Answered step by step

Verified Expert Solution

Question

1 Approved Answer

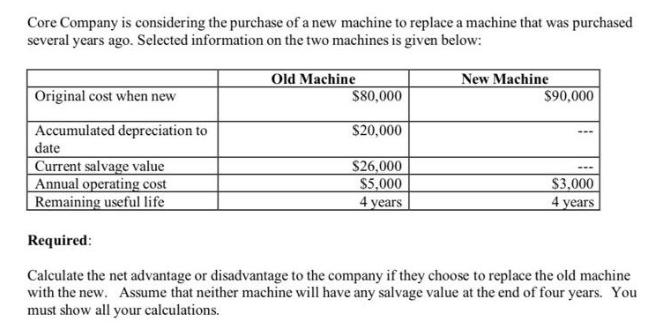

Core Company is considering the purchase of a new machine to replace a machine that was purchased several years ago. Selected information on the

Core Company is considering the purchase of a new machine to replace a machine that was purchased several years ago. Selected information on the two machines is given below: Original cost when new Accumulated depreciation to date Current salvage value Annual operating cost Remaining useful life Required: Old Machine $80,000 $20,000 $26,000 $5,000 4 years New Machine $90,000 $3,000 4 years Calculate the net advantage or disadvantage to the company if they choose to replace the old machine with the new. Assume that neither machine will have any salvage value at the end of four years. You must show all your calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the net advantage or disadvantage of replacing the old machine with the new one we need ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

661e87cbc3296_880235.pdf

180 KBs PDF File

661e87cbc3296_880235.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started