Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Corey's Copyediting is analyzing a possible merger with Katy's Copy Center. Corey's Copyediting has a tax loss carryforward of $350,000, which it could apply

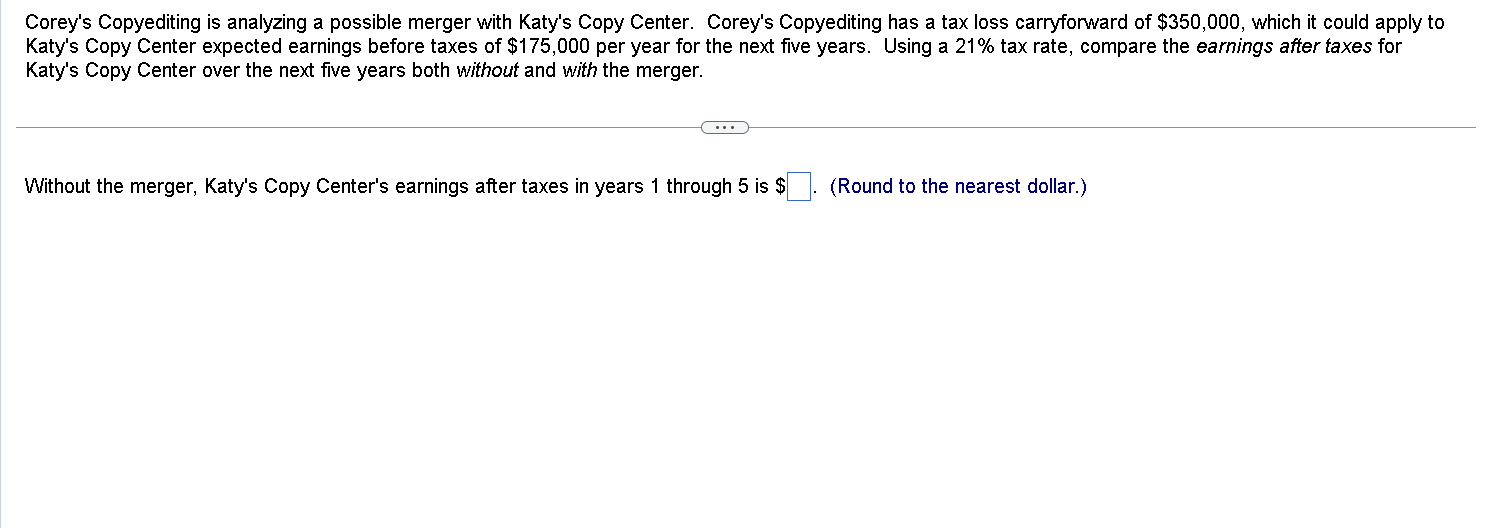

Corey's Copyediting is analyzing a possible merger with Katy's Copy Center. Corey's Copyediting has a tax loss carryforward of $350,000, which it could apply to Katy's Copy Center expected earnings before taxes of $175,000 per year for the next five years. Using a 21% tax rate, compare the earnings after taxes for Katy's Copy Center over the next five years both without and with the merger. Without the merger, Katy's Copy Center's earnings after taxes in years 1 through 5 is $ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Without the merger Katys Copy Centers earnings after taxes can be calculated using the formula Earni...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started