Answered step by step

Verified Expert Solution

Question

1 Approved Answer

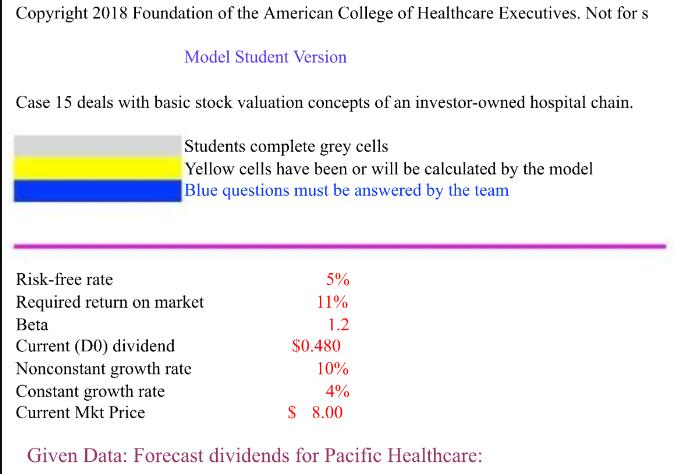

Copyright 2018 Foundation of the American College of Healthcare Executives. Not for s Model Student Version Case 15 deals with basic stock valuation concepts

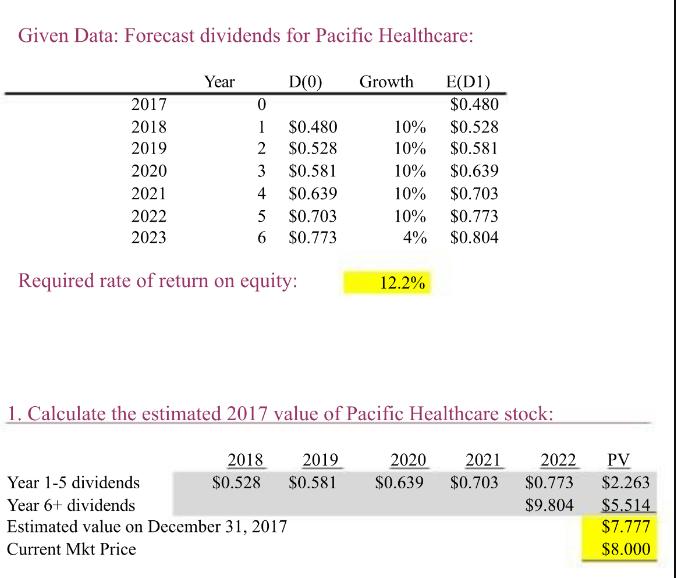

Copyright 2018 Foundation of the American College of Healthcare Executives. Not for s Model Student Version Case 15 deals with basic stock valuation concepts of an investor-owned hospital chain. Students complete grey cells Yellow cells have been or will be calculated by the model Blue questions must be answered by the team Risk-free rate Required return on market Beta Current (DO) dividend 5% 11% 1.2 $0.480 Nonconstant growth rate 10% Constant growth rate 4% $ 8.00 Current Mkt Price Given Data: Forecast dividends for Pacific Healthcare: Given Data: Forecast dividends for Pacific Healthcare: Year D(0) Growth E(D1) 2017 0 $0.480 2018 1 $0.480 10% $0.528 2019 2 $0.528 10% $0.581 2020 3 $0.581 10% $0.639 2021 4 $0.639 10% $0.703 2022 5 $0.703 10% $0.773 2023 6 $0.773 4% $0.804 Required rate of return on equity: 12.2% 1. Calculate the estimated 2017 value of Pacific Healthcare stock: 2018 2019 2020 2021 2022 PV Year 1-5 dividends Year 6+ dividends $0.528 $0.581 $0.639 $0.703 $0.773 $2.263 $9.804 $5.514 Estimated value on December 31, 2017 Current Mkt Price $7.777 $8.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started