Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cordell Incorporated experienced the following events in Year 1, its first year of operation: 1. Received $52,000 cash from the issue of common stock.

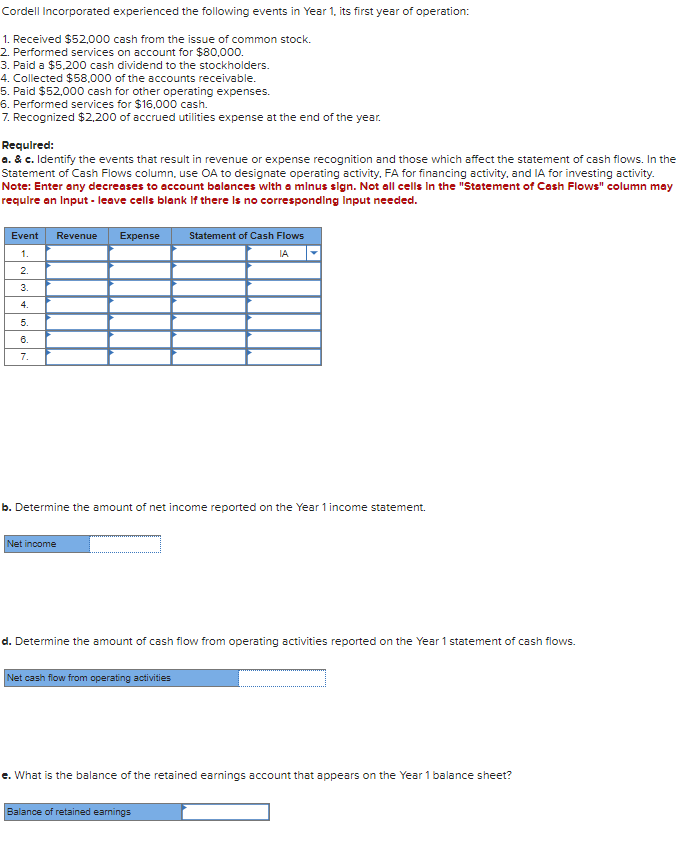

Cordell Incorporated experienced the following events in Year 1, its first year of operation: 1. Received $52,000 cash from the issue of common stock. 2. Performed services on account for $80,000. 3. Paid a $5,200 cash dividend to the stockholders. 4. Collected $58,000 of the accounts receivable. 5. Paid $52,000 cash for other operating expenses. 6. Performed services for $16,000 cash. 7. Recognized $2,200 of accrued utilities expense at the end of the year. Required: a. & c. Identify the events that result in revenue or expense recognition and those which affect the statement of cash flows. In the Statement of Cash Flows column, use OA to designate operating activity, FA for financing activity, and IA for investing activity. Note: Enter any decreases to account balances with a minus sign. Not all cells in the "Statement of Cash Flows" column may require an Input - leave cells blank if there is no corresponding Input needed. Event Revenue Expense 1. Statement of Cash Flows IA 2. 3. 4. 5. 6. 7. b. Determine the amount of net income reported on the Year 1 income statement. Net income d. Determine the amount of cash flow from operating activities reported on the Year 1 statement of cash flows. Net cash flow from operating activities e. What is the balance of the retained earnings account that appears on the Year 1 balance sheet? Balance of retained earnings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Since the image displays a list of transactions and questions related to accounting for Cordell Incorporated I will break down the answer for each par...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started