Question

Cooper Manufacturing-Accy 202. Show Work Please! Please use the Big Picture of Overhead Accounting: I. Apply MOH to individual production jobs: throughout the year estimated

Cooper Manufacturing-Accy 202. Show Work Please!

Cooper Manufacturing-Accy 202. Show Work Please!

Please use the Big Picture of Overhead Accounting:

I. Apply MOH to individual production jobs: throughout the year estimated MOH is applied or charged to production jobs using the predetermined overhead rate. At the beginning of the year, calculated the predetermined overhead rate using the below formula.

Predetermined Overhead Rate= Total Budgeted MOH/Total Budgeted Cost Driver

Throughout the year, utilize the predetermined overhead rate to apply or charge estimated MOH to individual production jobs. Apply MOH by using the following formula.

Applied MOH = predetermined overhead rate * actual cost driver incurred on job

II. Recorded Actual MOH as incurred throughout the year: actual MOH costs are incurred and are initially accumulated on the left side of the MOH clearing account.

III. Dispose of Over/Under applied MOH: At end of accounting period the actual overhead incurred is compared tot he estimated overhead charged to jobs and the difference known as "over" or "under" applied MOH will be written off to cost of goods sold.

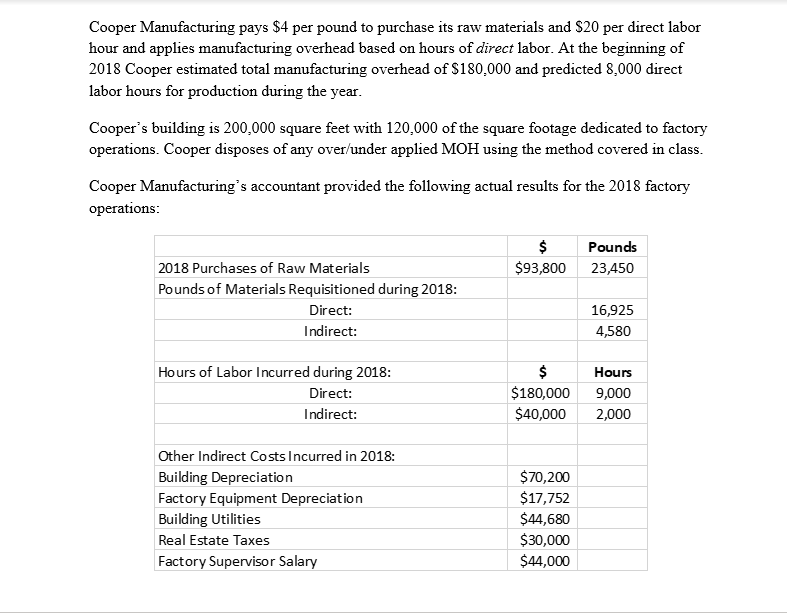

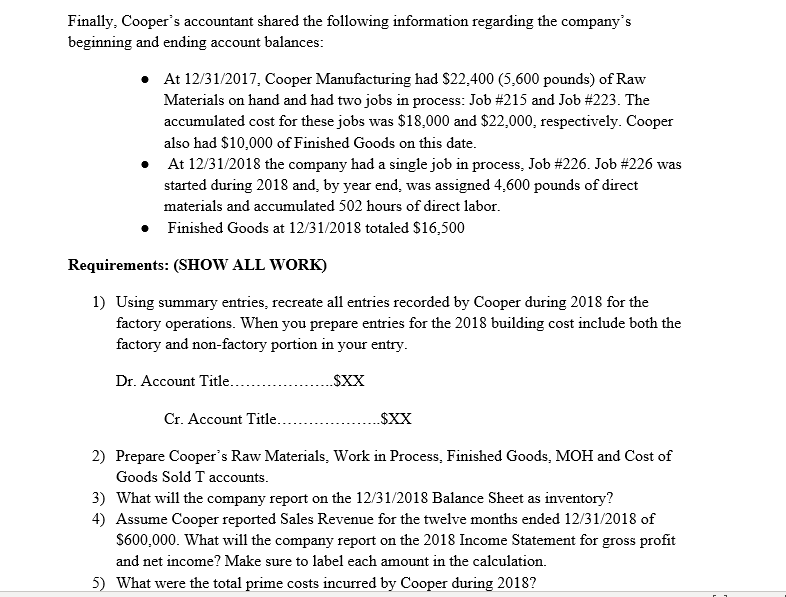

Cooper Manufacturing pays $4 per pound to purchase its raw materials and $20 per direct labor hour and applies manufacturing overhead based on hours of direct labor. At the beginning of 2018 Cooper estimated total manufacturing overhead of $180,000 and predicted 8,000 direct labor hours for production during the year. Cooper's building is 200,000 square feet with 120,000 of the square footage dedicated to factory operations. Cooper disposes of any over/under applied MOH using the method covered in class. Cooper Manufacturing's accountant provided the following actual results for the 2018 factory operations: Pounds 23,450 $93,800 2018 Purchases of Raw Materials Pounds of Materials Requisitioned during 2018: Direct: Indirect: 16,925 4,580 Hours of Labor Incurred during 2018: Direct: Indirect: $180,000 $40,000 Hours 9,000 2,000 Other Indirect Costs Incurred in 2018: Building Depreciation Factory Equipment Depreciation Building Utilities Real Estate Taxes Factory Supervisor Salary $70,200 $17,752 $44,680 $30,000 $44,000 Finally, Cooper's accountant shared the following information regarding the company's beginning and ending account balances: At 12/31/2017, Cooper Manufacturing had $22.400 (5,600 pounds) of Raw Materials on hand and had two jobs in process: Job #215 and Job #223. The accumulated cost for these jobs was $18,000 and $22,000, respectively. Cooper also had $10,000 of Finished Goods on this date. At 12/31/2018 the company had a single job in process, Job #226. Job #226 was started during 2018 and, by year end, was assigned 4.600 pounds of direct materials and accumulated 502 hours of direct labor. Finished Goods at 12/31/2018 totaled $16,500 Requirements: (SHOW ALL WORK) 1) Using summary entries, recreate all entries recorded by Cooper during 2018 for the factory operations. When you prepare entries for the 2018 building cost include both the factory and non-factory portion in your entry. Dr. Account Title....................$XX Cr. Account Title...............$XX 2) Prepare Cooper's Raw Materials, Work in Process, Finished Goods, MOH and Cost of Goods Sold T accounts. 3) What will the company report on the 12/31/2018 Balance Sheet as inventory? 4) Assume Cooper reported Sales Revenue for the twelve months ended 12/31/2018 of $600,000. What will the company report on the 2018 Income Statement for gross profit and net income? Make sure to label each amount in the calculation. 5) What were the total prime costs incurred by Cooper during 2018? Requirements: (SHOW ALL WORK) 1) Using summary entries, recreate all entries recorded by Cooper during 2018 for the factory operations. When you prepare entries for the 2018 building cost include both the factory and non-factory portion in your entry. Dr. Account Title.....................$XX Cr. Account Title -$XX 2) Prepare Cooper's Raw Materials, Work in Process, Finished Goods, MOH and Cost of Goods Sold T accounts. 3) What will the company report on the 12/31/2018 Balance Sheet as inventory? 4) Assume Cooper reported Sales Revenue for the twelve months ended 12/31/2018 of $600,000. What will the company report on the 2018 Income Statement for gross profit and net income? Make sure to label each amount in the calculation. 5) What were the total prime costs incurred by Cooper during 2018? 6) What was the company's Cost of Goods Manufactured for the twelve months ended 12/31/2018? 7) Consider the company's ending finished goods inventory balance described above, noting that the $16,500 represents a single job, Job #225, which was started and finished in 2018. If 725 pounds of direct materials were requisitioned for Job #225, how many direct labor hours were incurred on Job #225? Cooper Manufacturing pays $4 per pound to purchase its raw materials and $20 per direct labor hour and applies manufacturing overhead based on hours of direct labor. At the beginning of 2018 Cooper estimated total manufacturing overhead of $180,000 and predicted 8,000 direct labor hours for production during the year. Cooper's building is 200,000 square feet with 120,000 of the square footage dedicated to factory operations. Cooper disposes of any over/under applied MOH using the method covered in class. Cooper Manufacturing's accountant provided the following actual results for the 2018 factory operations: Pounds 23,450 $93,800 2018 Purchases of Raw Materials Pounds of Materials Requisitioned during 2018: Direct: Indirect: 16,925 4,580 Hours of Labor Incurred during 2018: Direct: Indirect: $180,000 $40,000 Hours 9,000 2,000 Other Indirect Costs Incurred in 2018: Building Depreciation Factory Equipment Depreciation Building Utilities Real Estate Taxes Factory Supervisor Salary $70,200 $17,752 $44,680 $30,000 $44,000 Finally, Cooper's accountant shared the following information regarding the company's beginning and ending account balances: At 12/31/2017, Cooper Manufacturing had $22.400 (5,600 pounds) of Raw Materials on hand and had two jobs in process: Job #215 and Job #223. The accumulated cost for these jobs was $18,000 and $22,000, respectively. Cooper also had $10,000 of Finished Goods on this date. At 12/31/2018 the company had a single job in process, Job #226. Job #226 was started during 2018 and, by year end, was assigned 4.600 pounds of direct materials and accumulated 502 hours of direct labor. Finished Goods at 12/31/2018 totaled $16,500 Requirements: (SHOW ALL WORK) 1) Using summary entries, recreate all entries recorded by Cooper during 2018 for the factory operations. When you prepare entries for the 2018 building cost include both the factory and non-factory portion in your entry. Dr. Account Title....................$XX Cr. Account Title...............$XX 2) Prepare Cooper's Raw Materials, Work in Process, Finished Goods, MOH and Cost of Goods Sold T accounts. 3) What will the company report on the 12/31/2018 Balance Sheet as inventory? 4) Assume Cooper reported Sales Revenue for the twelve months ended 12/31/2018 of $600,000. What will the company report on the 2018 Income Statement for gross profit and net income? Make sure to label each amount in the calculation. 5) What were the total prime costs incurred by Cooper during 2018? Requirements: (SHOW ALL WORK) 1) Using summary entries, recreate all entries recorded by Cooper during 2018 for the factory operations. When you prepare entries for the 2018 building cost include both the factory and non-factory portion in your entry. Dr. Account Title.....................$XX Cr. Account Title -$XX 2) Prepare Cooper's Raw Materials, Work in Process, Finished Goods, MOH and Cost of Goods Sold T accounts. 3) What will the company report on the 12/31/2018 Balance Sheet as inventory? 4) Assume Cooper reported Sales Revenue for the twelve months ended 12/31/2018 of $600,000. What will the company report on the 2018 Income Statement for gross profit and net income? Make sure to label each amount in the calculation. 5) What were the total prime costs incurred by Cooper during 2018? 6) What was the company's Cost of Goods Manufactured for the twelve months ended 12/31/2018? 7) Consider the company's ending finished goods inventory balance described above, noting that the $16,500 represents a single job, Job #225, which was started and finished in 2018. If 725 pounds of direct materials were requisitioned for Job #225, how many direct labor hours were incurred on Job #225Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started