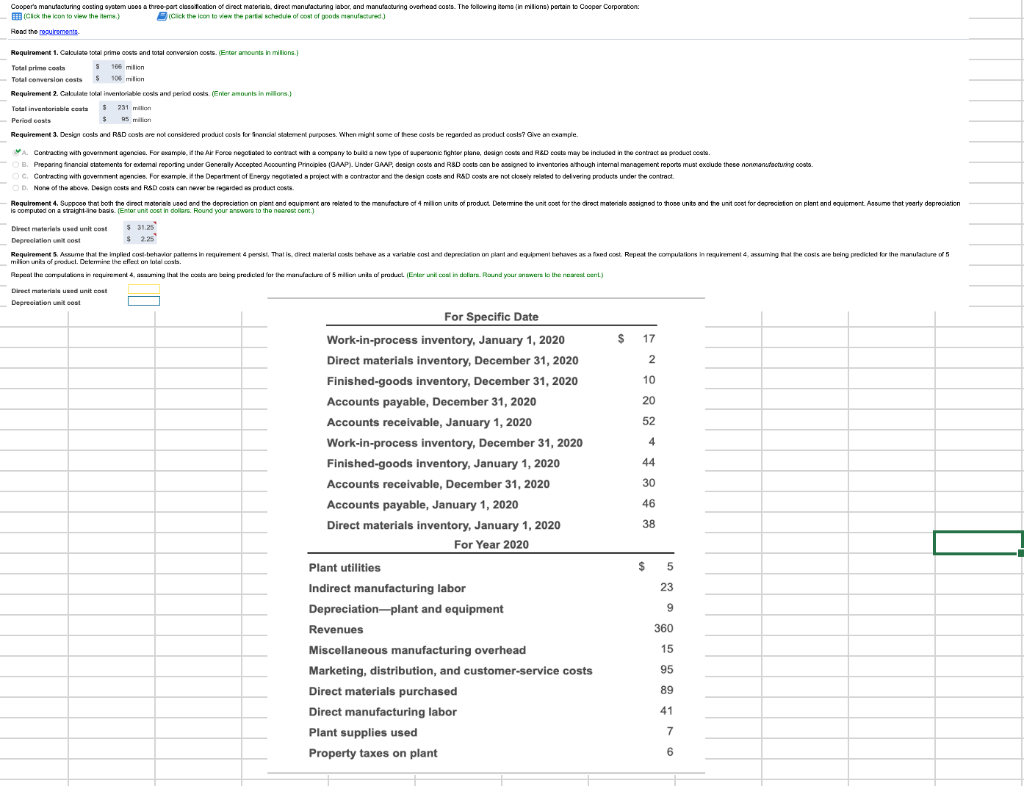

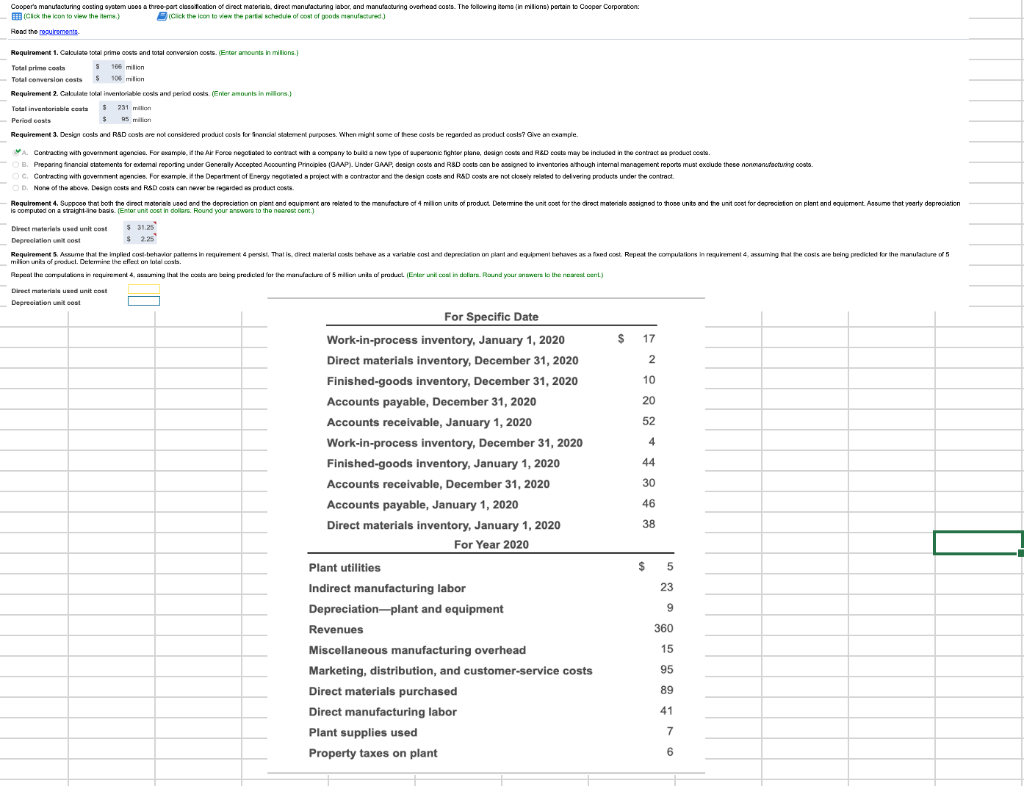

Coopero manufacturing costing oystom uses a three part close frontion of direct materiala, direct manufacturing labor and manufacturing overhead costs. The following items in milions) pertain to Cooper Corporation: (Click the icon to view the terms] Click the icon to ven the partie schedule of cost of goods sucured) Road the roulements Requirement 1. Calculate total primo costs and total conversion costs. (Enter amounts in milions.) Totalprime coats 5 106 milion Total conversion costs $ 106 milion Requirement 2. Calculate total inventoriable costs and period posts. (Ener amounts in millions.) Total inventoriable conta $ 231 million Period costs $ 5 million Requirement 3. Design costs and RSD costs are not considered product costs for Frencial statement purposes. When might some of these costs be regarded as product costs? Give an example. A. Contracting with government agencies. For example, in the Al Force negotiated to contact with a company to build a new type of superacne fighter plane, design codi and R&D cote may be included in the contractes product ca. B. Preparing financial statements for condemnal reporing under Generally Accepted Accounting Principles (GAP). Under GAAP, design costs and RBD costs can be signed to inventories although internal management reports must exclude these antecting costs. 6. Contracting with government agencies. For example, the Department of Energy negotiated a project with a contractor and the design costs and R&D costs are not closely related to delivering products under the contract D. None of the above. Design costs and RSD costs can never be regarded producto Requirement 4. Suspooo that both the direct materials used and the doprociation on plant and equipment are nolanod to the manufacture of 4 million units of product Determine the unit cost for the direct materials assigned to those unts and the unit cost for depreciston on plant and equipment Assume that yourty depreciation en related 4 . . a straight-(Entor dollars) Direct materials used unit cost $ 31.25 Depreciation is $ 2.25 Requirement 5. Asume that the implied cost-behavior patterns in requirement 4 persist. That is, direct malerbal costs behave as a variable cost and depreciation on plant and equipment belves as a fowed cost. Repeat the computations in requirement 4 assuming that the costs are being predicted for the manufacture of 5 million unit of product. De kermine the effect on ollub Repeat the sampulaliinin requirement 4, assuming that the care being predicted for the manufacture of 5 million unit al product ( Ernical in delar. Round your inwers to the nearesten) Direet materials used unite Depreciation wit om For Specific Date Work-in-process inventory, January 1, 2020 $ 17 Direct materials inventory, December 31, 2020 2 Finished-goods inventory, December 31, 2020 10 Accounts payable, December 31, 2020 20 Accounts receivable, January 1, 2020 52 Work-in-process inventory, December 31, 2020 Finished-goods inventory, January 1, 2020 44 Accounts receivable, December 31, 2020 30 Accounts payable, January 1, 2020 46 Direct materials inventory, January 1, 2020 38 For Year 2020 Plant utilities $ 5 Indirect manufacturing labor 23 Depreciation-plant and equipment 9 9 Revenues 360 Miscellaneous manufacturing overhead 15 Marketing, distribution, and customer-service costs 95 Direct materials purchased 89 Direct manufacturing labor 41 Plant supplies used 7 Property taxes on plant 6