Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CORA Limited is a digital health platform providing health services including tracking health records, booking appointments with doctors, video consultation with specialist doctors, pathology

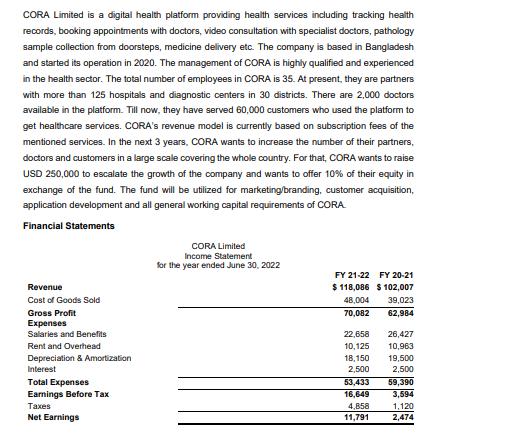

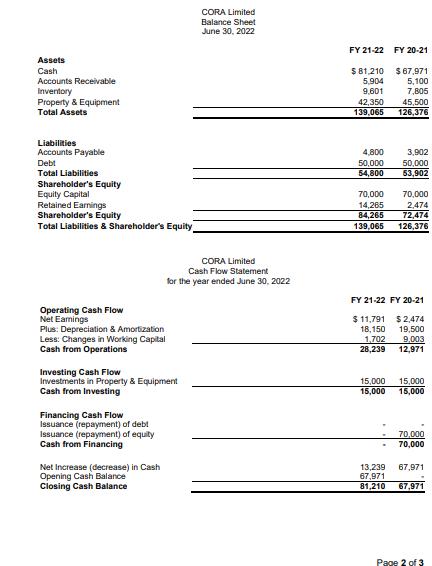

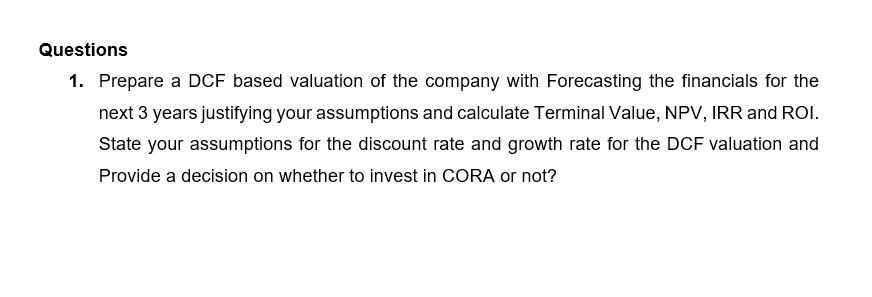

CORA Limited is a digital health platform providing health services including tracking health records, booking appointments with doctors, video consultation with specialist doctors, pathology sample collection from doorsteps, medicine delivery etc. The company is based in Bangladesh and started its operation in 2020. The management of CORA is highly qualified and experienced in the health sector. The total number of employees in CORA is 35. At present, they are partners with more than 125 hospitals and diagnostic centers in 30 districts. There are 2,000 doctors available in the platform. Till now, they have served 60,000 customers who used the platform to get healthcare services. CORA's revenue model is currently based on subscription fees of the mentioned services. In the next 3 years, CORA wants to increase the number of their partners, doctors and customers in a large scale covering the whole country. For that, CORA wants to raise USD 250,000 to escalate the growth of the company and wants to offer 10% of their equity in exchange of the fund. The fund will be utilized for marketing/branding, customer acquisition, application development and all general working capital requirements of CORA Financial Statements Revenue Cost of Goods Sold Gross Profit Expenses Salaries and Benefits Rent and Overhead Depreciation & Amortization Interest Total Expenses Earnings Before Tax Taxes Net Earnings CORA Limited Income Statement for the year ended June 30, 2022 FY 21-22 FY 20-21 $ 118,086 $ 102,007 48,004 39,023 70,082 62,984 22,658 26,427 10,125 10,963 18,150 19,500 2,500 2,500 53,433 16,649 4,858 11,791 59,390 3,594 1,120 2,474 Assets Cash Accounts Receivable Inventory Property & Equipment Total Assets Liabilities Accounts Payable Debt Total Liabilities Shareholder's Equity Equity Capital Retained Earnings Shareholder's Equity Total Liabilities & Shareholder's Equity Operating Cash Flow Net Earnings Plus: Depreciation & Amortization. Less: Changes in Working Capital Cash from Operations CORA Limited Cash Flow Statement for the year ended June 30, 2022 Investing Cash Flow Investments in Property & Equipment Cash from Investing Financing Cash Flow Issuance (repayment) of debt Issuance (repayment) of equity Cash from Financing Net Increase (decrease) in Cash Opening Cash Balance Closing Cash Balance CORA Limited Balance Sheet June 30, 2022 FY 21-22 FY 20-21 $81,210 5,904 9,601 42,350 139,065 4,800 50,000 54,800 70,000 14,265 84,265 139,065 $67,971 5,100 7,805 45,500 126,376 . 3,902 50,000 53,902 FY 21-22 FY 20-21 $ 11,791 $2,474 18,150 19,500 9,003 1,702 28,239 12,971 13,239 67,971 81,210 70,000 2,474 72,474 126,376 15,000 15,000 15,000 15,000 70,000 70,000 67,971 67,971 Page 2 of 3 Questions 1. Prepare a DCF based valuation of the company with Forecasting the financials for the next 3 years justifying your assumptions and calculate Terminal Value, NPV, IRR and ROI. State your assumptions for the discount rate and growth rate for the DCF valuation and Provide a decision on whether to invest in CORA or not?

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answer DCF Valuation Assumptions Discount Rate 10 Growth Rate 5 Financial Forecast Based on the current financial position we can forecast the future financials of CORA Limited The projected figures f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started