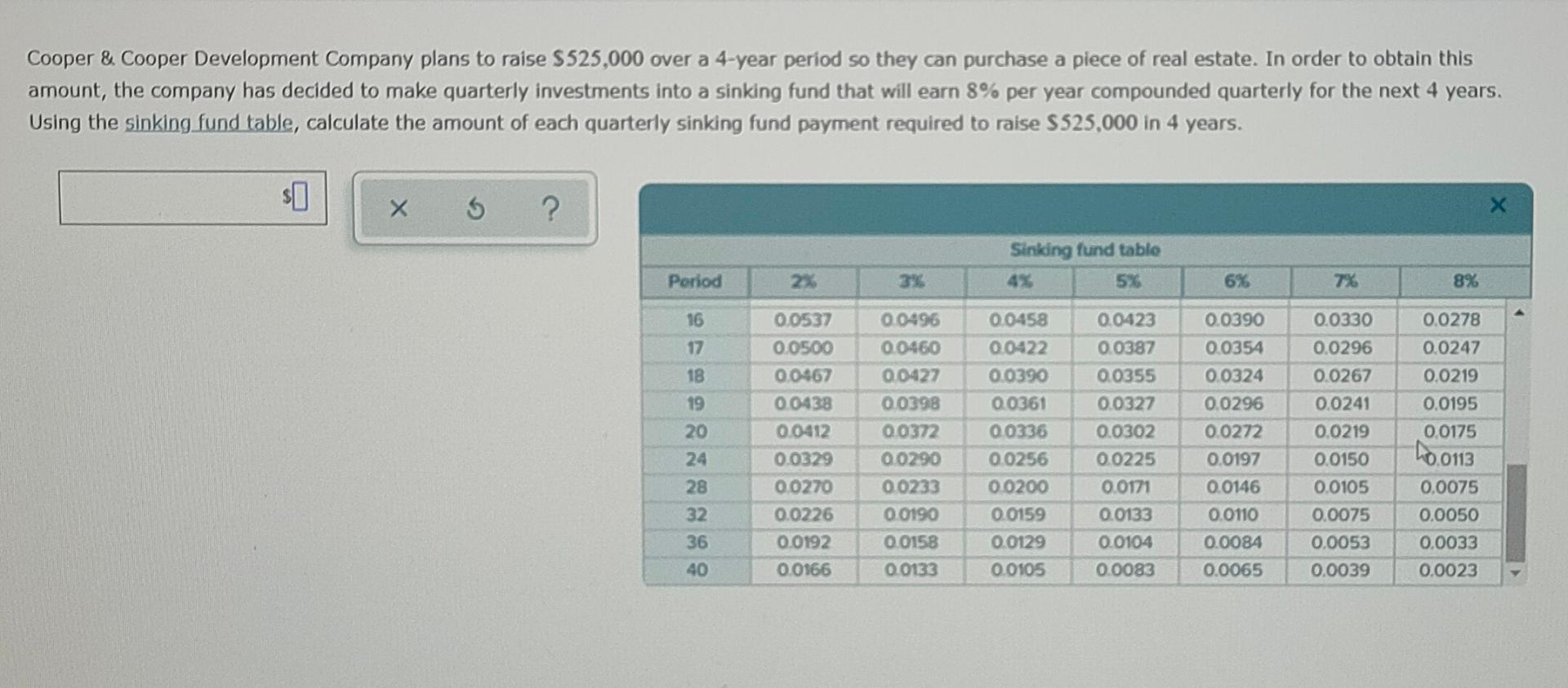

Cooper & Cooper Development Company plans to raise $525,000 over a 4-year period so they can purchase a piece of real estate. In order to

Cooper & Cooper Development Company plans to raise $525,000 over a 4-year period so they can purchase a piece of real estate. In order to obtain this amount, the company has decided to make quarterly investments into a sinking fund that will earn 8% per year compounded quarterly for the next 4 years. Using the sinking fund table, calculate the amount of each quarterly sinking fund payment required to raise $525.000 in 4 years. s0 ?. Sinking fund tablo 5% Period 33 6% 7% 8% 16 17 0.0423 0.0387 0.0355 18 19 20 24 28 32 0.0537 0.0500 0.0467 0.0438 0.0412 0.0329 0.0270 0.0226 0.0192 0.0166 0.0496 0.0460 00427 00398 0.0372 00290 0.0233 0.0190 0.0158 00133 0.0458 0.0422 0.0390 0.0361 00336 0.0256 0.0200 0.0159 0.0129 0.0105 0.0327 0.0302 0.0225 0.0171 0.0133 0.0104 0.0083 0.0390 0.0354 0.0324 0.0296 0.0272 0.0197 0.0146 0.0110 0.0084 0.0065 0.0330 0.0296 0.0267 0.0241 0.0219 0.0150 0.0105 0.0075 0.0053 0.0039 0.0278 0.0247 0.0219 0.0195 0.0175 10.0113 0.0075 0.0050 0.0033 0.0023 36 40

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started