Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Corporate Accounting 1 Assignment Question 1 (10 marks) Select the assumption, principle, or constraint that most appropriately justifies these procedures and practices. (Do not use

Corporate Accounting 1 Assignment

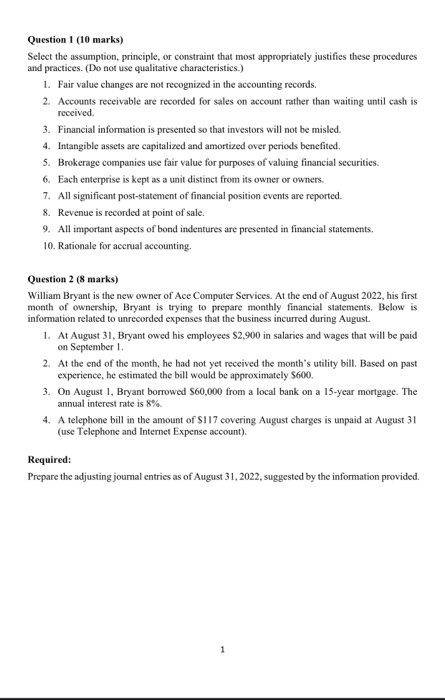

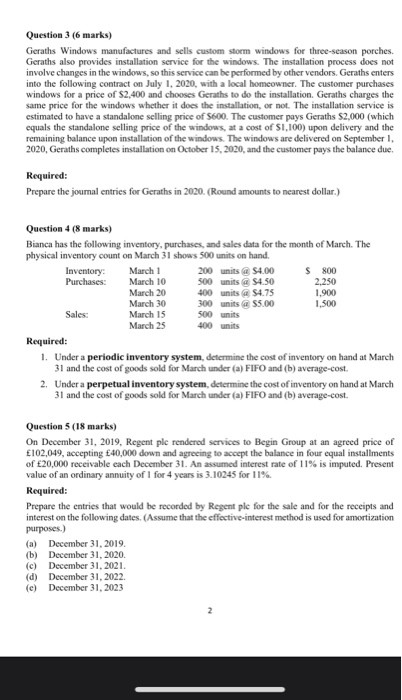

Question 1 (10 marks) Select the assumption, principle, or constraint that most appropriately justifies these procedures and practices. (Do not use qualitative characteristics.) 1. Fair value changes are not recognized in the accounting records. 2. Accounts receivable are recorded for sales on account rather than waiting until cash is received 3. Financial information is presented so that investors will not be misled. 4. Intangible assets are capitalized and amortized over periods benefited, 5. Brokerage companies use fair value for purposes of valuing financial securities. 6. Each enterprise is kept as a unit distinct from its owner or owners. 7. All significant post-statement of financial position events are reported. 8. Revenue is recorded at point of sale. 9. All important aspects of bond indentures are presented in financial statements, 10. Rationale for accrual accounting, Question 2 (8 marks) William Bryant is the new owner of Ace Computer Services. At the end of August 2022, his first month of ownership, Bryant is trying to prepare monthly financial statements. Below is information related to unrecorded expenses that the business incurred during August 1. At August 31, Bryant owed his employees $2,900 in salaries and wages that will be paid on September 1 2. At the end of the month, he had not yet received the month's utility bill. Based on past experience, he estimated the bill would be approximately $600. 3. On August 1, Bryant borrowed $60,000 from a local bank on a 15-year mortgage. The annual interest rate is 8%. 4. A telephone bill in the amount of $117 covering August charges is unpaid at August 31 (use Telephone and Internet Expense account). Required: Prepare the adjusting journal entries as of August 31, 2022, suggested by the information provided. 1 Question 3 (6 marks) Geraths Windows manufactures and sells custom storm windows for three-season porches. Geraths also provides installation service for the windows. The installation process does not involve changes in the windows, so this service can be performed by other vendors. Geraths enters into the following contract on July 1, 2020, with a local homeowner. The customer purchases windows for a price of $2,400 and chooses Geraths to do the installation. Geraths charges the same price for the windows whether it does the installation, or not. The installation service is estimated to have a standalone selling price of $600. The customer pays Geraths $2,000 (which equals the standalone selling price of the windows, at a cost of S1,100) upon delivery and the remaining balance upon installation of the windows. The windows are delivered on September I. 2020, Geraths completes installation on October 15, 2020, and the customer pays the balance due. Required: Prepare the journal entries for Geraths in 2020. (Round amounts to nearest dollar.) Question 4 (8 marks) Bianca has the following inventory, purchases, and sales data for the month of March. The physical inventory count on March 31 shows 500 units on hand. Inventory: March 1 200 units @ $4.00 $ 800 Purchases: March 10 500 units @ $4.50 2.250 March 20 400 units @ $4.75 1.900 March 30 300 units @ $5.00 1,500 Sales: March 15 500 units March 25 400 units Required: 1. Under a periodic inventory system, determine the cost of inventory on hand at March 31 and the cost of goods sold for March under (a) FIFO and (b) average-cost. 2. Under a perpetual inventory system, determine the cost of inventory on hand at March 31 and the cost of goods sold for March under (a) FIFO and (b) average-cost. Question 5 (18 marks) On December 31, 2019, Regent ple rendered services to Begin Group at an agreed price of 102,049, accepting 40,000 down and agreeing to accept the balance in four equal installments of 20,000 receivable each December 31. An assumed interest rate of 11% is imputed. Present value of an ordinary annuity of 1 for 4 years is 3.10245 for 11% Required: Prepare the entries that would be recorded by Regent ple for the sale and for the receipts and interest on the following dates. (Assume that the effective-interest method is used for amortization purposes.) (a) December 31, 2019 (b) December 31, 2020. (c) December 31, 2021. (d) December 31, 2022 (c) December 31, 2023 2 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started