Answered step by step

Verified Expert Solution

Question

1 Approved Answer

corporate finance Arnica plc has 10,000 bonds outstanding 12:01 PM 6% annual coupon rate 12:01 PM 8 years 12:01 PM 1100 market price 12:01 PM

corporate finance

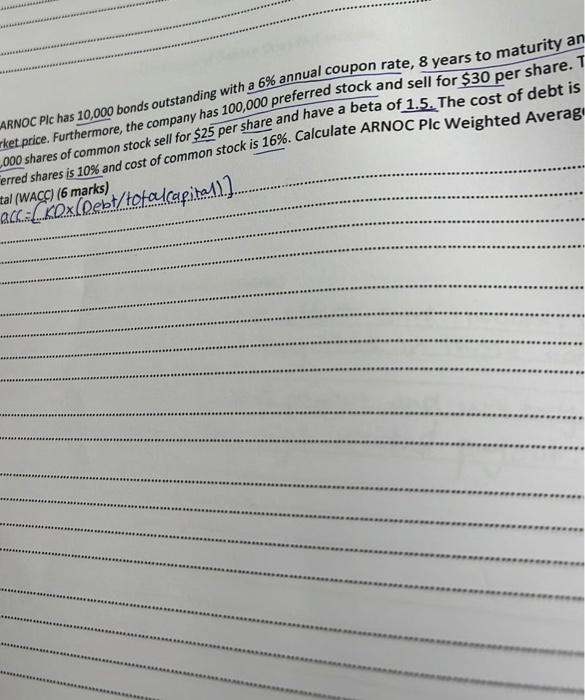

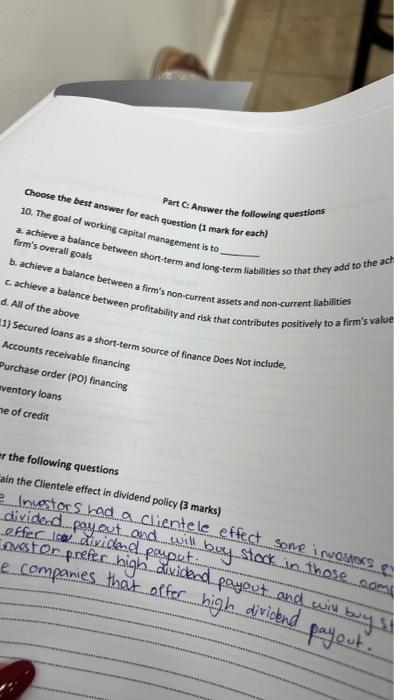

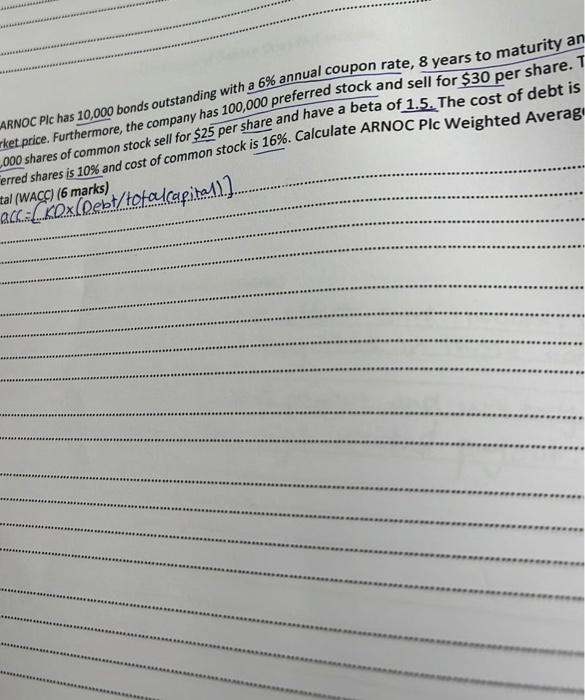

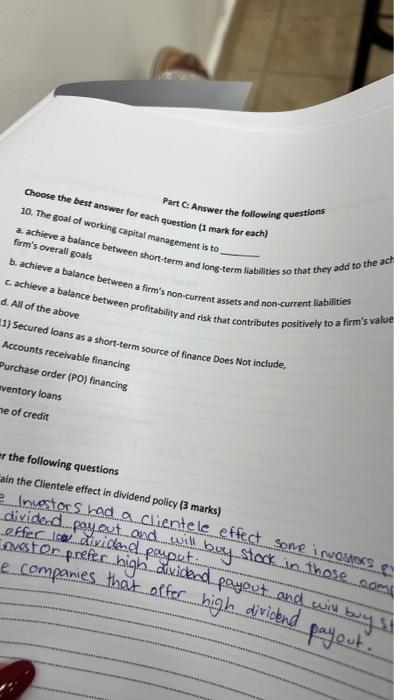

Arnica plc has 10,000 bonds outstanding 12:01 PM 6% annual coupon rate 12:01 PM 8 years 12:01 PM 1100 market price 12:01 PM 100000 preferred stocks 12:01 PM 30 per share 12:01 PM 500000 shares common stock 12:01 PM 25 per share 12:01 PM 1.5 beta 12:01 PM Cost of debt 4,48 12:01 PM Calculate wacc 12:01 PM All of this was 12:01 PM 1q 12:02 PM ARNOC Plc has 10,000 bonds outstanding with 6%6 annual coupon rate, 8 years to maturity an rket price. Furthermore, the company has 100,000 preferred stock and sell for $30 per share. T 000 shares of common stock sell for $25 per share and have a beta of 1.5 . The cost of debt is eerred shares is 10% and cost of common stock is 16%. Calculate ARNOC PIc Weighted Averag' (WACC) (6 marks) ( total (apital).]. Part C: Answer the following questions 10. The goal of working cach question ( 1 mark for each) a. achieve a balance betwe capital management is to firm's overall Boals between short-term and long-term liabilities so that they add to the ach b. achieve a balance between a firm's non-current assets and non-current liabilities c. achieve a balance between profitability and risk that contributes positively to a firm's value d. All of the above 1) Secured loans as a short-term source of finance Does Nor include, Accounts recelvable financing Purchase order (PO) financing Ventory loans le of credit the following questions ain the Clientele effect in dividend policy ( 3 marks) Inuestors had a clientele effect some invovors o companies that afficend payout and wiy buy e companies that affer high dirlend payou

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started