Answered step by step

Verified Expert Solution

Question

1 Approved Answer

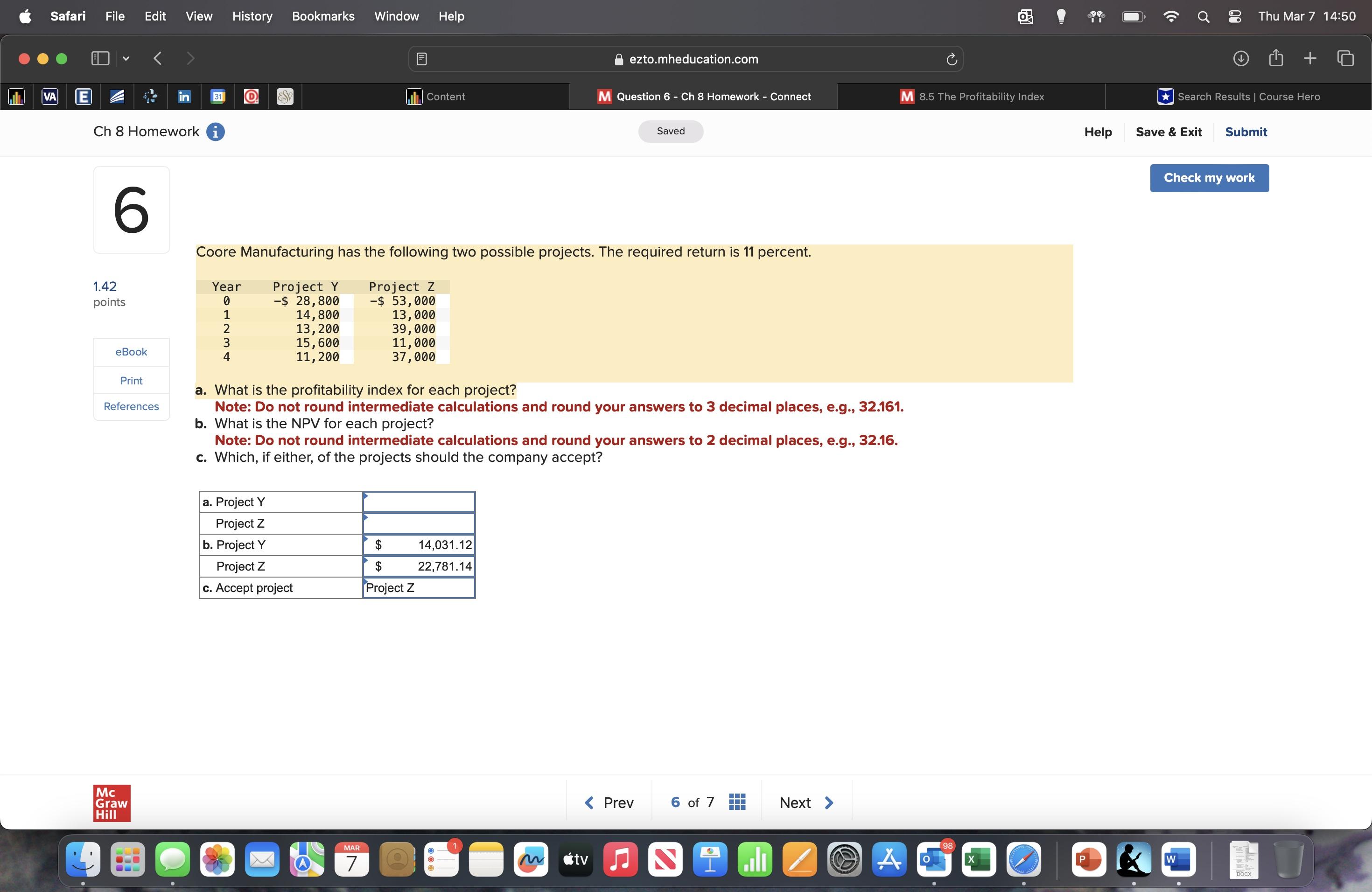

Coore Manufacturing has the following two possible projects. The required return is 11 percent. Year Project Y 0- $ 28,800 1- 14,800 2- 13,200 3-

Coore Manufacturing has the following two possible projects. The required return is 11 percent. Year

Project Y 0- $ 28,800 1- 14,800 2- 13,200 3- 15,600 4- 11,200

Project Z 0 −$ 53,000 1 -13,000 2- 39,000 3- 11,000 4- 37,000

What is the profitability index for each project?

Safari File Edit View History Bookmarks Window Help VA [E] in 31 Ch 8 Homework i Thu Mar 7 14:50 ezto.mheducation.com Content M Question 6 - Ch 8 Homework - Connect M 8.5 The Profitability Index Search Results | Course Hero Saved Help Save & Exit Submit 6 Coore Manufacturing has the following two possible projects. The required return is 11 percent. 1.42 Year Project Y Project Z points 0 -$ 28,800 -$ 53,000 1 14,800 13,000 2 13,200 39,000 3 15,600 11,000 eBook 4 11,200 37,000 Print References a. What is the profitability index for each project? Note: Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161. b. What is the NPV for each project? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. c. Which, if either, of the projects should the company accept? Mc Graw Hill a. Project Y Project Z b. Project Y $ Project Z $ 14,031.12 22,781.14 c. Accept project Project Z MAR 7 tv < Prev 6 of 7 Next > Check my work 98 A X P W DOCX

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started