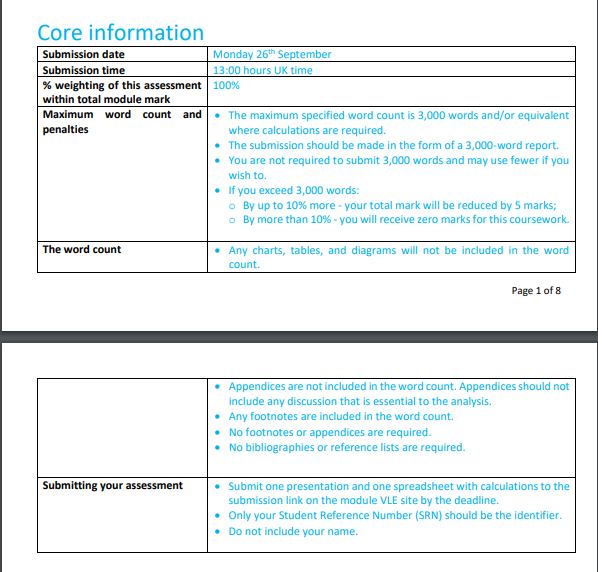

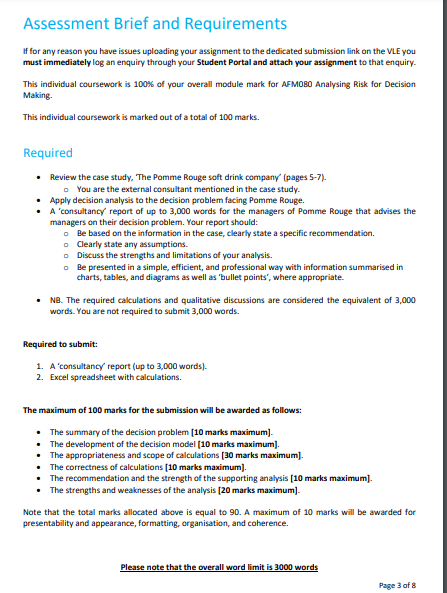

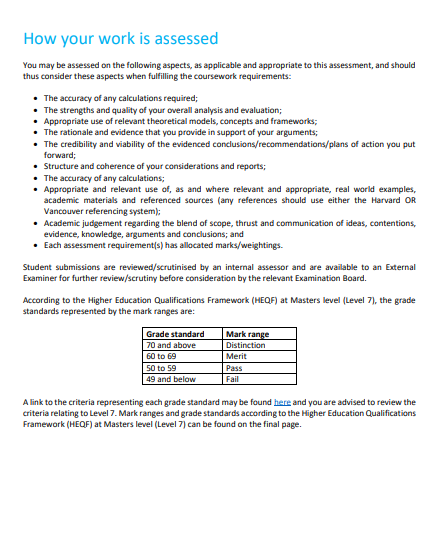

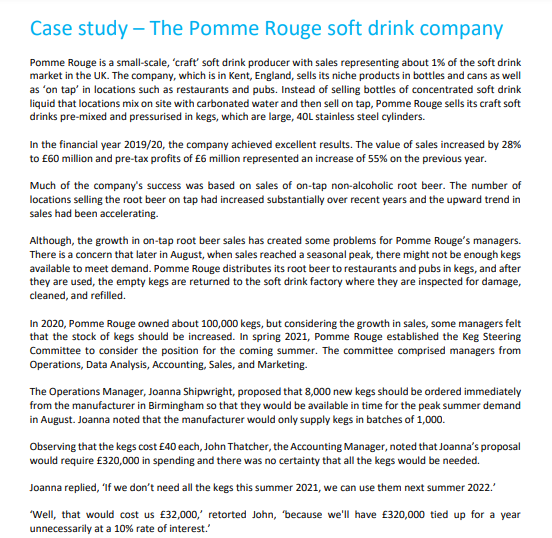

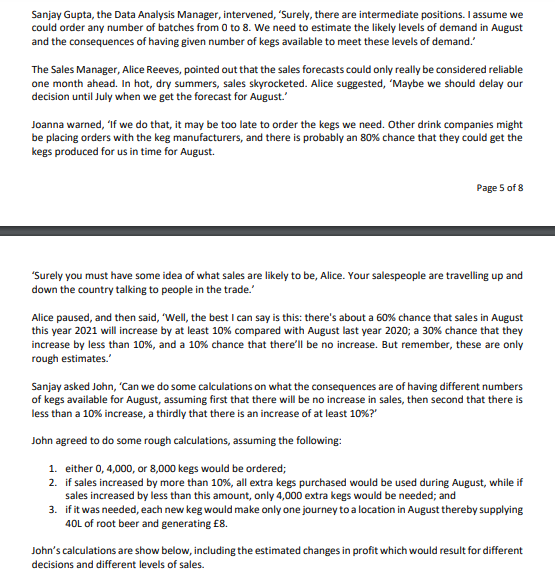

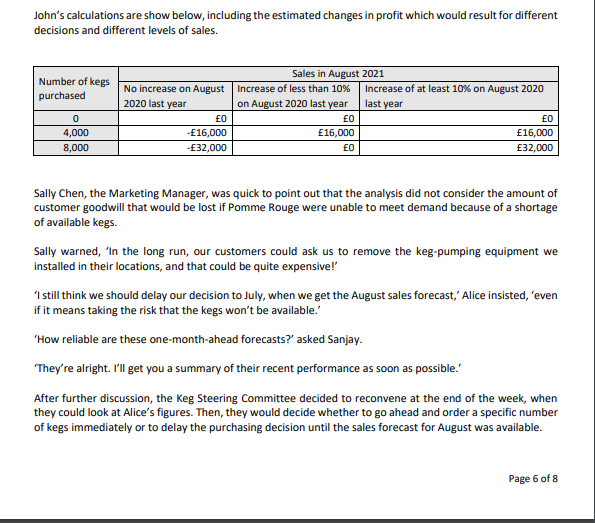

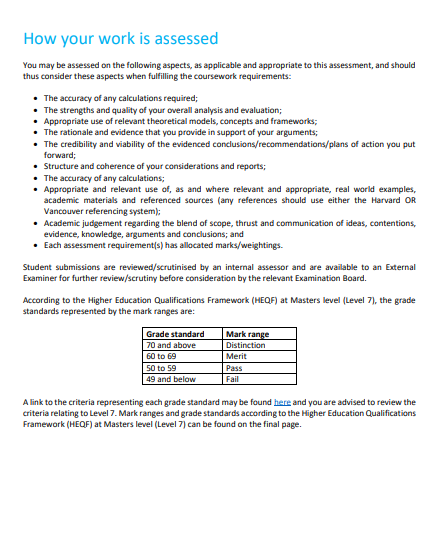

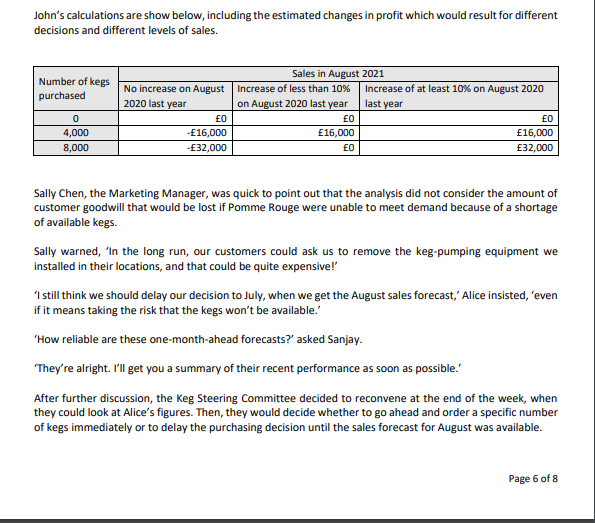

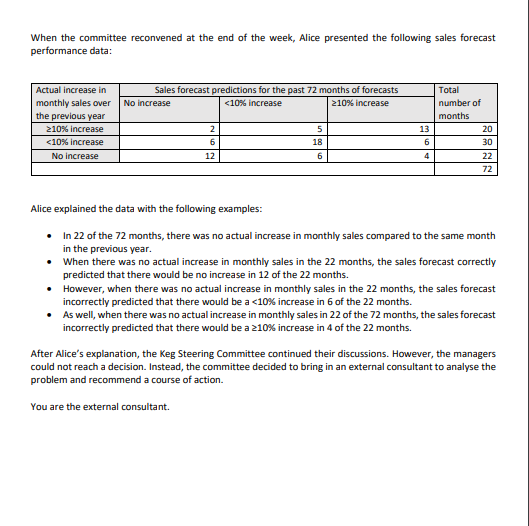

Core information Page 1 of 8 Assessment Brief and Requirements If for any reason you have issues uploading your assignment to the dedicated submission link on the VLE you must immediately log an enquiry through your Student Portal and attach your assignment to that enquiry. This individual coursework is 100% of your overall module mark for AFM0s0 Analysing Risk for Decision Making. This individual coursework is marked out of a total of 100 marks. Required - Review the case study, The Pomme Rouge soft drink company' (pages 5-7). - You are the external consultant mentioned in the case study. - Apply decision analysis to the decision problem facing Pomme Rouge. - A 'consultancy' report of up to 3,000 words for the managers of Pomme Rouge that atvises the managers on their decision problem. Your report should: Be based on the information in the case, clearly state a specific recommendation. - Clearly state arry assumptions. Discuss the strengths and limitations of your analysis. Be preserited in a simple, efficient, and professional way with information summarised in charts, tables, and diagrams as well as 'bullet points", where appropriate. - Ne. The required calculations and qualitative discussions are considered the equivalent of 3,000 words. You are not required to submit 3,000 words. Required to submit: 1. A 'consultancy' report (up to 3,000 words). 2. Excel spreadsheet with calculations. The maximum of 100 marks for the submission will be awarded as follows: - The summary of the decision problem [10 marks maximum]. - The development of the decision model [10 marks maximum]. - The appropriateness and scope of calculations [30 marks maximum]. - The correctress of calculations [10 marks maximum]. - The recommendation and the strength of the supporting analysis [10 marks maximum]. - The strengths and weaknesses of the analysis [20 marks maximum]. Note that the total marks allocated above is equal to 90 . A maximum of 10 marks will be awarded for presentability and appearance, formatting, organisation, and coherence. Please note that the overall word limit is 3000 words Page 3 of 8 You may be assesed on the following aspects, as applicable and appropriate to this assessiment, and should thus consider these aspects when fulfilling the coursework requirements: - The accuracy of arry calculations required; - The strengths and quality of your overall analysis and evaluation; - Appropriate use of relevant theoretical models, concepts and frameworks; - The rationale and evidence that you provide in support of your arguments; - The credibility and viability of the evidenced conclusions/recommendations/plans of action you put. forward; - Structure and coherence of your considerations and reports; - The accuracy of ariy calculations; - Appropriate and relevant use of, as and where relevant and appropriate, real world examples, academic materials and referenced sources (arry references should use either the Harvard OR Vancouver referencing system); - Academic judgement regarding the blend of scope, thrust and communication of ideas, conteritions, evidence, knowledge, argumerits and conclusions; and - Each assessment requirement(s) has allocated marks/weightings. Student submissions are reviewed/scrutinised by an internal assessor and are available to an External Examiner for further review/scrutiny before consideration by the relevant Examination Goard. According to the Higher Education Qualifications Framework (HEQF) at Masters level (Level 7), the grade standards represented by the mark ranges are: A link to the criteria representing each grade standard may be found here and you are advised to review the criteria relating to Level 7. Mark ranges and grade standards according to the Higher Education Qualifications Framework (HEQF) at Masters level (Level 7 ) can be found on the final page. Pomme Rouge is a small-scale, 'craft' soft drink producer with sales representing about 1% of the soft drink market in the UK. The company, which is in Kent, England, sells its niche products in bottles and cans as well as 'on tap' in locations such as restaurants and pubs. Instead of selling bottles of concentrated soft drink liquid that locations mix on site with carbonated water and then sell on tap, Pomme Rouge sells its craft soft drinks pre-mixed and pressurised in kegs, which are large, 40L stainless steel cylinders. In the financial year 2019/20, the company achieved excellent results. The value of sales increased by 28% to 60 million and pre-tax profits of 6 million represented an increase of 55% on the previous year. Much of the company's success was based on sales of on-tap non-alcoholic root beer. The number of locations selling the root beer on tap had increased substantially over recent years and the upward trend in sales had been accelerating. Although, the growth in on-tap root beer sales has created some problems for Pomme Rouge's managers. There is a concern that later in August, when sales reached a seasonal peak, there might not be enough kegs available to meet demand. Pomme Rouge distributes its root beer to restaurants and pubs in kegs, and after they are used, the empty kegs are returned to the soft drink factory where they are inspected for damage, cleaned, and refilled. In 2020, Pomme Rouge owned about 100,000 kegs, but considering the growth in sales, some managers felt that the stock of kegs should be increased. In spring 2021, Pomme Rouge established the Keg Steering Committee to consider the position for the coming summer. The committee comprised managers from Operations, Data Analysis, Accounting, Sales, and Marketing. The Operations Manager, Joanna Shipwright, proposed that 8,000 new kegs should be ordered immediately from the manufacturer in Birmingham so that they would be available in time for the peak summer demand in August. Joanna noted that the manufacturer would only supply kegs in batches of 1,000 . Observing that the kegs cost 40 each, John Thatcher, the Accounting Manager, noted that Joanna's proposal would require 320,000 in spending and there was no certainty that all the kegs would be needed. Joanna replied, 'If we don't need all the kegs this summer 2021, we can use them next summer 2022.' 'Well, that would cost us 32,000,' retorted John, 'because we'll have f320,000 tied up for a year unnecessarily at a 10% rate of interest.' Sanjay Gupta, the Data Analysis Manager, intervened, 'Surely, there are intermediate positions. I assume we could order any number of batches from 0 to 8 . We need to estimate the likely levels of demand in August and the consequences of having given number of kegs available to meet these levels of demand.' The Sales Manager, Alice Reeves, pointed out that the sales forecasts could only really be considered reliable one month ahead. In hot, dry summers, sales skyrocketed. Alice suggested, 'Maybe we should delay our decision until July when we get the forecast for August.' Joanna warned, 'If we do that, it may be too late to order the kegs we need. Other drink companies might be placing orders with the keg manufacturers, and there is probably an 80% chance that they could get the kegs produced for us in time for August. Page 5 of 8 "Surely you must have some idea of what sales are likely to be, Alice. Your salespeople are travelling up and down the country talking to people in the trade.' Alice paused, and then said, 'Well, the best I can say is this: there's about a 60% chance that sales in August this year 2021 will increase by at least 10% compared with August last year 2020 ; a 30% chance that they increase by less than 10%, and a 10% chance that there'll be no increase. But remember, these are only rough estimates." Sanjay asked John, 'Can we do some calculations on what the consequences are of having different numbers of kegs available for August, assuming first that there will be no increase in sales, then second that there is less than a 10% increase, a thirdly that there is an increase of at least 10% ?' John agreed to do some rough calculations, assuming the following: 1. either 0,4,000, or 8,000 kegs would be ordered; 2. if sales increased by more than 10%, all extra kegs purchased would be used during August, while if sales increased by less than this amount, only 4,000 extra kegs would be needed; and 3. if it was needed, each new keg would make only one journey to a location in August thereby supplying 40L of root beer and generating E. John's calculations are show below, including the estimated changes in profit which would result for different decisions and different levels of sales. John's calculations are show below, including the estimated changes in profit which would result for different decisions and different levels of sales. Sally Chen, the Marketing Manager, was quick to point out that the analysis did not consider the amount of customer goodwill that would be lost if Pomme Rouge were unable to meet demand because of a shortage of available kegs. Sally warned, 'In the long run, our customers could ask us to remove the keg-pumping equipment we installed in their locations, and that could be quite expensive!' 'I still think we should delay our decision to July, when we get the August sales forecast,' Alice insisted, 'even if it means taking the risk that the kegs won't be available.' 'How reliable are these one-month-ahead forecasts?' asked Sanjay. 'They're alright. I'll get you a summary of their recent performance as soon as possible.' After further discussion, the Keg Steering Committee decided to reconvene at the end of the week, when they could look at Alice's figures. Then, they would decide whether to go ahead and order a specific number of kegs immediately or to delay the purchasing decision until the sales forecast for August was available. When the committee reconvened at the end of the week, Alice presented the following sales forecast performance data: Alice explained the data with the following examples: - In 22 of the 72 months, there was no actual increase in monthly sales compared to the same month in the previous year. - When there was no actual increase in monthly sales in the 22 months, the sales forecast correctly predicted that there would be no increase in 12 of the 22 months. - However, when there was no actual increase in monthly sales in the 22 months, the sales forecast incorrectly predicted that there would be a 10% increase in 4 of the 22 months. After Alice's explanation, the Keg Steering Committee continued their discussions. However, the managers could not reach a decision. Instead, the committee decided to bring in an external consultant to analyse the problem and recommend a course of action. You are the external consultant. Core information Page 1 of 8 Assessment Brief and Requirements If for any reason you have issues uploading your assignment to the dedicated submission link on the VLE you must immediately log an enquiry through your Student Portal and attach your assignment to that enquiry. This individual coursework is 100% of your overall module mark for AFM0s0 Analysing Risk for Decision Making. This individual coursework is marked out of a total of 100 marks. Required - Review the case study, The Pomme Rouge soft drink company' (pages 5-7). - You are the external consultant mentioned in the case study. - Apply decision analysis to the decision problem facing Pomme Rouge. - A 'consultancy' report of up to 3,000 words for the managers of Pomme Rouge that atvises the managers on their decision problem. Your report should: Be based on the information in the case, clearly state a specific recommendation. - Clearly state arry assumptions. Discuss the strengths and limitations of your analysis. Be preserited in a simple, efficient, and professional way with information summarised in charts, tables, and diagrams as well as 'bullet points", where appropriate. - Ne. The required calculations and qualitative discussions are considered the equivalent of 3,000 words. You are not required to submit 3,000 words. Required to submit: 1. A 'consultancy' report (up to 3,000 words). 2. Excel spreadsheet with calculations. The maximum of 100 marks for the submission will be awarded as follows: - The summary of the decision problem [10 marks maximum]. - The development of the decision model [10 marks maximum]. - The appropriateness and scope of calculations [30 marks maximum]. - The correctress of calculations [10 marks maximum]. - The recommendation and the strength of the supporting analysis [10 marks maximum]. - The strengths and weaknesses of the analysis [20 marks maximum]. Note that the total marks allocated above is equal to 90 . A maximum of 10 marks will be awarded for presentability and appearance, formatting, organisation, and coherence. Please note that the overall word limit is 3000 words Page 3 of 8 You may be assesed on the following aspects, as applicable and appropriate to this assessiment, and should thus consider these aspects when fulfilling the coursework requirements: - The accuracy of arry calculations required; - The strengths and quality of your overall analysis and evaluation; - Appropriate use of relevant theoretical models, concepts and frameworks; - The rationale and evidence that you provide in support of your arguments; - The credibility and viability of the evidenced conclusions/recommendations/plans of action you put. forward; - Structure and coherence of your considerations and reports; - The accuracy of ariy calculations; - Appropriate and relevant use of, as and where relevant and appropriate, real world examples, academic materials and referenced sources (arry references should use either the Harvard OR Vancouver referencing system); - Academic judgement regarding the blend of scope, thrust and communication of ideas, conteritions, evidence, knowledge, argumerits and conclusions; and - Each assessment requirement(s) has allocated marks/weightings. Student submissions are reviewed/scrutinised by an internal assessor and are available to an External Examiner for further review/scrutiny before consideration by the relevant Examination Goard. According to the Higher Education Qualifications Framework (HEQF) at Masters level (Level 7), the grade standards represented by the mark ranges are: A link to the criteria representing each grade standard may be found here and you are advised to review the criteria relating to Level 7. Mark ranges and grade standards according to the Higher Education Qualifications Framework (HEQF) at Masters level (Level 7 ) can be found on the final page. Pomme Rouge is a small-scale, 'craft' soft drink producer with sales representing about 1% of the soft drink market in the UK. The company, which is in Kent, England, sells its niche products in bottles and cans as well as 'on tap' in locations such as restaurants and pubs. Instead of selling bottles of concentrated soft drink liquid that locations mix on site with carbonated water and then sell on tap, Pomme Rouge sells its craft soft drinks pre-mixed and pressurised in kegs, which are large, 40L stainless steel cylinders. In the financial year 2019/20, the company achieved excellent results. The value of sales increased by 28% to 60 million and pre-tax profits of 6 million represented an increase of 55% on the previous year. Much of the company's success was based on sales of on-tap non-alcoholic root beer. The number of locations selling the root beer on tap had increased substantially over recent years and the upward trend in sales had been accelerating. Although, the growth in on-tap root beer sales has created some problems for Pomme Rouge's managers. There is a concern that later in August, when sales reached a seasonal peak, there might not be enough kegs available to meet demand. Pomme Rouge distributes its root beer to restaurants and pubs in kegs, and after they are used, the empty kegs are returned to the soft drink factory where they are inspected for damage, cleaned, and refilled. In 2020, Pomme Rouge owned about 100,000 kegs, but considering the growth in sales, some managers felt that the stock of kegs should be increased. In spring 2021, Pomme Rouge established the Keg Steering Committee to consider the position for the coming summer. The committee comprised managers from Operations, Data Analysis, Accounting, Sales, and Marketing. The Operations Manager, Joanna Shipwright, proposed that 8,000 new kegs should be ordered immediately from the manufacturer in Birmingham so that they would be available in time for the peak summer demand in August. Joanna noted that the manufacturer would only supply kegs in batches of 1,000 . Observing that the kegs cost 40 each, John Thatcher, the Accounting Manager, noted that Joanna's proposal would require 320,000 in spending and there was no certainty that all the kegs would be needed. Joanna replied, 'If we don't need all the kegs this summer 2021, we can use them next summer 2022.' 'Well, that would cost us 32,000,' retorted John, 'because we'll have f320,000 tied up for a year unnecessarily at a 10% rate of interest.' Sanjay Gupta, the Data Analysis Manager, intervened, 'Surely, there are intermediate positions. I assume we could order any number of batches from 0 to 8 . We need to estimate the likely levels of demand in August and the consequences of having given number of kegs available to meet these levels of demand.' The Sales Manager, Alice Reeves, pointed out that the sales forecasts could only really be considered reliable one month ahead. In hot, dry summers, sales skyrocketed. Alice suggested, 'Maybe we should delay our decision until July when we get the forecast for August.' Joanna warned, 'If we do that, it may be too late to order the kegs we need. Other drink companies might be placing orders with the keg manufacturers, and there is probably an 80% chance that they could get the kegs produced for us in time for August. Page 5 of 8 "Surely you must have some idea of what sales are likely to be, Alice. Your salespeople are travelling up and down the country talking to people in the trade.' Alice paused, and then said, 'Well, the best I can say is this: there's about a 60% chance that sales in August this year 2021 will increase by at least 10% compared with August last year 2020 ; a 30% chance that they increase by less than 10%, and a 10% chance that there'll be no increase. But remember, these are only rough estimates." Sanjay asked John, 'Can we do some calculations on what the consequences are of having different numbers of kegs available for August, assuming first that there will be no increase in sales, then second that there is less than a 10% increase, a thirdly that there is an increase of at least 10% ?' John agreed to do some rough calculations, assuming the following: 1. either 0,4,000, or 8,000 kegs would be ordered; 2. if sales increased by more than 10%, all extra kegs purchased would be used during August, while if sales increased by less than this amount, only 4,000 extra kegs would be needed; and 3. if it was needed, each new keg would make only one journey to a location in August thereby supplying 40L of root beer and generating E. John's calculations are show below, including the estimated changes in profit which would result for different decisions and different levels of sales. John's calculations are show below, including the estimated changes in profit which would result for different decisions and different levels of sales. Sally Chen, the Marketing Manager, was quick to point out that the analysis did not consider the amount of customer goodwill that would be lost if Pomme Rouge were unable to meet demand because of a shortage of available kegs. Sally warned, 'In the long run, our customers could ask us to remove the keg-pumping equipment we installed in their locations, and that could be quite expensive!' 'I still think we should delay our decision to July, when we get the August sales forecast,' Alice insisted, 'even if it means taking the risk that the kegs won't be available.' 'How reliable are these one-month-ahead forecasts?' asked Sanjay. 'They're alright. I'll get you a summary of their recent performance as soon as possible.' After further discussion, the Keg Steering Committee decided to reconvene at the end of the week, when they could look at Alice's figures. Then, they would decide whether to go ahead and order a specific number of kegs immediately or to delay the purchasing decision until the sales forecast for August was available. When the committee reconvened at the end of the week, Alice presented the following sales forecast performance data: Alice explained the data with the following examples: - In 22 of the 72 months, there was no actual increase in monthly sales compared to the same month in the previous year. - When there was no actual increase in monthly sales in the 22 months, the sales forecast correctly predicted that there would be no increase in 12 of the 22 months. - However, when there was no actual increase in monthly sales in the 22 months, the sales forecast incorrectly predicted that there would be a 10% increase in 4 of the 22 months. After Alice's explanation, the Keg Steering Committee continued their discussions. However, the managers could not reach a decision. Instead, the committee decided to bring in an external consultant to analyse the problem and recommend a course of action. You are the external consultant