Answered step by step

Verified Expert Solution

Question

1 Approved Answer

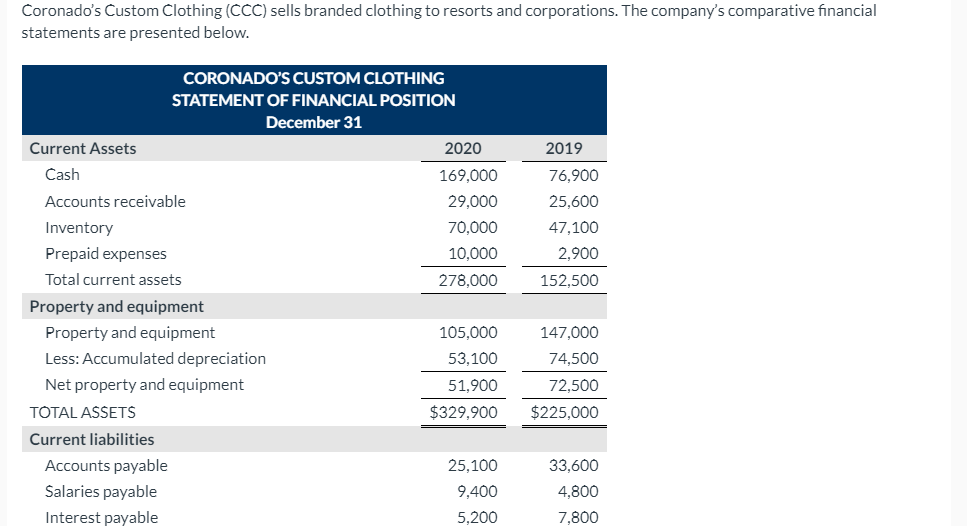

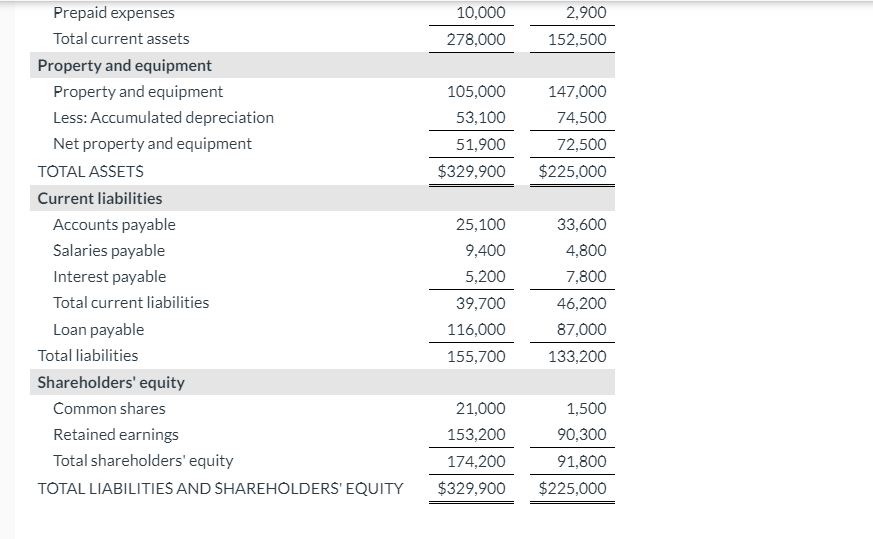

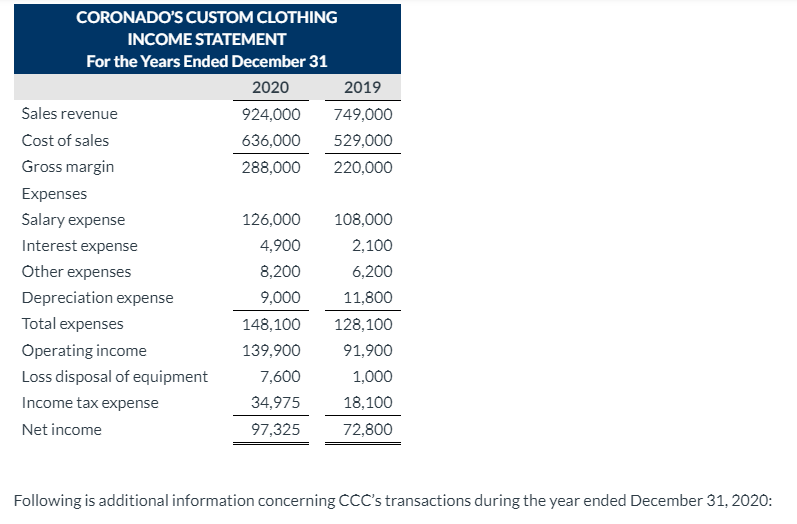

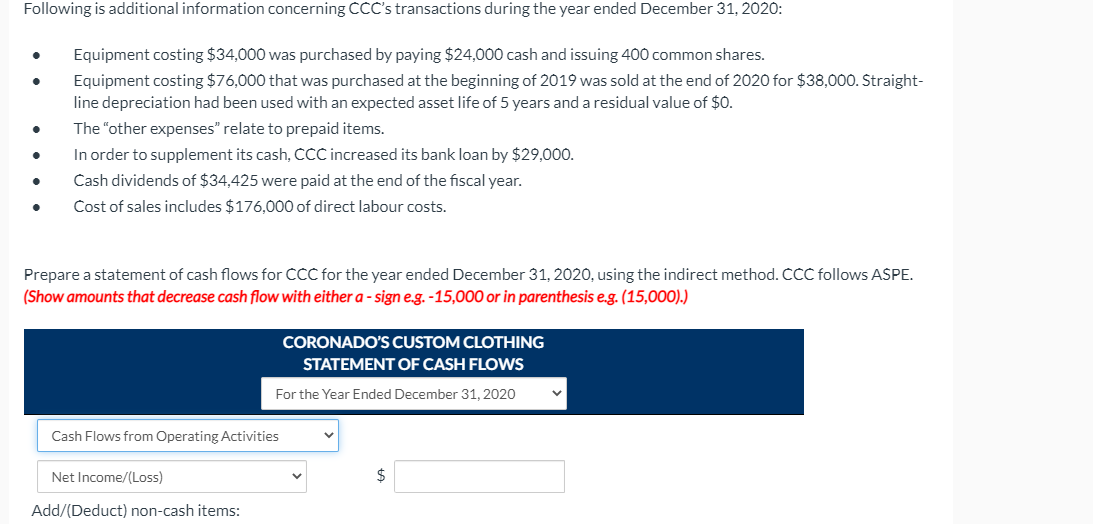

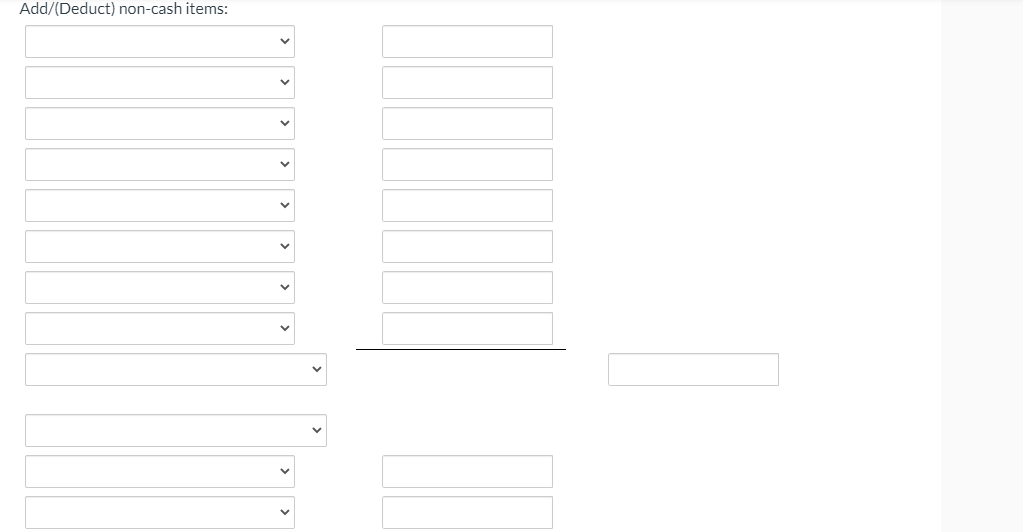

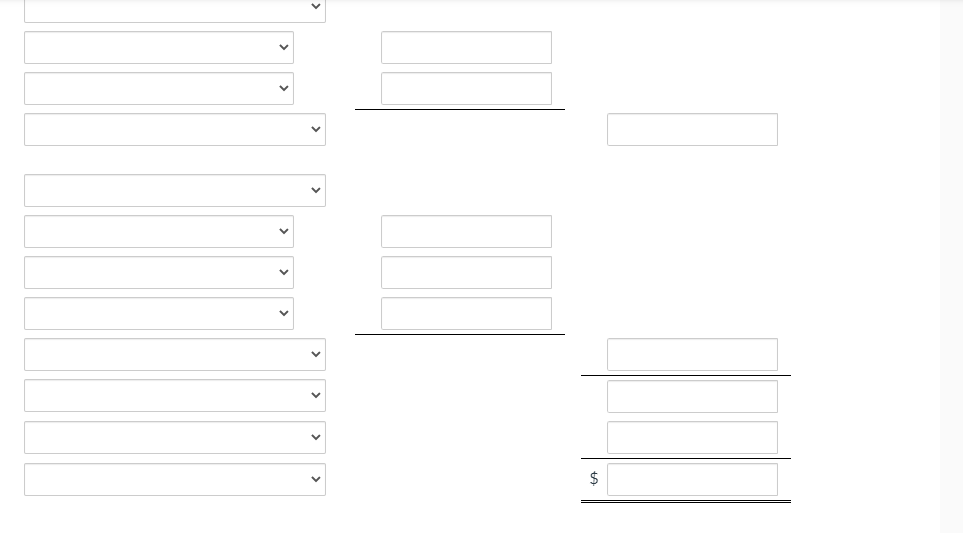

Coronado's Custom Clothing (CCC) sells branded clothing to resorts and corporations. The company's comparative financial statements are presented below. 2019 29,000 76,900 25,600 47.100 2,900

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started