Answered step by step

Verified Expert Solution

Question

1 Approved Answer

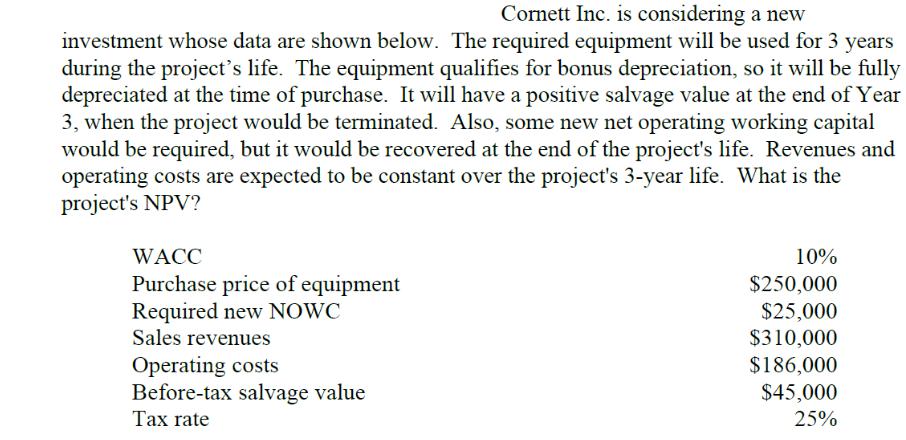

Cornett Inc. is considering a new investment whose data are shown below. The required equipment will be used for 3 years during the project's

Cornett Inc. is considering a new investment whose data are shown below. The required equipment will be used for 3 years during the project's life. The equipment qualifies for bonus depreciation, so it will be fully depreciated at the time of purchase. It will have a positive salvage value at the end of Year 3, when the project would be terminated. Also, some new net operating working capital would be required, but it would be recovered at the end of the project's life. Revenues and operating costs are expected to be constant over the project's 3-year life. What is the project's NPV? WACC Purchase price of equipment Required new NOWC Sales revenues Operating costs Before-tax salvage value Tax rate 10% $250,000 $25,000 $310,000 $186,000 $45,000 25%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the projects net present value NPV we need to determine the cash flows associated with the project and discount them to the present value using the weighted average cost of capit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started