Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Coors Innen- Comparative Financial Ratios for Competitors COOrs B= r- 21. COORS Your boss wants a good estimate of the market value of Coors property,

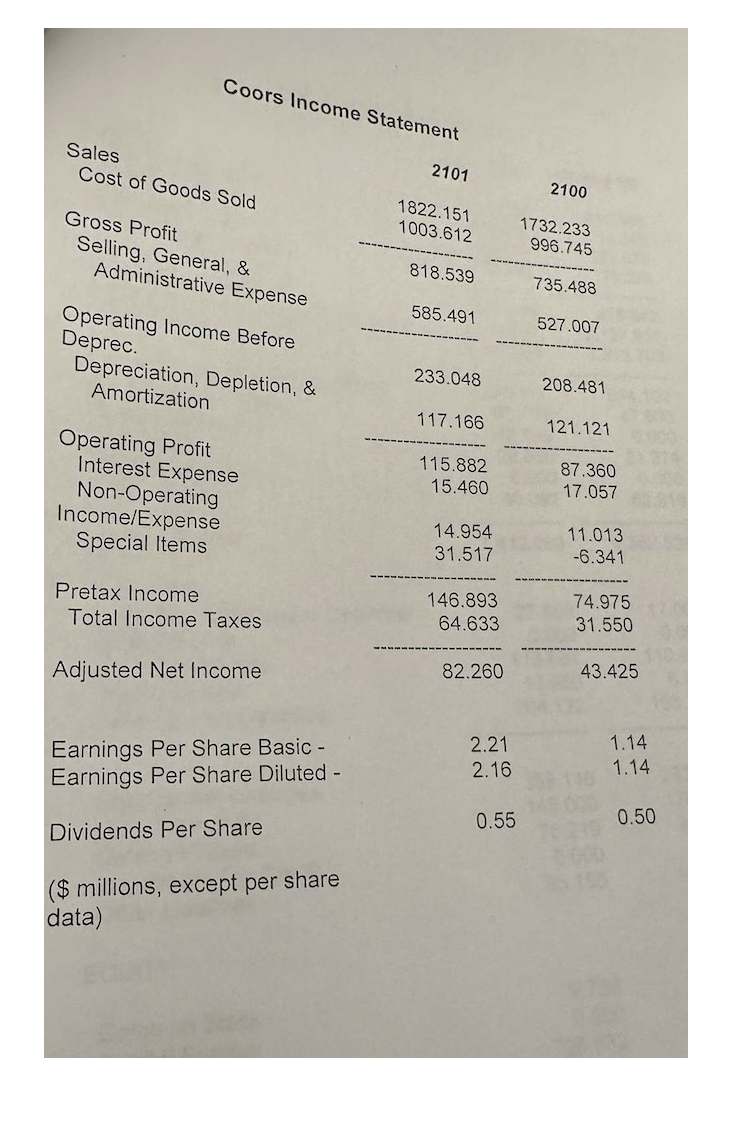

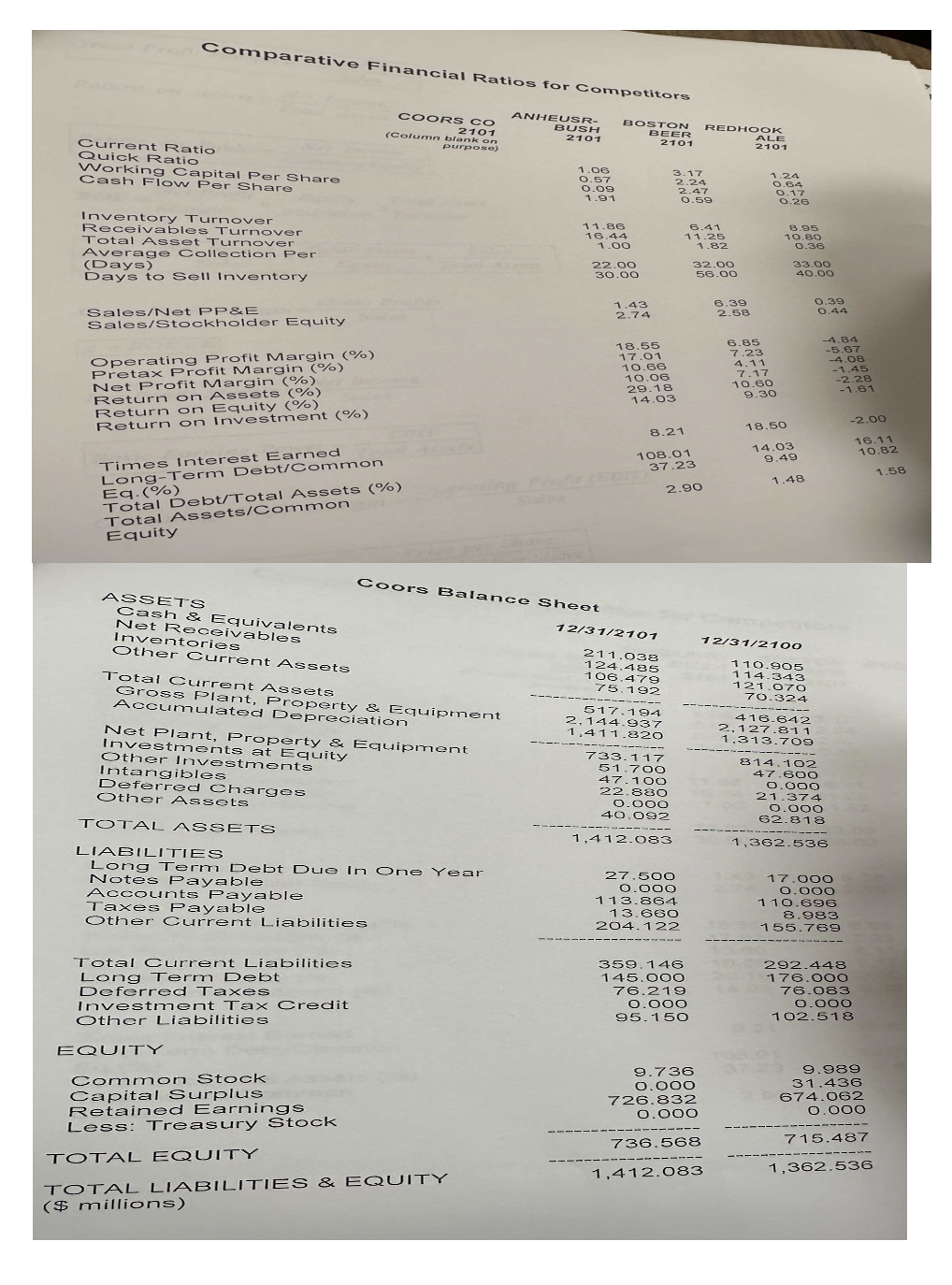

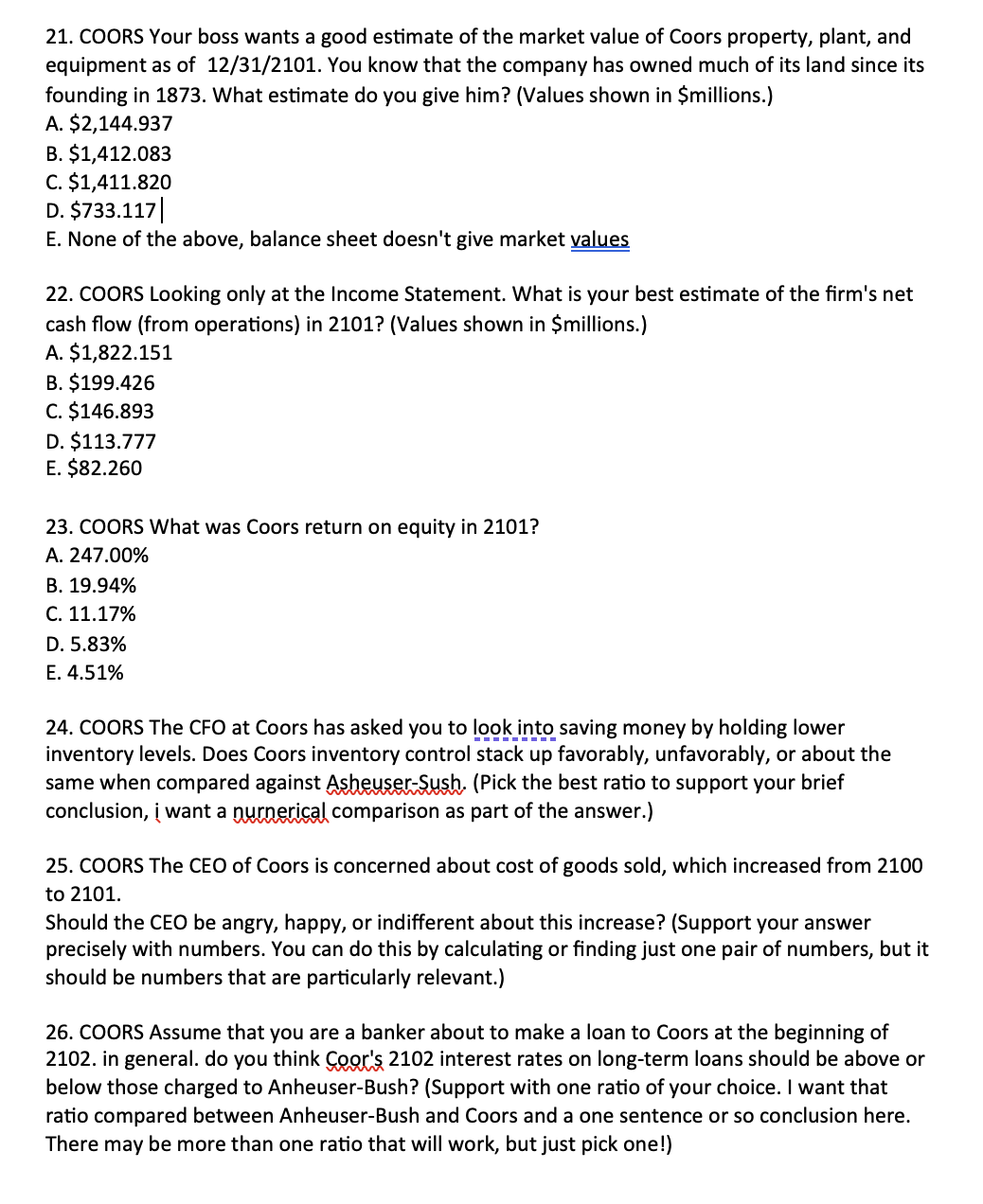

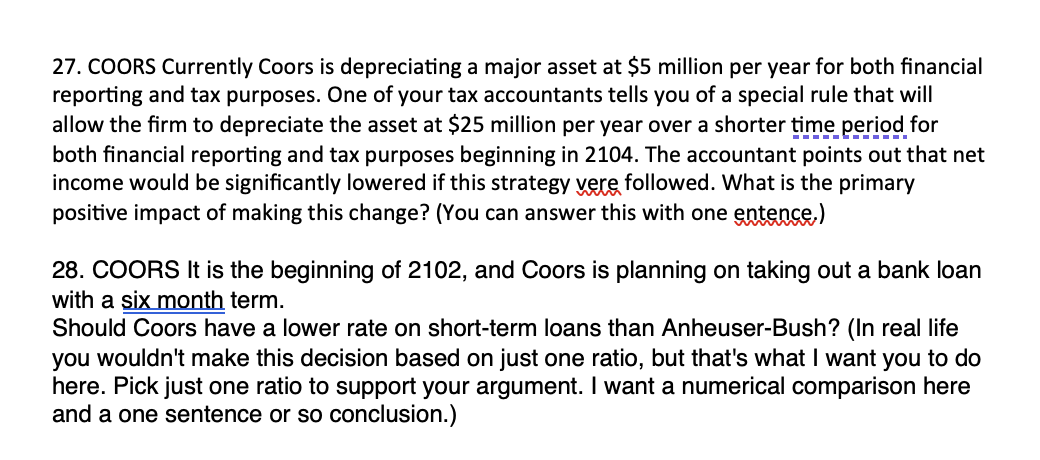

Coors Innen- Comparative Financial Ratios for Competitors COOrs B= r- 21. COORS Your boss wants a good estimate of the market value of Coors property, plant, and equipment as of 12/31/2101. You know that the company has owned much of its land since its founding in 1873. What estimate do you give him? (Values shown in \$millions.) A. $2,144.937 B. $1,412.083 C. $1,411.820 D. $733.117 E. None of the above, balance sheet doesn't give market values 22. COORS Looking only at the Income Statement. What is your best estimate of the firm's net cash flow (from operations) in 2101 ? (Values shown in \$millions.) A. $1,822.151 B. $199.426 C. $146.893 D. $113.777 E. $82.260 23. COORS What was Coors return on equity in 2101 ? A. 247.00% B. 19.94% C. 11.17% D. 5.83% E. 4.51% 24. COORS The CFO at Coors has asked you to look into saving money by holding lower inventory levels. Does Coors inventory control stack up favorably, unfavorably, or about the same when compared against Asheuser-Sush. (Pick the best ratio to support your brief conclusion, i want a nurnerical comparison as part of the answer.) 25. COORS The CEO of Coors is concerned about cost of goods sold, which increased from 2100 to 2101 . Should the CEO be angry, happy, or indifferent about this increase? (Support your answer precisely with numbers. You can do this by calculating or finding just one pair of numbers, but it should be numbers that are particularly relevant.) 26. COORS Assume that you are a banker about to make a loan to Coors at the beginning of 2102. in general. do you think Coor's 2102 interest rates on long-term loans should be above or below those charged to Anheuser-Bush? (Support with one ratio of your choice. I want that ratio compared between Anheuser-Bush and Coors and a one sentence or so conclusion here. There may be more than one ratio that will work, but just pick one!) 27. COORS Currently Coors is depreciating a major asset at $5 million per year for both financial reporting and tax purposes. One of your tax accountants tells you of a special rule that will allow the firm to depreciate the asset at $25 million per year over a shorter time period for both financial reporting and tax purposes beginning in 2104 . The accountant points out that net income would be significantly lowered if this strategy vere followed. What is the primary positive impact of making this change? (You can answer this with one entence,) 28. COORS It is the beginning of 2102 , and Coors is planning on taking out a bank loan with a six month term. Should Coors have a lower rate on short-term loans than Anheuser-Bush? (In real life you wouldn't make this decision based on just one ratio, but that's what I want you to do here. Pick just one ratio to support your argument. I want a numerical comparison here and a one sentence or so conclusion.) Coors Innen- Comparative Financial Ratios for Competitors COOrs B= r- 21. COORS Your boss wants a good estimate of the market value of Coors property, plant, and equipment as of 12/31/2101. You know that the company has owned much of its land since its founding in 1873. What estimate do you give him? (Values shown in \$millions.) A. $2,144.937 B. $1,412.083 C. $1,411.820 D. $733.117 E. None of the above, balance sheet doesn't give market values 22. COORS Looking only at the Income Statement. What is your best estimate of the firm's net cash flow (from operations) in 2101 ? (Values shown in \$millions.) A. $1,822.151 B. $199.426 C. $146.893 D. $113.777 E. $82.260 23. COORS What was Coors return on equity in 2101 ? A. 247.00% B. 19.94% C. 11.17% D. 5.83% E. 4.51% 24. COORS The CFO at Coors has asked you to look into saving money by holding lower inventory levels. Does Coors inventory control stack up favorably, unfavorably, or about the same when compared against Asheuser-Sush. (Pick the best ratio to support your brief conclusion, i want a nurnerical comparison as part of the answer.) 25. COORS The CEO of Coors is concerned about cost of goods sold, which increased from 2100 to 2101 . Should the CEO be angry, happy, or indifferent about this increase? (Support your answer precisely with numbers. You can do this by calculating or finding just one pair of numbers, but it should be numbers that are particularly relevant.) 26. COORS Assume that you are a banker about to make a loan to Coors at the beginning of 2102. in general. do you think Coor's 2102 interest rates on long-term loans should be above or below those charged to Anheuser-Bush? (Support with one ratio of your choice. I want that ratio compared between Anheuser-Bush and Coors and a one sentence or so conclusion here. There may be more than one ratio that will work, but just pick one!) 27. COORS Currently Coors is depreciating a major asset at $5 million per year for both financial reporting and tax purposes. One of your tax accountants tells you of a special rule that will allow the firm to depreciate the asset at $25 million per year over a shorter time period for both financial reporting and tax purposes beginning in 2104 . The accountant points out that net income would be significantly lowered if this strategy vere followed. What is the primary positive impact of making this change? (You can answer this with one entence,) 28. COORS It is the beginning of 2102 , and Coors is planning on taking out a bank loan with a six month term. Should Coors have a lower rate on short-term loans than Anheuser-Bush? (In real life you wouldn't make this decision based on just one ratio, but that's what I want you to do here. Pick just one ratio to support your argument. I want a numerical comparison here and a one sentence or so conclusion.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started