Question

Corporate Finance please provide me with details how you reach the final answer. could you please answer with details a thru g cuz I have

Corporate Finance

please provide me with details how you reach the final answer.

could you please answer with details a thru g cuz I have 0 idea how to solve it and i need to practice these example question for the final next month...

I will rate you well!!! please help...

for your info

You can consider the real option examples.

Suppose that there are two possible states in this economy, good and bad state.

We can construct any cash flow streams using two assets if their cash flows are not perfectly correlated.

In this example, we have two real assets, a condominium and a family home.

If you invest in each asset now, what cash flows would you gain in each state next period?

Once you figure this out, you can search for a combination of these two assets that generate a risk free cash flow.

For instance, if I have two assets, A and B, which generate cash flows (1,0) and (0,1) in the states (good, bad).

If I buy both assets by one unit, my portfolio will generate (1,1) next period which is risk free (i.e., cash flow equals 1 in both states).

If I know the current price of each asset, I can calculate the current market value of this portfolio and thus can obtain the risk free rate, which is the rate of return of this portfolio.

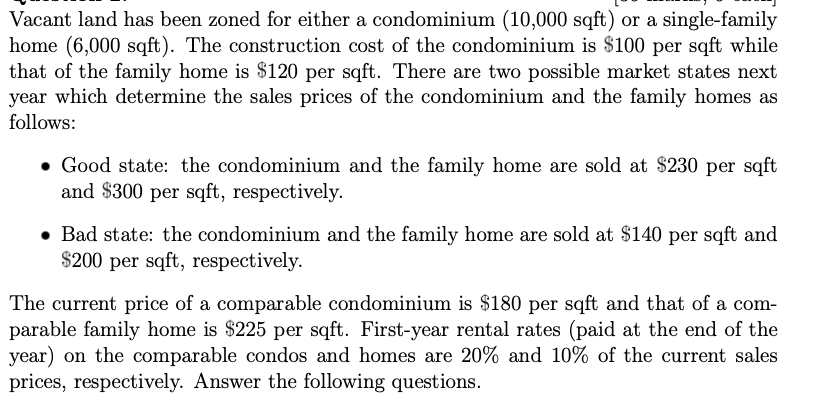

Vacant land has been zoned for either a condominium (10,000 sqft) or a single-family home (6,000 sqft). The construction cost of the condominium is $100 per sqft while that of the family home is $120 per sqft. There are two possible market states next year which determine the sales prices of the condominium and the family homes as follows: Good state: the condominium and the family home are sold at $230 per sqft and $300 per sqft, respectively. Bad state: the condominium and the family home are sold at $140 per sqft and $200 per sqft, respectively. The current price of a comparable condominium is $180 per sqft and that of a com- parable family home is $225 per sqft. First-year rental rates (paid at the end of the year) on the comparable condos and homes are 20% and 10% of the current sales prices, respectively. Answer the following questions. (a) Calculate the cash flows that a condominium and a family firm generates (i.e., the sum of the sales price and the rental revenue) in each state next year, respectively. (b) What is the implied risk-free rate? (Hint: Construct a mimicking portfolio of a risk free asset using the cash flows from a condominium and a family home.) (c) Suppose that you can build a condominium or a family home immediately. What is the value of the lot if you decide to build a condominium now? (d) What is the value of the lot if you instead decide to build a family home now? (e) Now suppose that you wait one year (i.e., until the realization of the states) before building a condominium or a family firm. Which building will you construct in each state? (f) What is the value of the lot if you wait one year as above? (g) Given all your answers (a)-(f), what is the best building alternative? Vacant land has been zoned for either a condominium (10,000 sqft) or a single-family home (6,000 sqft). The construction cost of the condominium is $100 per sqft while that of the family home is $120 per sqft. There are two possible market states next year which determine the sales prices of the condominium and the family homes as follows: Good state: the condominium and the family home are sold at $230 per sqft and $300 per sqft, respectively. Bad state: the condominium and the family home are sold at $140 per sqft and $200 per sqft, respectively. The current price of a comparable condominium is $180 per sqft and that of a com- parable family home is $225 per sqft. First-year rental rates (paid at the end of the year) on the comparable condos and homes are 20% and 10% of the current sales prices, respectively. Answer the following questions. (a) Calculate the cash flows that a condominium and a family firm generates (i.e., the sum of the sales price and the rental revenue) in each state next year, respectively. (b) What is the implied risk-free rate? (Hint: Construct a mimicking portfolio of a risk free asset using the cash flows from a condominium and a family home.) (c) Suppose that you can build a condominium or a family home immediately. What is the value of the lot if you decide to build a condominium now? (d) What is the value of the lot if you instead decide to build a family home now? (e) Now suppose that you wait one year (i.e., until the realization of the states) before building a condominium or a family firm. Which building will you construct in each state? (f) What is the value of the lot if you wait one year as above? (g) Given all your answers (a)-(f), what is the best building alternativeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started