Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cooper Inc. enters into a lease agreement to acquire the use of a piece of equipment for 4 years beginning on January 1, 2020.

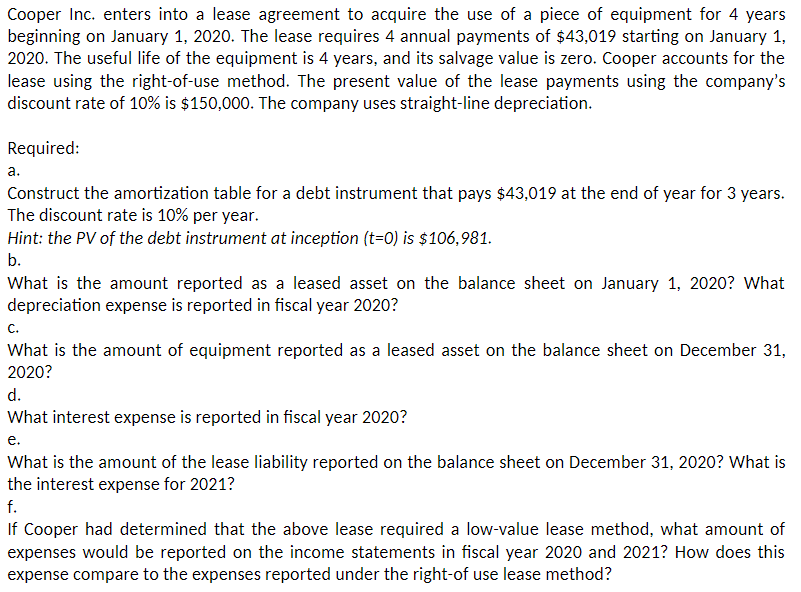

Cooper Inc. enters into a lease agreement to acquire the use of a piece of equipment for 4 years beginning on January 1, 2020. The lease requires 4 annual payments of $43,019 starting on January 1, 2020. The useful life of the equipment is 4 years, and its salvage value is zero. Cooper accounts for the lease using the right-of-use method. The present value of the lease payments using the company's discount rate of 10% is $150,000. The company uses straight-line depreciation. Required: a. Construct the amortization table for a debt instrument that pays $43,019 at the end of year for 3 years. The discount rate is 10% per year. Hint: the PV of the debt instrument at inception (t=0) is $106,981. b. What is the amount reported as a leased asset on the balance sheet on January 1, 2020? What depreciation expense is reported in fiscal year 2020? C. What is the amount of equipment reported as a leased asset on the balance sheet on December 31, 2020? d. What interest expense is reported in fiscal year 2020? e. What is the amount of the lease liability reported on the balance sheet on December 31, 2020? What is the interest expense for 2021? f. If Cooper had determined that the above lease required a low-value lease method, what amount of expenses would be reported on the income statements in fiscal year 2020 and 2021? How does this expense compare to the expenses reported under the right-of use lease method? Cooper Inc. enters into a lease agreement to acquire the use of a piece of equipment for 4 years beginning on January 1, 2020. The lease requires 4 annual payments of $43,019 starting on January 1, 2020. The useful life of the equipment is 4 years, and its salvage value is zero. Cooper accounts for the lease using the right-of-use method. The present value of the lease payments using the company's discount rate of 10% is $150,000. The company uses straight-line depreciation. Required: a. Construct the amortization table for a debt instrument that pays $43,019 at the end of year for 3 years. The discount rate is 10% per year. Hint: the PV of the debt instrument at inception (t=0) is $106,981. b. What is the amount reported as a leased asset on the balance sheet on January 1, 2020? What depreciation expense is reported in fiscal year 2020? C. What is the amount of equipment reported as a leased asset on the balance sheet on December 31, 2020? d. What interest expense is reported in fiscal year 2020? e. What is the amount of the lease liability reported on the balance sheet on December 31, 2020? What is the interest expense for 2021? f. If Cooper had determined that the above lease required a low-value lease method, what amount of expenses would be reported on the income statements in fiscal year 2020 and 2021? How does this expense compare to the expenses reported under the right-of use lease method?

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Cooper Inc Lease Calculations a Amortization Table Year Annual Payment Interest Expense Principal Pa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started