Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cornish Company has the following shareholders equity at 1/1/Year2. Assume Cornish acquired all of the treasury stock in a single transaction during Year1. Some

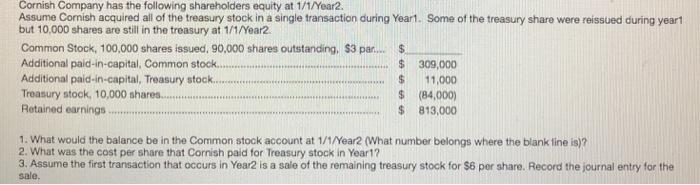

Cornish Company has the following shareholders equity at 1/1/Year2. Assume Cornish acquired all of the treasury stock in a single transaction during Year1. Some of the treasury share were reissued during yeart but 10,000 shares are still in the treasury at 1/1/Year2. Common Stock, 100,000 shares issued, 90,000 shares outstanding. $3 par. $ Additional paid-in-capital, Common stock. Additional paid-in-capital, Treasury stock. Treasury stock, 10,000 shares. Retained earnings $ 309,000 %24 11,000 $ (84,000) %24 813,000 1. What would the balance be in the Common stock account at 1/1/Year2 (What number belongs where the blank tine is)? 2. What was the cost per share that Cornish paid for Treasury stock in Year1? 3. Assume the first transaction that occurs in Year2 is a sale of the remaining treasury stock for $6 per share. Record the journal entry for the sale.

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Solution Ans 1 Balance in Common Stock acco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d7ec3f0031_176153.pdf

180 KBs PDF File

635d7ec3f0031_176153.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started