Question

Coronado Industries traded machinery with a book value of $965140 and a fair value of $902000. It received in exchange from Wildhorse Co. a

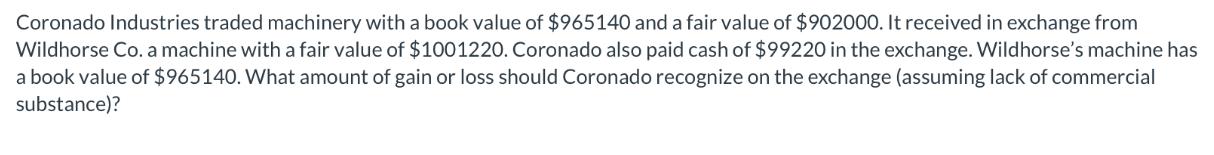

Coronado Industries traded machinery with a book value of $965140 and a fair value of $902000. It received in exchange from Wildhorse Co. a machine with a fair value of $1001220. Coronado also paid cash of $99220 in the exchange. Wildhorse's machine has a book value of $965140. What amount of gain or loss should Coronado recognize on the exchange (assuming lack of commercial substance)?

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To determine the gain or loss on the exchange we need to analyze the difference betw...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Volume 2

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel

8th Edition

1260881245, 9781260881240

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App