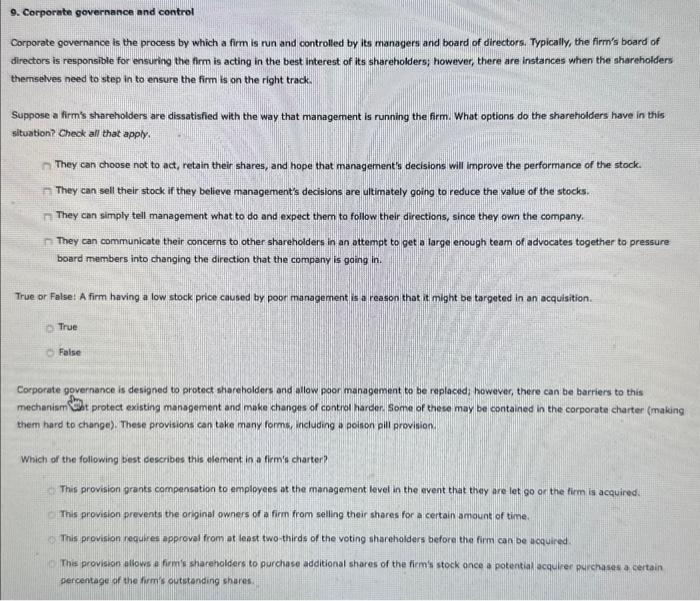

Corporate governance is the process by which a firm is run and controlled by its managers and board of directors. Typically, the firm's board of directors is responsible for ensuring the firm is acting in the best interest of its shareholders; however, there are instances when the shareholders themselves need to step in to ensure the firm is on the right track. Suppose a firm's shareholders are dissatisfied with the way that management is running the firm. What options do the shareholders have in this situation? Cheok all that apply. They can choose not to act, retain their shares, and hope that management's decisions will improve the performance of the stock. They can sell their stock if they believe management's decisions are ultimately going to reduce the value of the stocks. They can simply tell management what to do and expect them to follow their directions, since they own the company. They can communicate their concerns to other shareholders in an attempt to get a large enough team of advocates together to pressure board members into changing the direction that the company is going in. True or False: A firm having a low stock price caused by poor management is a reason that it might be targeted in an acquisition. True False Corporate governance is designed to protect shareholders and allow poor management to be replaced; however, there can be barriers to this mechanism Wht protect existing management and make changes of contiol harder. Some of these may be contained in the corporate charter (making them hard to change). These provisions can take many forms, including a poison pill provision. Which of the following best describes this dement in a firm's charter? This provision prants compensation to employees at the management level in the event that thay are let go or the firm is acquired. This provision prevents the original owners of a firm from selling their shares for a certain amount of tine. This provision requlres approval from at least two-thirds of the voting shareholders before the firm can be ucquired. This provision aliows a firm's shareholders to purchase additional shares of the firm's stock once a potential acqulier purchasas a certain percentage of the firm's outstanding shares. Corporate governance is the process by which a firm is run and controlled by its managers and board of directors. Typically, the firm's board of directors is responsible for ensuring the firm is acting in the best interest of its shareholders; however, there are instances when the shareholders themselves need to step in to ensure the firm is on the right track. Suppose a firm's shareholders are dissatisfied with the way that management is running the firm. What options do the shareholders have in this situation? Cheok all that apply. They can choose not to act, retain their shares, and hope that management's decisions will improve the performance of the stock. They can sell their stock if they believe management's decisions are ultimately going to reduce the value of the stocks. They can simply tell management what to do and expect them to follow their directions, since they own the company. They can communicate their concerns to other shareholders in an attempt to get a large enough team of advocates together to pressure board members into changing the direction that the company is going in. True or False: A firm having a low stock price caused by poor management is a reason that it might be targeted in an acquisition. True False Corporate governance is designed to protect shareholders and allow poor management to be replaced; however, there can be barriers to this mechanism Wht protect existing management and make changes of contiol harder. Some of these may be contained in the corporate charter (making them hard to change). These provisions can take many forms, including a poison pill provision. Which of the following best describes this dement in a firm's charter? This provision prants compensation to employees at the management level in the event that thay are let go or the firm is acquired. This provision prevents the original owners of a firm from selling their shares for a certain amount of tine. This provision requlres approval from at least two-thirds of the voting shareholders before the firm can be ucquired. This provision aliows a firm's shareholders to purchase additional shares of the firm's stock once a potential acqulier purchasas a certain percentage of the firm's outstanding shares