Question

Coronado Ranch & Farm is a distributor of ranch and farm equipment. Its products include small tools, power equipment for trench-digging and fencing, grain dryers,

Coronado Ranch & Farm is a distributor of ranch and farm equipment. Its products include small tools, power equipment for trench-digging and fencing, grain dryers, and barn winches. Most products are sold direct via its company Internet site. However, given some of its specialty products, select farm implement stores carry Coronados products. Pricing and cost information on three of Coronados most popular products are as follows.

| Item | Stand-Alone Selling Price (Cost) | ||

| Mini-trencher | $3,600 | ($2,000) | |

| Power fence hole auger | 1,200 | ($900) | |

| Grain/hay dryer | 14,105 | ($11,000) | |

Respond to the requirements related to the following independent revenue arrangements for Coronado Ranch & Farm. IFRS is a constraint.

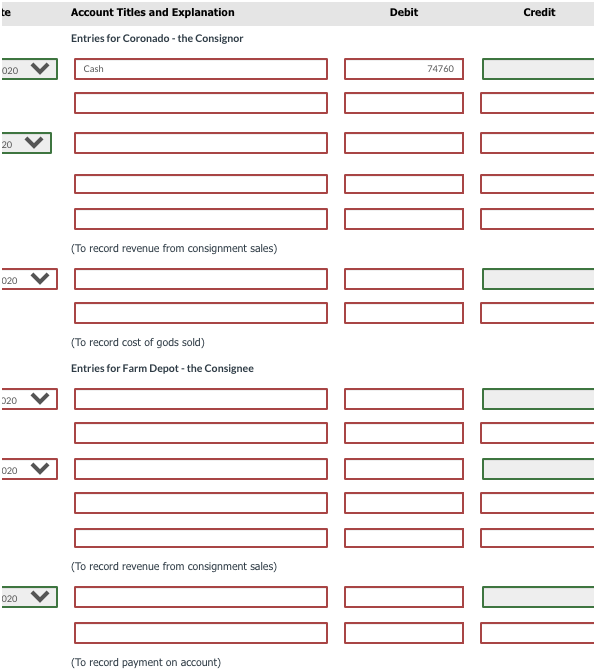

On April 25, 2020, Coronado ships 120 augers to Farm Depot, a farm supply dealer in Alberta, on consignment. By June 30, 2020, Farm Depot has sold 70 of the consigned augers at the listed price of $1,200 per unit. Farm Depot notifies Coronado of the sales, retains a 11% commission, and remits the cash due to Coronado. Prepare the journal entries for Coronado and Farm Depot for the consignment arrangement. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started